GBTC of Grayscale has just notched its biggest outflow of $642.5 Million since its launch. It is important to consider analysts’ positive outlook despite this movement.

Recent Movements in Spot Bitcoin ETFs

On March 18, more than $640 Million flowed out of crypto asset manager Grayscale’s spot Bitcoin ETF (GBTC). The day it marked the largest outflows for the fund since its conversion to a spot ETF on January 11, 2024.

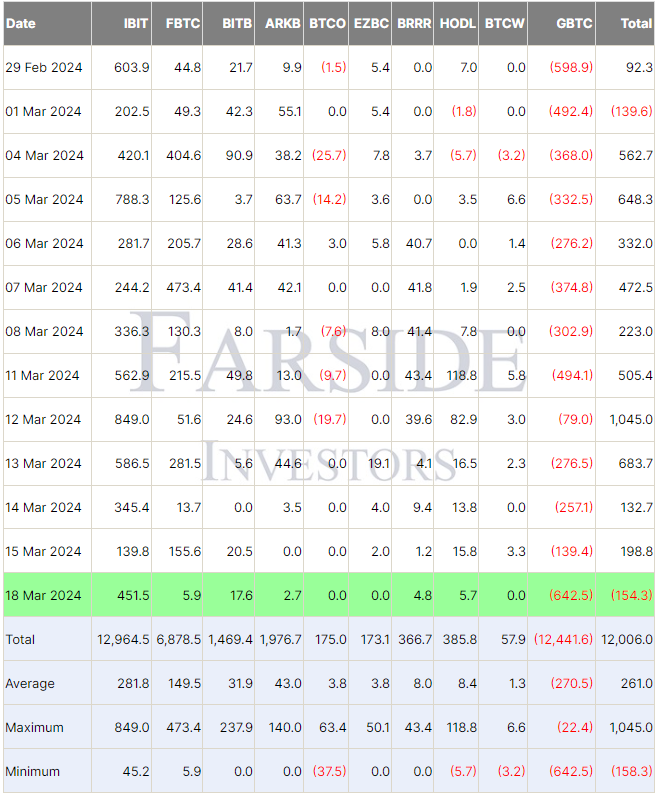

On the same day, the second largest Bitcoin ETF, Fidelity’s Bitcoin ETF, experienced an inflow of just $5.9 Million, which marked the day of its lowest inflow so far. The day-wise data from this month’s beginning is presented in the table below for all the major BTC ETF instruments.

IBIT experienced the largest inflow in the day of $451.5 Million. Collectively, considering the ten major spot BTC ETF instruments, this led to an outflow of $154.3 Million.

Movement of Bitcoin

After this movement in the Bitcoin ETF, BTC is trading in the range of $64,500 to $65,000. Bitcoin prices have been down by more than 4% since the previous trading session and more than 10% lower than the recently marked all-time high of $73,794 on March 14.

Analysts’ Perspective

Numerous market commentators have blamed the upcoming halving event for slowing the inflow in the Bitcoin ETFs. Another probable reason could be the upcoming United States Federal Reserve FOMC meeting on March 20. The Fed is expected to come out with a non-aggressive policy decision this time.

The vice president of the investment firm Carlson Group, Grant Englebart, told Bloomberg TV that his firm’s advisors have observed that only a small section of clients have allocated their funds to Bitcoin ETFs. Other analysts have shared their optimistic outlook for Bitcoin ETF flows moving forward.

Grant Engelbart, Carson Group vice president and investment strategist, sees a handful of advisors allocating 3.5% of Bitcoin ETFs on average to client household portfolios.

— Bloomberg TV (@BloombergTV) March 18, 2024

He speaks with Scarlet Fu and Katie Greifeld on Bloomberg ETF IQ https://t.co/OPSAiysQ3Y pic.twitter.com/acikDctTCe

ETF analyst Eric Balchunas commented on the X post of Bloomberg TV, stating that based on his interaction with Bitcoin ETF fund issuers and investors, only a small number of early adopters had been picking up a meaningful allocation to spot Bitcoin ETFs.

He said, “So far it’s only ones into BTC already, they are [a] ‘handful’ of early adopters inquiring, then making allocations.”

This ties out w what issuers telling me re Advisors’ clients: so far it’s only ones into btc already, they are “handful” of early adopters inquiring, then making allocations. Advisors are not yet soliciting the rest of their clients. All these flows are from inbound traffic.

— Eric Balchunas (@EricBalchunas) March 18, 2024

He further added, “Advisors are not yet soliciting the rest of their clients. All these flows are from inbound traffic.”

Some of the commentators have emphasized the remaining amount of Bitcoin on the books of GBTC, which is approximately 370,000 Bitcoin. Holdings justify the long-term bullish outlook on ETF flows.

Crypto market commentator Allesandro Ottavani shared an X post on March 19, commenting on the outflows of Bitcoin under GBTC.

COMMUNITY COMMENTS: GBTC had 378k Bitcoin and today sold 9.6k Bitcoin on Monday. According to crypto market commentator Allesandro Ottavani Grayscale cannot continue at this pace for a long time. https://t.co/2a0NKWYRBw

— BSCN (@BSCNews) March 19, 2024

GBTC was converted from an institutional fund to a spot ETF on January 11 with nine other spot Bitcoin ETFs from fund issuers including Fidelity, BlackRock and others.

Amanda Shinoy is one of the few women in the space invested knee-deep in crypto. An advocate for increasing the presence of women in crypto, she is known for her accurate technical analysis and price prediction of cryptocurrencies. Readers are often waiting for her opinion about the next rally. She is a finance expert with an MBA in finance. Quitting a corporate job at a leading financial institution, she now engages herself full-time into financial education for the general public.

thecoinrepublic.com

thecoinrepublic.com