Macro investor and fund manager Dan Tapiero says he’s analyzing the historical accuracy of a predictive model that suggests Bitcoin ($BTC) will reach $900,000 this cycle.

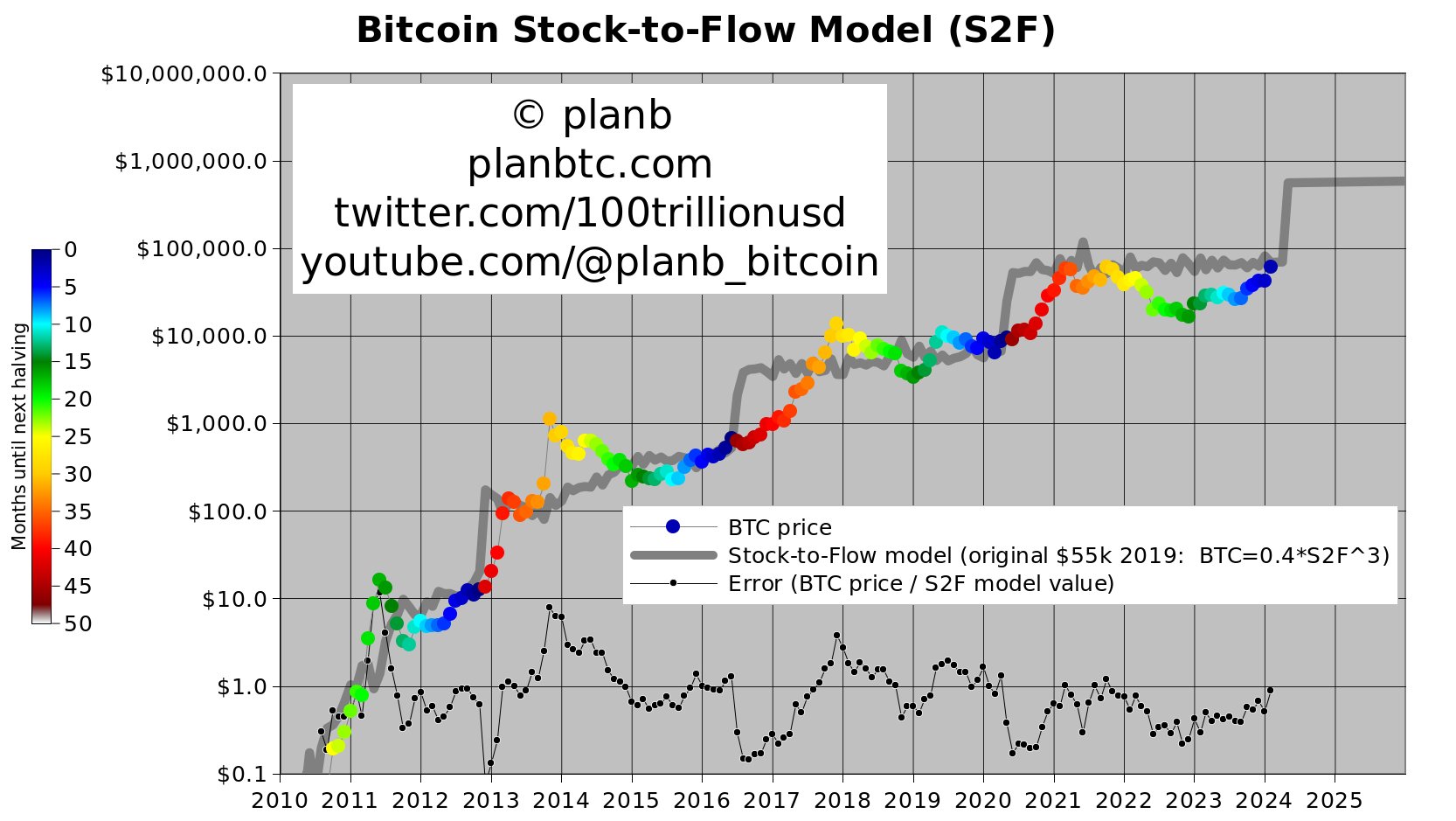

The CEO of investment firm 10T Holdings tells his 113,000 followers on the social media platform X that on-chain analyst PlanB’s stock-to-flow (S2F) model seems to be a reliable price gauge for Bitcoin.

S2F aims to forecast the longer-term market cycles based on $BTC’s halvings when miners’ rewards are cut in half.

Says Tapiero,

“Seems impossible, but the vertical spikes up in the S2F model in 2013, 2016, 2020 were all confirmed by price action within one year.

[The model] suggests a $900,000 Bitcoin price within 12-18 months. Not my call, just reading how model has worked.”

PlanB himself says that Bitcoin’s recent rally into the $60,000 range has the top-performing digital asset now tracking the price targets of his S2F model.

“Bitcoin February closing price: $61,181. Back to S2F model value.”

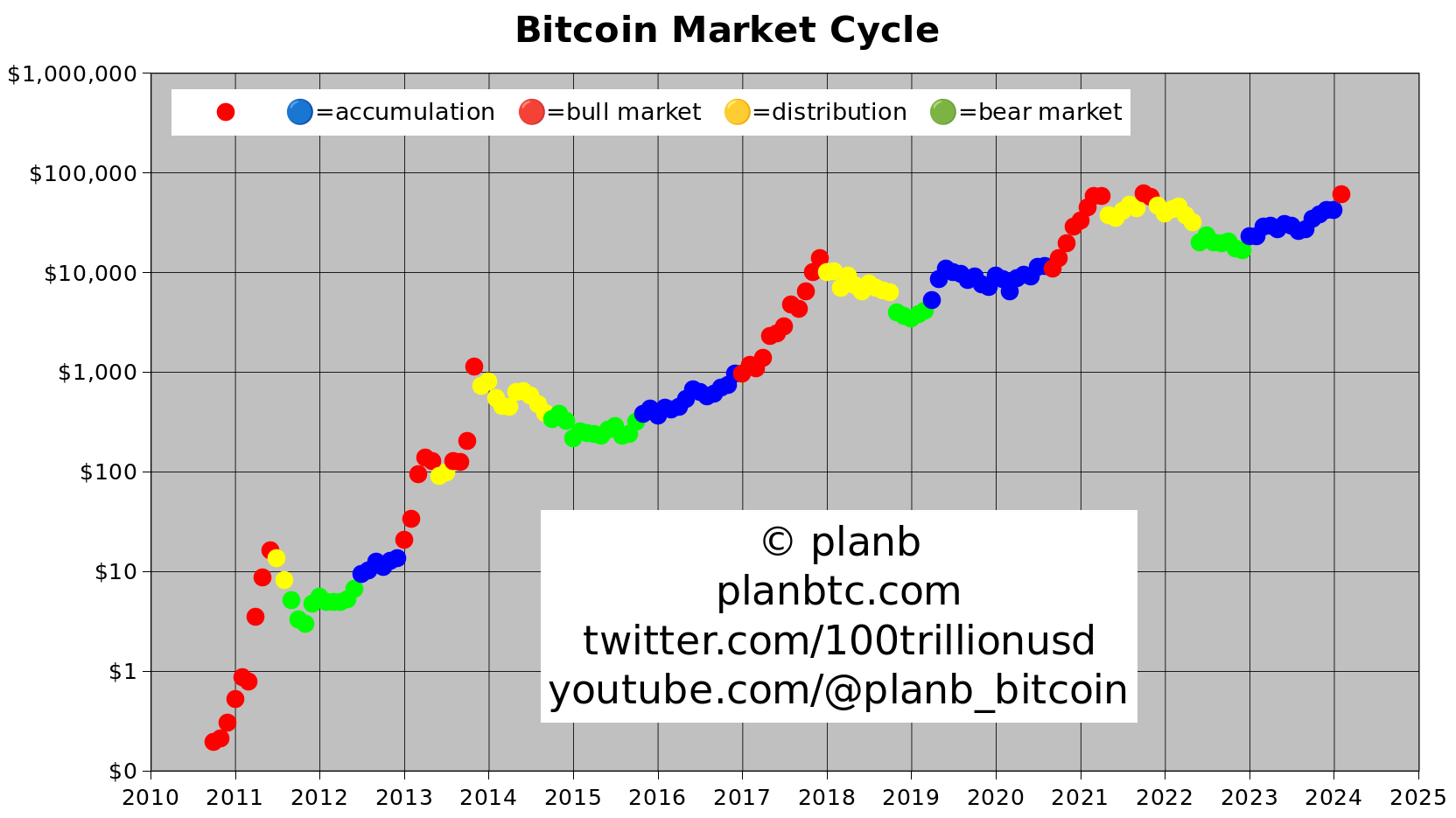

PlanB continues by predicting a Bitcoin bull market cycle has begun and will last for about 10 months. However, he warns there may be some abrupt dips of about 30%.

“Accumulation phase has ended: no more easy buying opportunities in orderly and slowly increasing markets. Bull market has started. If history is any guide, we will see ~10 months of face-melting FOMO (fear of missing out): extreme price pumps combined with multiple -30% drops. Enjoy!”

Shutterstock/solarseven/Natalia Siiatovskaia

dailyhodl.com

dailyhodl.com