Bitcoin (BTC) recently recorded a new all-time high above the $72,000 price territory today due to a confluence of bullish factors in its price discovery phase.

The crypto bull market is already taking full swing as Bitcoin slips into its price discovery phase after breaching the previous cycle’s all-time high. Amid this phase, BTC has continued to record new ATH values, surpassing previous expectations.

However, one of Bitcoin’s most substantial price surges came up today as the asset pushed above the pivotal psychological resistance threshold at $72,000, surging to a new all-time high of $72,226 earlier today. Despite facing a roadblock at this price, BTC holds above $71,900.

Factors Behind Recent Bitcoin ATH

As the premier crypto asset looks to leverage another upswing to hit hold above $72,000, market data has revealed some of the factors that propelled the latest surge above the $72,000 mark. The on-chain surveillance platform Lookonchain recently called attention to one possible factor.

Over the weekend, Lookonchain spotlighted a transaction from the Tether Treasury, which saw the minting of $2 billion worth of USDT on March 10. According to Lookonchain, the firm has already minted about $5 billion in USDT on the Ethereum and Tron blockchains over the last week.

Interestingly, amid yesterday’s minting of the 2 billion USDT, a whale address possibly belonging to an institution received 261.6 million USDT from Tether. The inflows began on March 9 at 12:39 (UTC), with the last transaction coming in at 19:30 (UTC) on March 10.

After #TetherTreasury minted 2B $USDT, a whale/institution received 261.6M $USDT from #TetherTreasury and deposited it into #Binance.https://t.co/ohBcxqbrzThttps://t.co/Cxs2WfFPCn pic.twitter.com/fvL7Cz5Tvv

— Lookonchain (@lookonchain) March 11, 2024

The whale address moved all the 261.6 million USDT to Binance. This was viewed as a bullish development, as it demonstrates an increase in whale purchasing power, a trend which typically leads to a growth in prices.

Notably, an increase in stablecoin deposits in exchanges is usually seen as a bullish sign, as it suggests that market participants are looking to procure more risk assets, essentially bolstering demand.

The 261.6 million deposit into Binance was one of the precursors of the latest Bitcoin spike above $72,000. In addition, on-chain data confirms that exchanges have continued to witness increased inflows of stablecoins despite a recent drop from previous highs.

Growing Investor Interest and Demand

Another possible factor behind the latest Bitcoin surge is the growing demand from U.S.-based institutions, both in the traditional Bitcoin market and in the spot Bitcoin ETF market. The Coinbase Premium Index has seen a marked upsurge of late, indicating increased buying pressure from U.S. institutional investors.

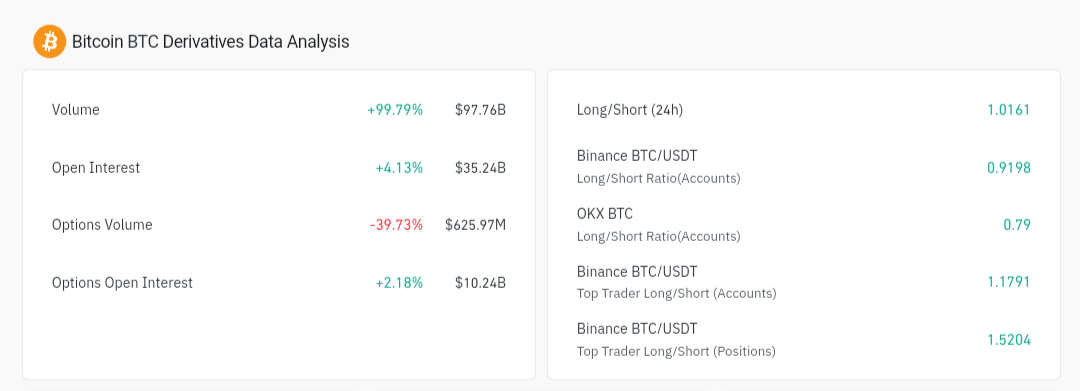

This rise in buying pressure can be attributed to the bullish sentiments surrounding the Bitcoin market. Amid the bullish sentiments, Coinglass data confirms that Bitcoin’s Futures Open Interest (OI) has spiked to $35.2 billion, with a predominance of long positions, as investors continue to bet on further price rises.

The $35.2 billion value is the largest recorded Bitcoin OI of all time, surpassing the previous all-time high of $26 billion on March 1. Bitcoin has continued to push toward greater heights, currently trading for $71,955.

thecryptobasic.com

thecryptobasic.com