A top analyst at the investment giant Fidelity thinks Bitcoin ($BTC) is primed to take market share from gold.

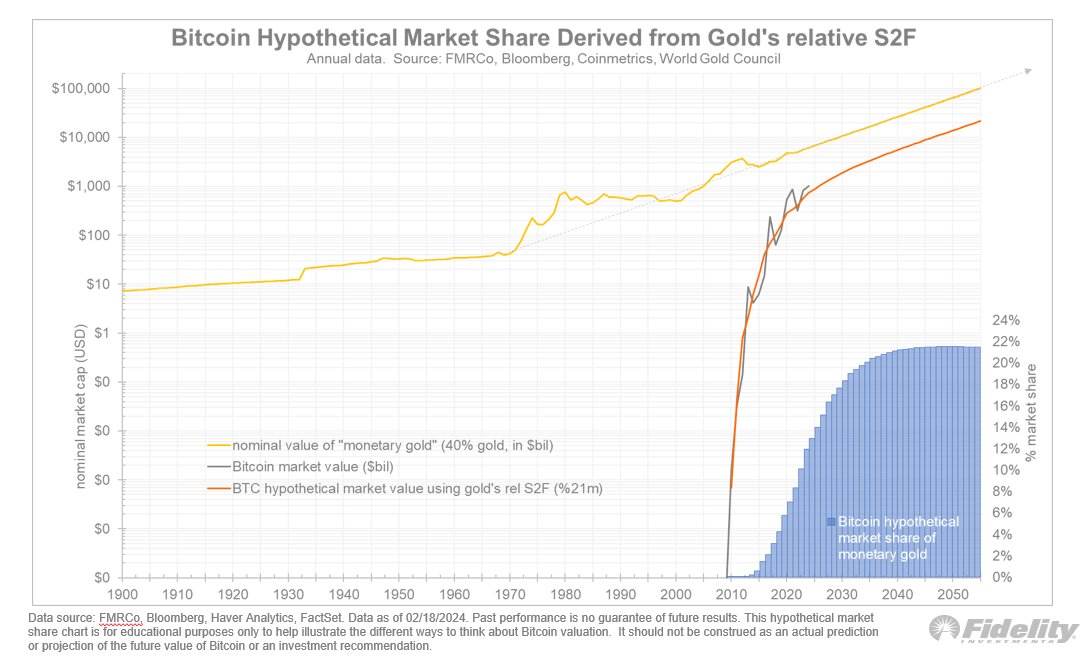

Jurrien Timmer, Fidelity’s director of global macro, shares a chart on the social media platform X that examines the value of “monetary gold.”

The term refers to the gold that’s explicitly held by central banks and private investors as a monetary asset and isn’t used for jewelry or industrial purposes.

“This is an admittedly inexact science, but based on data published by the World Gold Council, I am guessing that the share of monetary gold is around 40% of total above-ground gold.

Based on the calculations outlined in my previous threads, I estimate that Bitcoin will eventually capture around a quarter of the monetary gold market. At 40%, monetary gold is currently worth around $6 trillion, while Bitcoin is worth $1 trillion.”

A quarter of $6 trillion is a $1.5 trillion market cap, which would equate to a price per Bitcoin of around $76,000. Timmer, however, also assumes that by the time $BTC reaches that level of gold’s market share, the value of the precious metal will be “much higher,” suggesting that his estimated market cap for Bitcoin will be higher than $1.5 trillion.

Bitcoin is trading at $56,306, up over 9.30% in the last 24 hours.

Generated Image: Midjourney

dailyhodl.com

dailyhodl.com