, the most famous cryptocurrency, has been in the news for its price changes and the dynamics driving its rise. On Bitcoin’s 4-hour chart, the TD Sequential indicator flashes a sell signal, preparing traders for short-term corrections. Since February 15, this indicator has accurately predicted price drops of 1.50 to 4.20% in every sell signal.

The TD Sequential flashes a sell signal on the #Bitcoin 4-hour chart!

— Ali (@ali_charts) February 29, 2024

Since Feb 15, every sell signal from this indicator has been spot-on, leading to $BTC price corrections between 1.50% and 4.20%. This is a pattern worth noting for traders eyeing short-term movements! pic.twitter.com/TQhSG78WF3

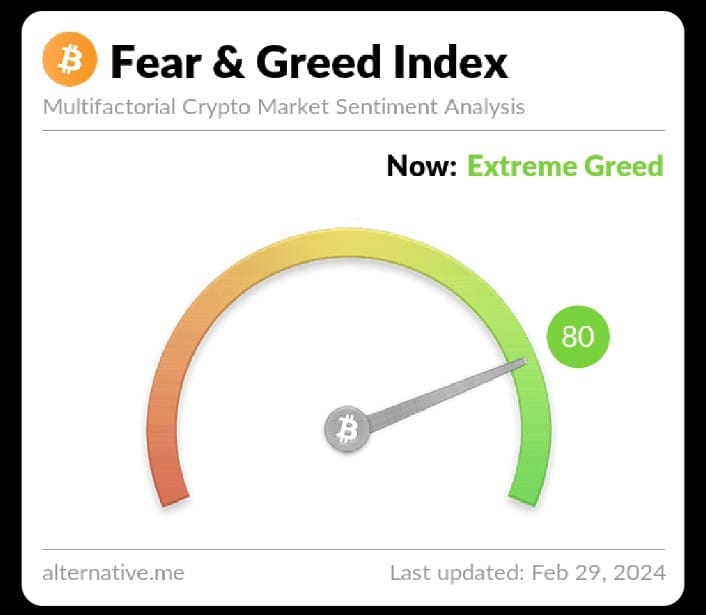

Bitcoin Fear and Greed Index at 80

Meanwhile, the Bitcoin Fear and Greed Index, at an unbelievable 80, shows that people are greedy. As of writing, it was worth $62,683. Institutional investors, particularly US ones, are driving this rise. Bitcoin’s price is soaring due to ETF excitement and big institutions’ involvement.

Bitcoin attracts investors seeking inflation protection and money security. Many call it “digital gold.” Its strong fundamentals and resilience make it a popular asset class for diversifying portfolios. Bitcoin is a better safe haven asset because it can weather economic uncertainty and market volatility and come out stronger.

Bitcoin spot ETFs in the US will revolutionize cryptocurrency markets. Bitcoin exchange-traded funds (ETFs) allow large and small investors to invest in Bitcoin without owning and storing it. This ease of access is expected to bring a lot of new money into the market, increasing Bitcoin use and investment to record levels.

Bitcoin’s rise to $62,683 is significant. Analysts now see $68,000, the previous cycle’s high point, as the next big hurdle. Bitcoin’s popularity will never fade, even if markets correct. Interest from institutions and large Bitcoin spot ETF investments boost confidence in Bitcoin’s ability to weather market storms.

Bitcoin Prepares to Lead Digital Asset Revolution Amid Challenges

Bitcoin has overcome skepticism to become a financial powerhouse, proving its critics wrong. Its decentralization and limited supply make it unique among fiat currencies. Bitcoin offers financial freedom and stability in a world of unstable economies and rising prices.

Bitcoin’s rise amid big business interest shows its growing importance in finance and investment. As more big players fight, Bitcoin’s market will change drastically. Its leadership in decentralized finance and digital currencies makes it even more powerful in changing global finance.

Lastly, Bitcoin faces challenges and opportunities. The TD Sequential indicator suggests prices may fall, but institutions are interested and Bitcoin spot ETFs are coming, so the cryptocurrency may rise. Bitcoin is ready to lead the digital asset revolution, enabling decentralized and open finance.