Gold, Bitcoin (BTC), and the S&P 500 peaked at new highs on March 8, quickly retracing to levels seen on the previous day. At the same time, the finance market‘s expectations for lower interest rates increase, creating a strong signal for investors.

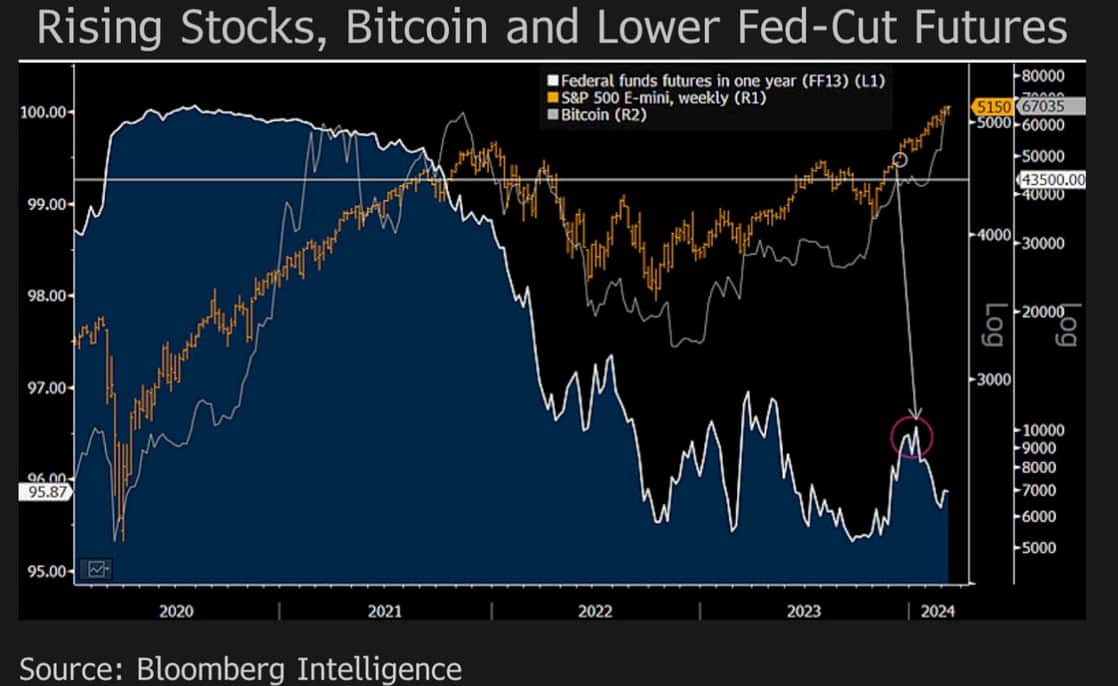

In a recent analysis, Bloomberg Intelligence’s Mike McGlone highlighted a crucial relationship between commodity prices, the S&P 500, and Federal Reserve rate-cut expectations amid potential recessionary warnings.

Notably, McGlone’s findings point to a paradoxical situation where the cure for high commodity prices could inadvertently trigger economic downturns. Meanwhile, risk assets reaching new highs would lead to increased inflation metrics. Further, it has potentially triggered renewed hawkish policies by the Federal Reserve.

“A simple technical signal may be better off not working due to deflationary dominoes and recession implications of the S&P 500 falling about 10% from March 7. Our graphic shows the rising stock index and diminishing Fed rate-cut expectations. There appears to be a connection.”

– Mike McGlone

Mike McGlone’s analysis of S&P 500, Bitcoin, and FED-cut rates

Central to McGlone’s analysis is a technical signal hinting at deflationary pressures and possible recession. Thus, suggesting a trend reversal for the S&P 500. This comes against a backdrop of the S&P 500 reaching an all-time high of $5,189, signaling investor confidence and a robust economic outlook.

Yet, the accompanying data reveals a dip in Federal Funds Futures, showing a decrease from nearly 97% to 95.87%, and a parallel surge in Bitcoin’s value, breaking its previous all-time high at $70,000.

Understanding the Fed Funds Futures is key to decoding McGlone’s insights. Essentially, these futures are financial contracts that speculate on the direction of the U.S. Federal Reserve’s interest rate policy.

A higher percentage implies market expectations leaning towards steady or increasing interest rates, whereas a drop suggests anticipation of rate cuts. Investors monitor these futures to gauge market sentiment toward economic health and policy shifts, using them as a barometer for investment decisions.

Gold, Bitcoin, and the S&P 500 thrive under interest rate cut expectations

Connecting the dots, McGlone’s analysis underscores a direct linkage between diminishing Federal Reserve rate-cut expectations and the surge of both the S&P 500 and Bitcoin. This correlation suggests that while stock and cryptocurrency markets thrive, underlying expectations of monetary easing hint at concerns over economic sustainability.

In the meantime, Gold carves a similar chart pattern to that of the former financial indicators. The leading commodity reached new highs at $2,195 per ounce, closing the week at $2,178. Therefore, it gives a potential sign of strength despite the shadows of recession raised by Bloomberg’s commodity expert.

Ultimately, the critical takeaway from McGlone’s post is the delicate balance between fostering economic growth and averting inflationary spirals. The interplay between Federal Reserve policies, investor sentiment, and market performance encapsulates the tightrope policymakers walk in steering the economy through choppy waters.

finbold.com

finbold.com