Bitcoin has successfully shattered its previous consolidation near the $52K level, experiencing a remarkable surge over the past 24 hours as buyers pushed through key resistance barriers. This momentum led to significant liquidations for sellers as the $BTC price soared to near $57K. Boosted by a series of positive developments,

achieved robust gains while altcoins stayed relatively quiet in the background. Should Bitcoin’s upward trajectory begin to decelerate, we may witness a shift in investor sentiment towards profit-taking and a subsequent redistribution of capital into various altcoins.

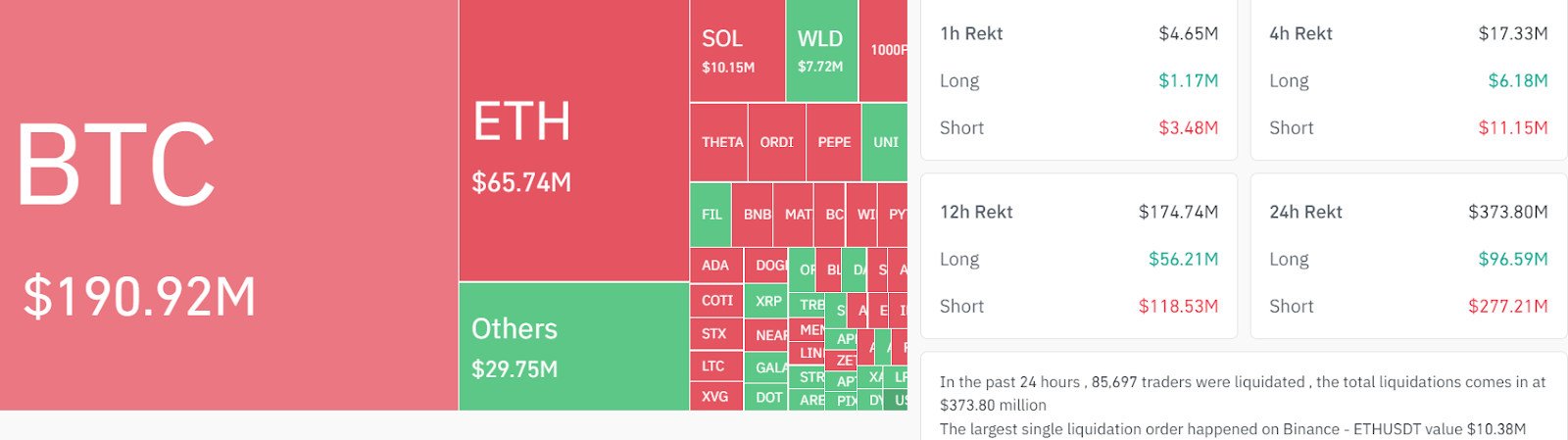

Crypto Market Faces $400 Million In Liquidations

In the past day, the cryptocurrency market has experienced a significant increase in liquidations. Data from Coinglass reveals that total liquidations exceeded $370 million, with approximately $275 million coming from the liquidation of short positions. Concurrently, Bitcoin’s price witnessed a substantial rise, leading to the liquidation of short positions valued at $163 million, following its jump from $53K.

The abrupt surge can be attributed to recent bullish developments. According to Farside data, the net inflows into the 10 Bitcoin ETFs reached over $515 million on February 26, marking one of the largest influx days since these ETFs received approval on January 11. Tyler Winklevoss, the co-founder of the US-based crypto exchange Gemini, captured the sentiment by stating, “We’re so back!” Meanwhile, well-known Bitcoin enthusiast Dan Held interpreted today’s market movement as “the beginning of the Bitcoin bull run.”

On Monday, CoinShares, a prominent digital assets investment firm in Europe, announced that the cryptocurrency market experienced its fourth straight week of inflows. Last week, the market saw an inflow of $598 million, predominantly directed towards spot Bitcoin ETF products.

Additionally, Microstrategy’s recent Bitcoin purchase boosted the market sentiment. MicroStrategy saw its stock surge by more than 16 percent following an announcement by Michael Saylor that the company purchased an additional 3,000 Bitcoins at a cost of $155 million. As a result, MicroStrategy’s Bitcoin holdings have expanded to approximately 193,000, accounting for nearly 1 percent of the total circulating supply. Interestingly, the unreleased profit on this holding now nears $5 billion.

Moreover, the growing urge to mitigate the effects of high fiat currency inflation and inadequate monetary policies has significantly accelerated the adoption of Bitcoin.

This resurgence in Bitcoin’s market value comes at a time when traders’ interest in $BTC is at an all-time high. The current bull cycle has seen Bitcoin outperform expectations, with previous instances of resistance levels being breached leading to a redistribution of profits into more speculative assets. However, this time around, the focus remains firmly on Bitcoin, suggesting a possible shift.

Smaller traders might attempt to outmaneuver larger investors, or “whales,” by pumping money into meme coins in anticipation of quick profits. However, such strategies could inadvertently contribute to Bitcoin’s growing dominance if these smaller assets fail to deliver expected returns.

What’s Next For $BTC Price?

Bitcoin surged past the $53,000 resistance barrier on February 26, ending a period of tight consolidation, indicating that the market’s bullish sentiment persists. As a result, buyers gained a surge in confidence and $BTC price continued to break above immediate Fib channels. However, $BTC price met selling pressure after it attempted to break the $57K mark, suggesting domination by sellers. As of writing, $BTC price trades at $56,639, surging over 11% from yesterday’s rate.

Should the price remain above $57,000, it’s expected that the $BTC/USDT trading pair could gain further momentum, potentially reaching the $60,000 mark, where it’s anticipated that bears will present significant resistance.

On the downside, multiple support levels are established. A downtrend toward $53,000 could see bulls attempting to halt further losses at the 20-day EMA ($53,139), followed by the critical $50,000 level. For bears to signal a more substantial correction, they would need to push the price beneath $50K, possibly leading towards the retest of $48,500.