Brian Kelly is a financial analyst and television personality known for his expertise in cryptocurrencies and blockchain technology. He is the founder and CEO of BKCM LLC, an investment firm focused on digital currencies. Kelly is also a frequent contributor to CNBC, where he provides analysis and commentary on financial markets, with a particular focus on cryptocurrency trends and investment strategies. He has authored “The Bitcoin Big Bang: How Alternative Currencies Are About to Change the World,” which explores the potential of Bitcoin and other digital currencies to revolutionize the financial industry.

On February 28, Kelly appeared on CNBC’s “Fast Money” to discuss the surging price of Bitcoin, at a time when it was trading just under the $61,000 level. In a detailed conversation with host Melissa Lee, Kelly shared his insights on the cryptocurrency market’s dynamics and what the future holds.

Kelly emphasized the importance of timeframe when considering Bitcoin’s future trajectory. He acknowledged the cryptocurrency’s resistance at previous highs and noted the significant increase in funding rates, which could indicate an impending pullback. Kelly pointed out that a short-term retracement wouldn’t be surprising, given the asset’s history of volatility. Even during the bullish market of 2017, Bitcoin experienced substantial monthly drops. Thus, a 25% to 30% pullback in the near term is within the realm of possibility, according to Kelly.

He said:

“In the relatively short term, it would not surprise me to see a pullback, and I tell my team every single day, even in 2017 when we had, you know, Ethereum up 4,000%, it still had a month that was down 50%. So, this is an asset that is still extremely volatile. If it pulled back 25 or 30%, it wouldn’t surprise me at all.“

Despite the potential for short-term volatility, Kelly’s long-term outlook for Bitcoin remains bullish. He believes that the cryptocurrency will continue to reach new highs, driven by its inherent value and increasing adoption.

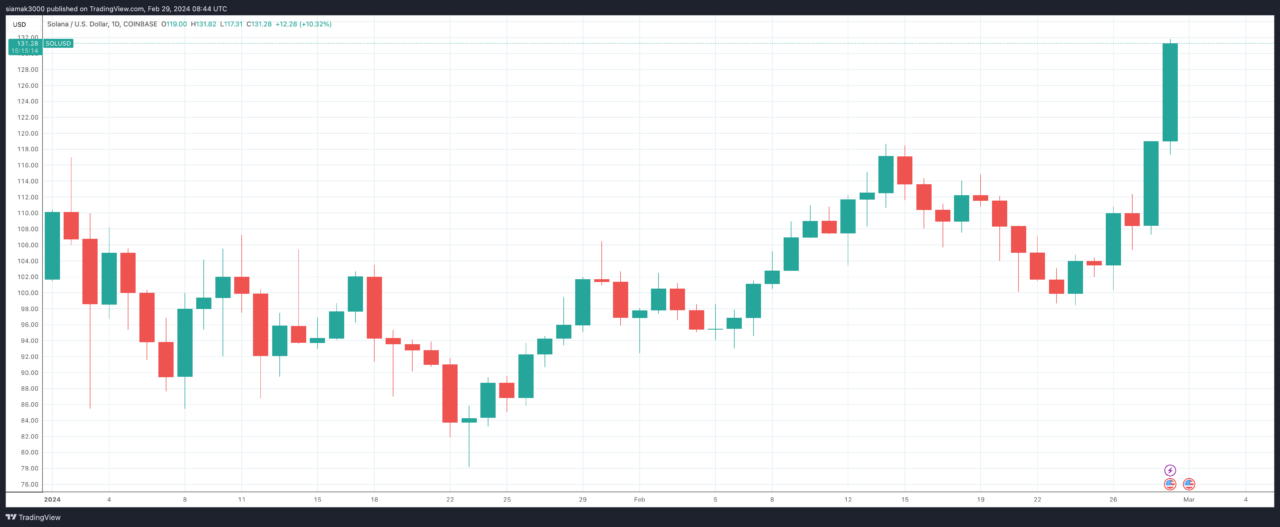

The conversation also touched upon the potential impact of an approved spot Ethereum (Ether) ETF and its implications for the crypto space. Kelly suggested that the anticipation of a spot Ether ETF might drive prices up, similar to what has been observed with Bitcoin. He also highlighted the broader interest in other cryptocurrencies, such as Solana ($SOL), which could benefit from a rotation of investments following gains in Bitcoin and Ethereum.

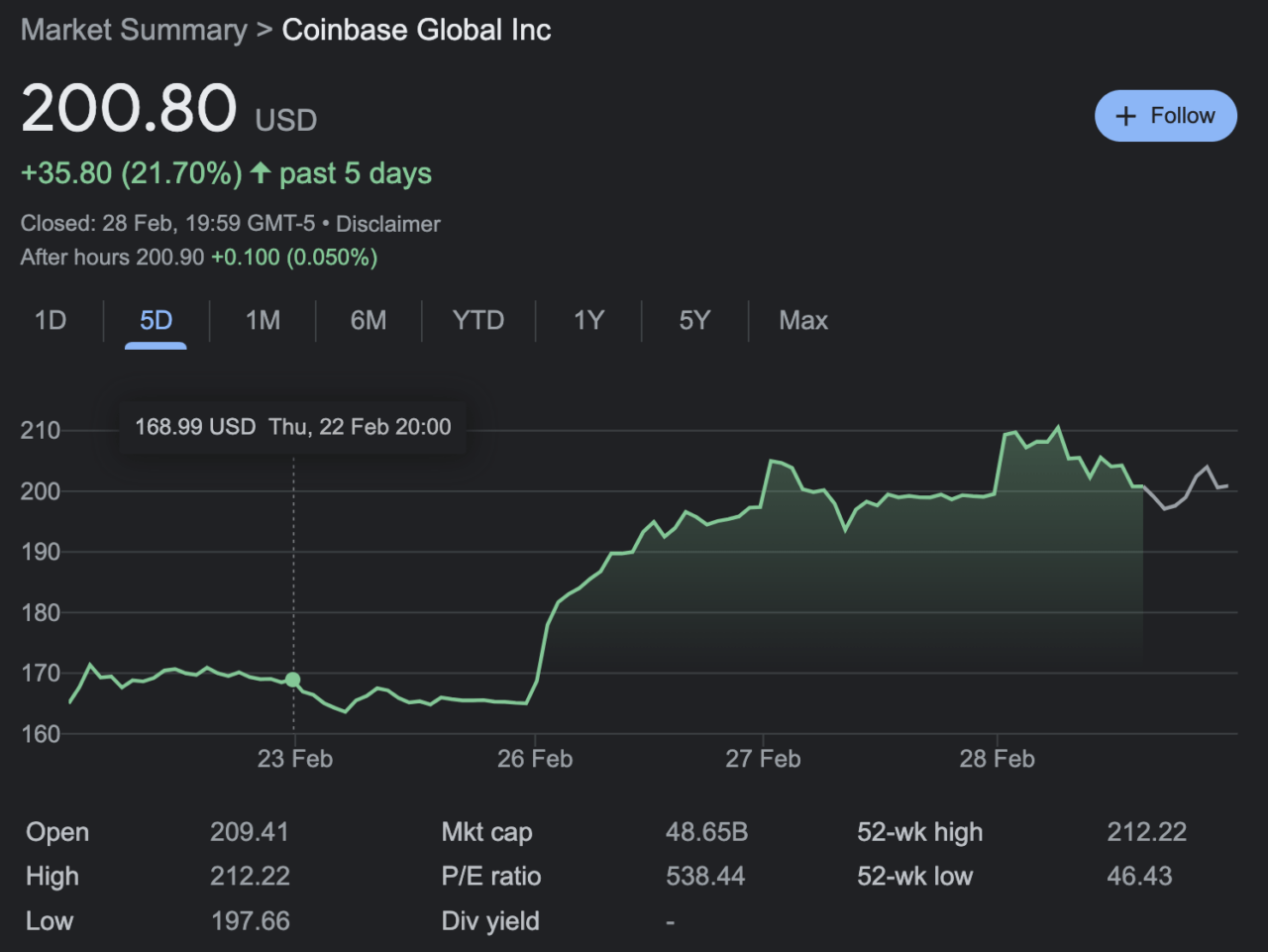

Kelly also provided insights into equities that might benefit from the current crypto wave, including miners and service providers like Coinbase (NASDAQ: COIN). While he acknowledged the challenging nature of the mining business due to its capital-intensive requirements, he also pointed out the significant gains miners can achieve during bull markets. He says that Coinbase, as a major player in the cryptocurrency exchange space, stands out as a beneficiary of the influx of investments into cryptocurrencies.

Addressing the distribution of investments within the crypto space, Kelly observed that Bitcoin and Ethereum have dominated recent gains, potentially at the expense of other cryptocurrencies. However, he anticipates a possible rotation of investments into other promising projects with solid fundamentals and use cases, such as Solana ($SOL) and Chainlink (LINK), especially if Bitcoin experiences a short-term pullback.

Discussing the efficiency of public miners and the impact of the Bitcoin halving event (which is expected in April 2024), Kelly believes the halving is more psychological than fundamental in its influence on the market. He expects miners to remain profitable by controlling costs and views the halving as part of the market’s cyclical nature, which historically aligns with bull markets.

When pressed for his top cryptocurrency pick outside of Bitcoin, Kelly highlighted Solana as his choice for the next potential surge. His preference for Solana is based on its promise and the anticipated rotation of investments from Bitcoin and Ethereum into other cryptocurrencies with growth potential.

Featured Image via Pixabay

cryptoglobe.com

cryptoglobe.com