Bitcoin isn’t showing signs of slowing down anytime soon as the flagship crypto token rose above $57,000 on February 27, the first time since 2021. This price surge is likely due to several recent developments that undoubtedly provide a bullish narrative for $BTC.

Demand For Bitcoin Is Skyrocketing

Bloomberg analyst Eric Balchunas revealed in an X (formerly Twitter) post that the new nine Spot Bitcoin ETFs (excluding Grayscale’s GBTC) set a new all-time trading volume record with $2.4 billion traded on February 26. This is significant as it shows the increased demand for the flagship crypto from institutional investors.

Due to the interest in these Bitcoin ETFs, the fund issuers have continued to accumulate a significant amount of Bitcoin. Interestingly, as revealed by Bloomberg analyst James Seyffart, these issuers had to purchase over $403 million worth of $BTC because of the all-time trading volume recorded on February 26.

These Bitcoin ETF issuers aren’t the only institutional investors that have accumulated a large amount of $BTC as of late. Bitcoinist recently reported that MicroStrategy purchased 3,000 $BTC this month, increasing its holdings to 193,000 $BTC.

These purchases further highlight the general sentiment among $BTC whales who have continued accumulating, even when Bitcoin’s price experienced a downward trend following the approval of the Spot $BTC ETFs. Meanwhile, NewsBTC recently reported how $BTC’s supply is currently playing catchup with the demand, another factor which is driving $BTC’s price up.

The much-anticipated Bitcoin Halving is also drawing near, another factor which has continued to contribute to the bullish momentum in the market. This event will further decrease the rate at which $BTC comes into circulation, which could spark a significant upward movement in $BTC price, especially if the demand for the flagship crypto continues at this pace.

The Derivatives Market Also Contributing To $BTC’s Price Surge

There has been increased trading activity in the derivatives market lately, with data from CoinGlass showing how open interest has continued to rise. This increase indicates that new money is flowing into the Bitcoin ecosystem, with many traders placing bullish leveraged bets on $BTC.

This conclusion can also be reached when one considers the amount of Bitcoin shorts liquidated in the last 24 hours. Data from Coinglass shows that traders betting on $BTC decline have lost $270 million in this period. As such, it is more than likely that those causing the open interest to rise are likely the bulls rather than the bears.

The derivatives market is believed to be integral to $BTC’s price discovery. CryptoQuant’s CEO once noted that “Bitcoin is in a futures-driven market,” which is less affected by trading activity in the Spot market.

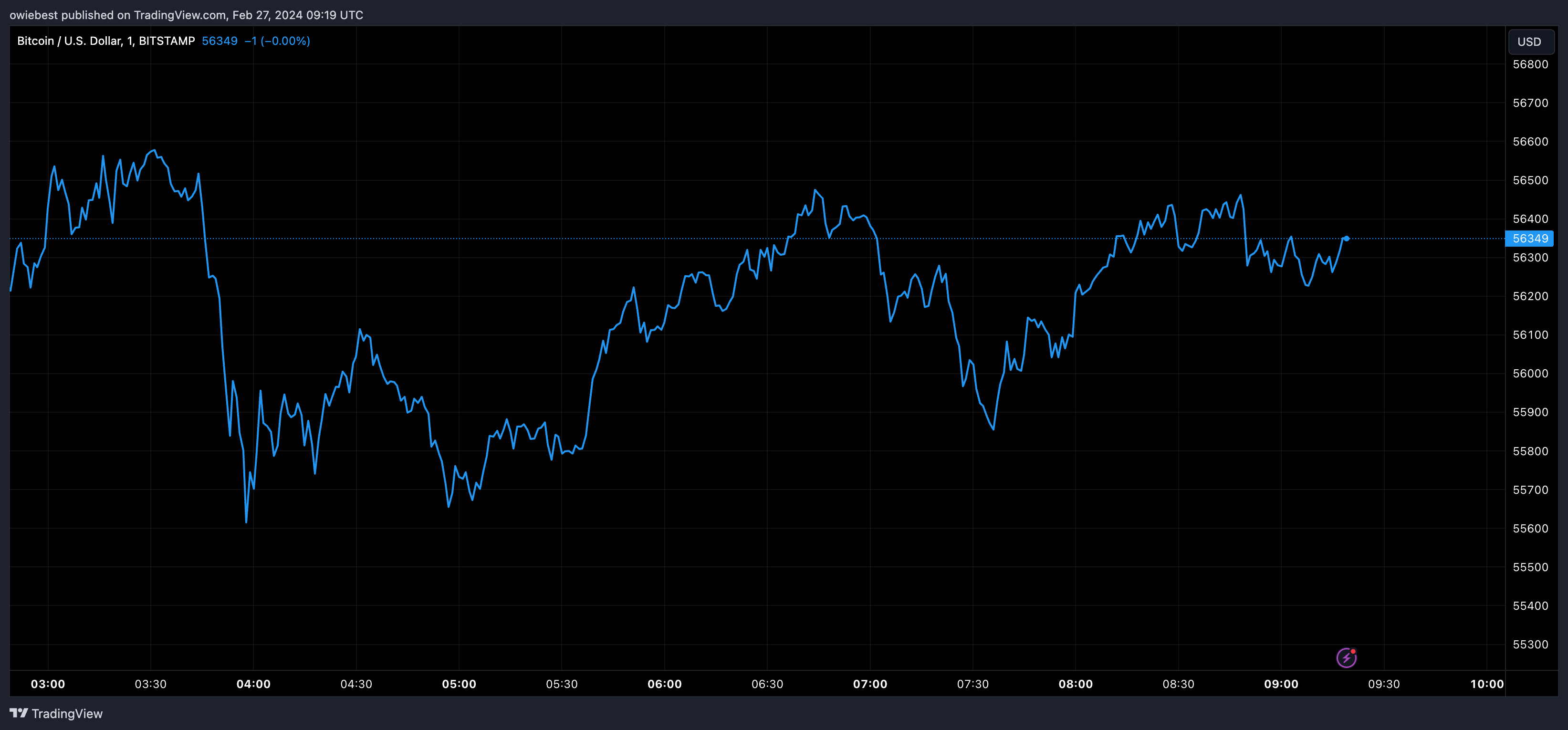

At the time of writing, $BTC was trading at around $56,100, up over 8% in the last 24 hours, according to data from CoinMarketCap.

$BTC readies to test $56,500 resistance | Source: BTCUSD on Tradingview.com

bitcoinist.com

bitcoinist.com