MicroStrategy has revealed plans for a new private offering of convertible senior notes worth $500 million, with the funds earmarked for expanding the company’s Bitcoin (BTC) holdings. The notes, which will be unsecured senior obligations, will accrue interest payable semi-annually beginning on September 15, 2024, with maturity set for March 15, 2031.

You might also like

Telegram Nears Profitability, Contemplates IPO, Says Owner Durov

BlockFi’s Zac Prince Breaks Silence on Bankruptcy and Future Ventures

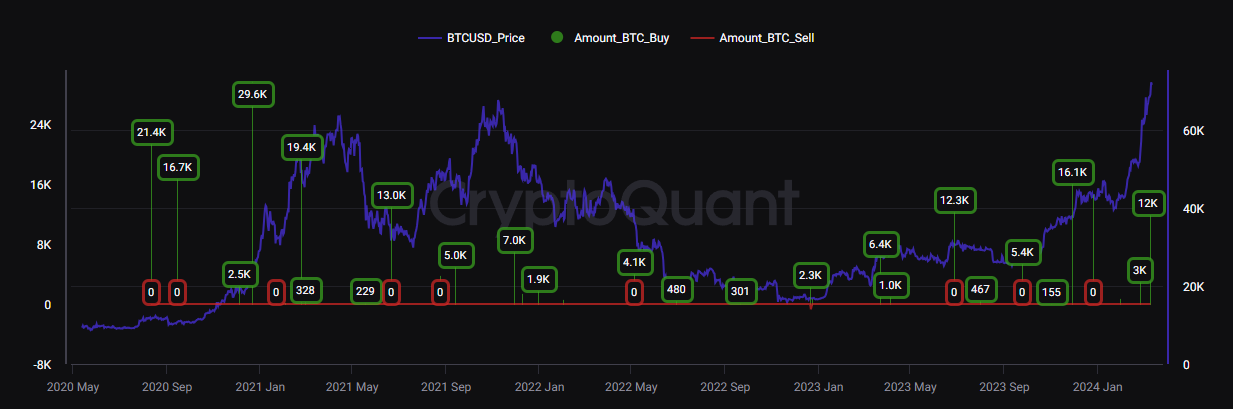

Just days before this announcement, the firm, led by Bitcoin advocate Michael Saylor, bolstered its Bitcoin holdings by acquiring 12,000 BTC at an average price of $68,477. This marked MicroStrategy’s first Bitcoin acquisition above the $60,000 threshold. With a total of 205,000 BTC now under its management, MicroStrategy boasts a larger Bitcoin portfolio than any of the ten spot BTC exchange-traded funds (ETFs) in the US, acquired at an average price of $33,706.

MicroStrategy’s strategic approach has proven successful, evident in the company’s unrealized profit of over $7.7 billion on its $14.6 billion Bitcoin holdings, as reported by on-chain data platform CryptoQuant. Since November last year, MicroStrategy has been consistently accumulating Bitcoin, with a total of 37,755 BTC acquired.

If Bitcoin meets price projections and reaches $100,000 by mid-2025, MicroStrategy’s unrealized profit from its BTC holdings could surpass $13.5 billion, yielding a return on investment of 197% within five years.

coinculture.com

coinculture.com