In this article, we dive into the recent surge in Bitcoin prices, reaching a remarkable high above $72,000. This comes on the heels of a pivotal announcement from the United Kingdom, signaling a significant shift in the cryptocurrency landscape.

The UK’s Green Light for Crypto

The Financial Conduct Authority (FCA) of the United Kingdom has made a groundbreaking announcement that it will permit exchanges to list cryptocurrency-linked exchange-traded products (ETPs) for the first time. This move has been anticipated by crypto enthusiasts and investors alike, paving the way for a more regulated and structured market for cryptocurrencies in the UK.

To maintain order and protect investors, the FCA mandates that exchanges must implement stringent controls. These measures ensure orderly trading and the safeguarding of professional investors, aligning with the requirements of the UK’s listing regime. This involves the issuance of prospectuses and the maintenance of ongoing disclosures.

The Impact on Cryptocurrency Prices

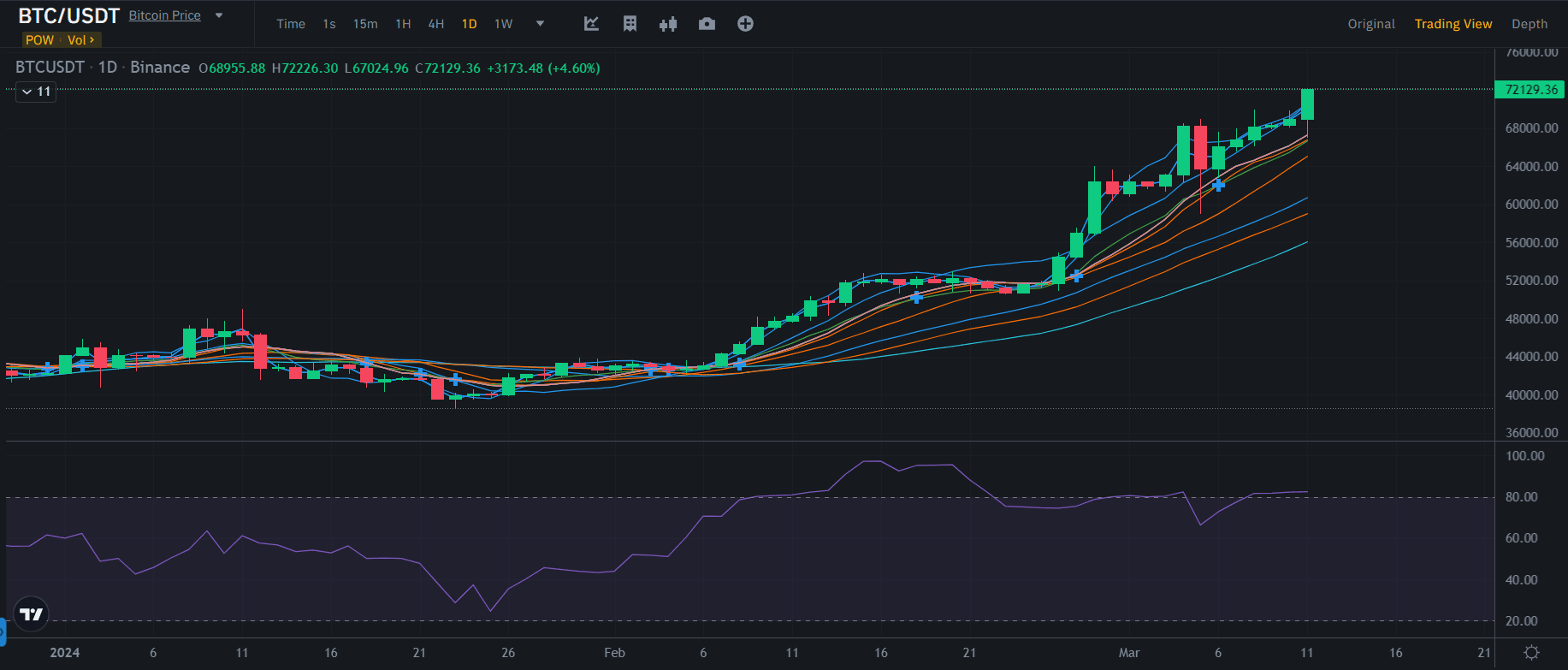

Following the FCA’s announcement, Bitcoin’s value skyrocketed, surpassing 3% to hit an all-time high of $72,211.51 early in the morning. Though there was a slight retreat, the cryptocurrency remains robust, showcasing the significant impact of regulatory acceptance on market prices. Similarly, Ether, another major cryptocurrency, experienced a notable increase, climbing over 2% to $4,041.23.

The London Stock Exchange has responded positively to the FCA’s new stance, announcing it will start accepting applications for Bitcoin and Ether ETNs beginning in the second quarter of this year. However, it’s crucial to note that these products are aimed exclusively at professional investors, continuing the UK’s cautious approach to retail investment in crypto-related products.

Why This is a Landmark for Cryptocurrency

The FCA’s decision marks a significant departure from its previous stance, where it had banned the sale of crypto-linked ETNs and derivatives to retail consumers, citing concerns over volatility and financial crime. This new direction not only aligns the UK with other countries, such as the US, which recently approved Bitcoin ETFs, but it also signals a growing acceptance of cryptocurrencies within mainstream financial markets.

Conclusion

The recent developments in the UK signify a notable shift towards the integration of cryptocurrencies into the conventional financial system. While the FCA maintains its warning about the high-risk nature of crypto assets, the allowance for crypto-linked ETPs represents a considerable step forward.

Where to buy BTC?

For individuals eager to enter the cryptocurrency market, Bitget emerges as a reliable platform. Offering low fees, a user-friendly interface, and a straightforward onboarding process, Bitget provides a convenient experience for both novice and seasoned traders. Whether you are an experienced investor or a newcomer, Bitget offers a streamlined avenue to buy and trade cryptocurrencies in the dynamic and rapidly evolving market.

cryptoticker.io

cryptoticker.io