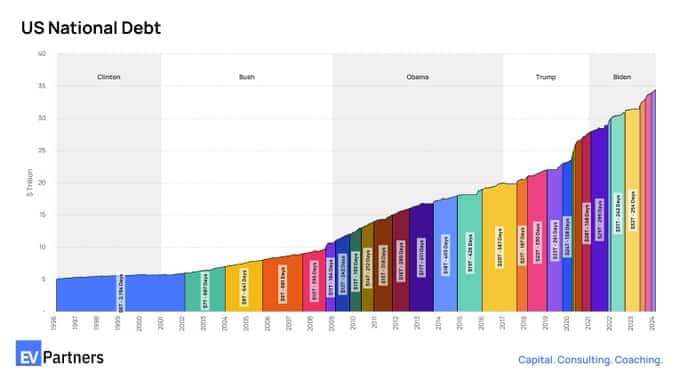

Coinbase CEO Brian Armstrong explains the importance of Bitcoin in response to the United States’ $30 trillion surge in national debt over the last 28 years.

In the context of the United States’ burgeoning national debt, Robert Sterling, CFO of 20 Dollar Consulting, highlights the alarming rate at which the U.S. debt has grown, underscoring a bipartisan trend of fiscal expansion under successive administrations.

Sterling points out that the acceleration of debt accumulation began with George W. Bush and continued through the previous three presidencies. Significant milestones were crossed in response to military spending, tax cuts, the Great Recession, and, most recently, the COVID-19 pandemic.

Armstrong responds to this fiscal trajectory by advocating for Bitcoin as a counterbalance. The Coinbase CEO suggests that Bitcoin (BTC) represents a return to a form of financial discipline reminiscent of the gold standard abandoned in 1971.

Armstrong argues that cryptocurrency could serve as a crucial check on the continuous growth of deficit spending, which he views as pivotal for maintaining the strength of the U.S. and its currency.

This is (in part) why Bitcoin matters. It’s a return to the gold standard that we left fully in 1971. A return to financial discipline.

— Brian Armstrong 🛡️ (@brian_armstrong) March 12, 2024

Bitcoin will be an important check and balance on excessive deficit spending which is essential to the U.S. and the dollar remaining strong. https://t.co/u4mN5SgPTX

Read more: Coinbase stock surpasses initial listing price amid Bitcoin rally