The Bitcoin ($BTC) price saw wild trading conditions on Tuesday, briefly hitting new all-time highs above $73,000 shortly after the release of hotter-than-expected US inflation data, before suddenly dropping into the $68,000s.

$BTC has since recovered over 3.5% from earlier session lows to $71,000, with its violent $4,500 price swing having wiped out positions held by leverage trader worth over $100 million, as per coinglass.com.

The Bitcoin price’s strong rebound from sub-$70,000 intra-day lows will embolden the bulls, who remain very much in control.

Bitcoin is up 12.7% in seven days and 42% in the past 30 days, as per CoinMarketCap.

Driving the upside has been a mix of bullish fundamentals.

These include huge continual inflows into the recently launched spot Bitcoin ETFs and FOMO as Bitcoin gears up for its four-yearly halving event.

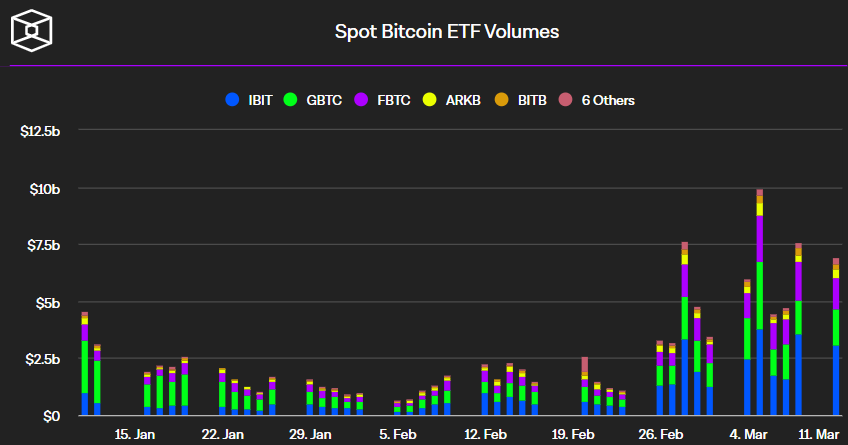

Spot ETF trading volumes clocked in at close to $7 billion on Monday, as per The Block data.

Last week, volumes averaged over $6.5 billion per day.

That’s a more than 6x jump from early February when daily volumes were averaging around $1 billion per day.

Surging demand for spot Bitcoin ETFs has powered the price higher. Source: The Block

Surging demand for spot Bitcoin ETFs has powered the price higher. Source: The BlockWhere Next for the Bitcoin Price?

And while the latest hotter-than-expected US inflation figures has pushed back on Fed rate cut expectations, with the CME Fed Watch Tool showing that money markets now price a 32% of no rate cuts by June (up from 28% on Monday), analysts do not expect this to have a lasting impact on the current bull market.

“There is too much bullish momentum in crypto,” Nansen analyst Aurelie Barthere said in a research note.

“We do not expect a significant sell-off for crypto as this repricing has happened in the past few months without questioning the bull market.”

The rate at which new $BTC tokens are issued to network validators (or miners) is scheduled to halve next month.

With the supply shock of the halving looming coupled with a massive influx of new demand from the ETFs, Bitcoin price risks remain tilted strongly to the upside.

While there could easily be short-term setbacks, Bitcoin remains in a period of price discovery as it scales all-time highs.

In such scenarios, investors tend to focus on major round numbers as their price targets.

$100,000 is one such level that the market is likely to be fixated on.

There remains an outside chance that Bitcoin can rally here ahead of the April halving.

cryptonews.com

cryptonews.com