With Bitcoin maintaining its position above $50,000, recent data indicates an increase in market depth. Despite experiencing a dip to $38,555 after the launch of spot Bitcoin ETF products on January 11, BTC later recovered.

#BTC market depth is up 19% since the start of 2024.

— Kaiko (@KaikoData) February 21, 2024

Is liquidity back for good? 👀 pic.twitter.com/oG7keKA0hn

According to a report released by crypto data provider Kaiko, Bitcoin’s market depth has increased by 19% since the beginning of 2024. Kaiko shared this report on X, saying, “Is liquidity back for good?” According to Kaiko, market depth is defined as the market’s ability to sustain relatively large market orders without impacting the asset’s price.

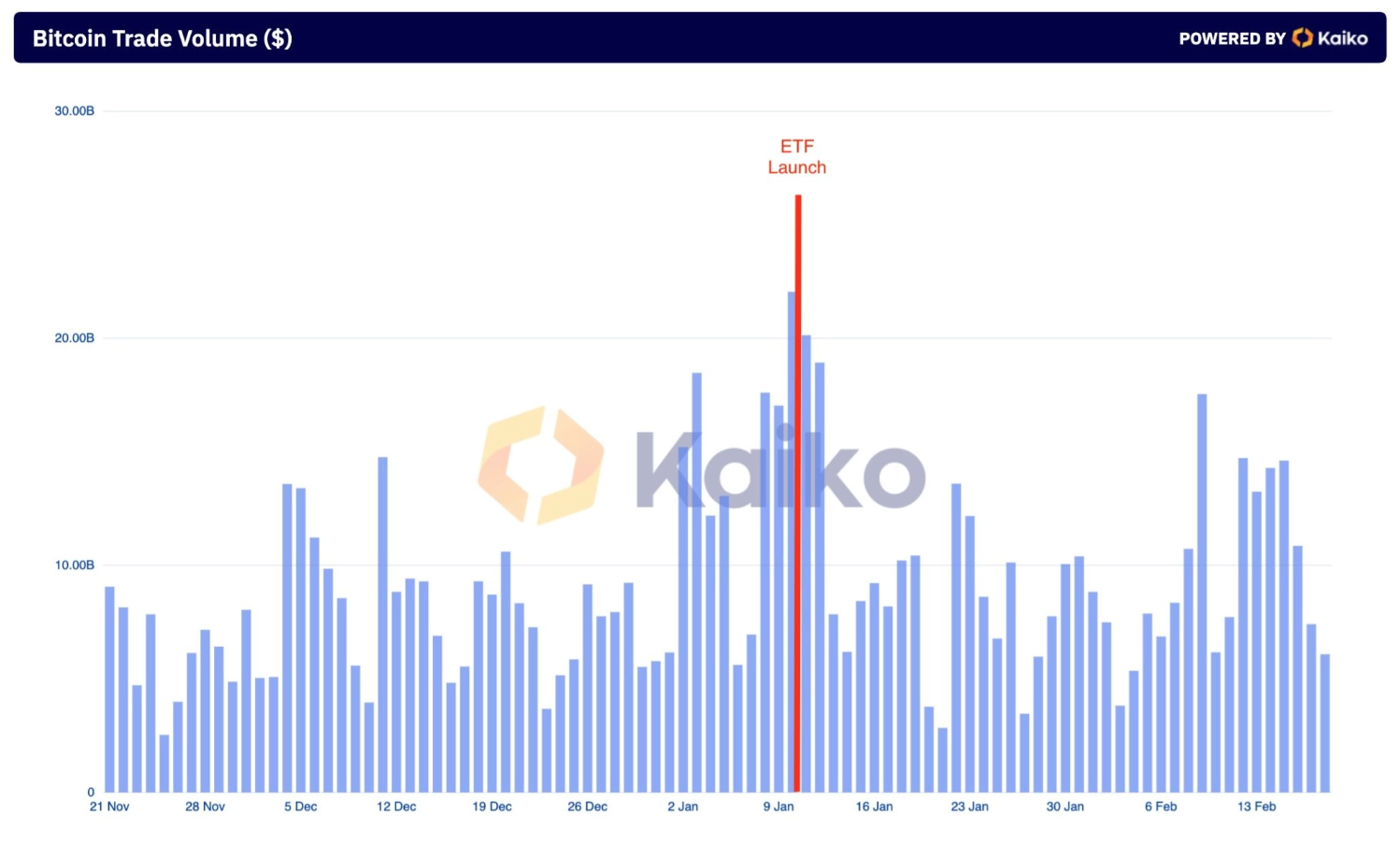

The report shared on February 19 showed the increase in Bitcoin’s volume, which is depicted in a graph. The graph illustrates a surge in Bitcoin trade volume when spot Bitcoin ETFs in the United States commenced trading.

Additionally, the data shows that Bitcoin’s average trade size across 33 exchanges reached its highest level in a year on February 13, consistently exceeding $1,000 since the beginning of 2024.

Recently, Web3 research platform SoSoValue reported a net inflow of $135 million into spot Bitcoin ETFs on February 20. The highest daily inflow was $631 million on February 13. It is worth noting that Bitcoin surpassed $50,000 on February 12.

Bitcoin is currently trading at $51,200, experiencing a 1.6% loss in the last 24 hours; however, the trading volume has increased by 47% in the last 24 hours, surpassing $32 billion.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com