As Bitcoin gears up for its highly anticipated halving event in April 2024, renowned investor Mike Novogratz shares his bullish sentiments on the future trajectory of the leading digital asset.

Novogratz, CEO of Galaxy Investment, which specializes in crypto investments, took to social media to provide insight into Bitcoin's upcoming halving. With cryptocurrency recently breaching the $1 trillion market capitalization mark and nearing a valuation of $52,500, just shy of its previous all-time high of $69,000, Novogratz emphasizes the significance of the impending halving.

Highlighting the scarcity, Novogratz mentioned the impending difficulty increase in BTC mining, underscoring the potential for increased demand and diminished supply to propel Bitcoin's price further upward. He stressed the role of supply dynamics in determining asset prices, echoing the sentiment that diminishing supply amid sustained demand could drive Bitcoin's value higher in the long term.

2 months to the halving!! Man time flies... I remember celebrating the last one on a zoom with @ToneVays and @woonomic and tons of other $BTC fanatics!!

— Mike Novogratz (@novogratz) February 15, 2024

Mining about to get a whole lot harder ...

But ETF demand and less supply gonna drive price.

Always remember, prices…

In addition to Novogratz's remarks, recent developments from institutional investors further underscore Bitcoin's growing mainstream acceptance. BlackRock, a global investment management corporation, has bolstered its Bitcoin holdings to 105,280 BTC for its spot iShares Bitcoin Trust, IBIT, signaling continued institutional confidence in the digital asset.

Prepare for roller coaster ride

However, historical data suggests that Bitcoin typically experiences a dip in price in March of halving years, followed by renewed upward momentum. Matrixport, a leading digital asset financial services platform, previously noted this trend, further reinforcing the narrative of short-term volatility amid long-term bullishness.

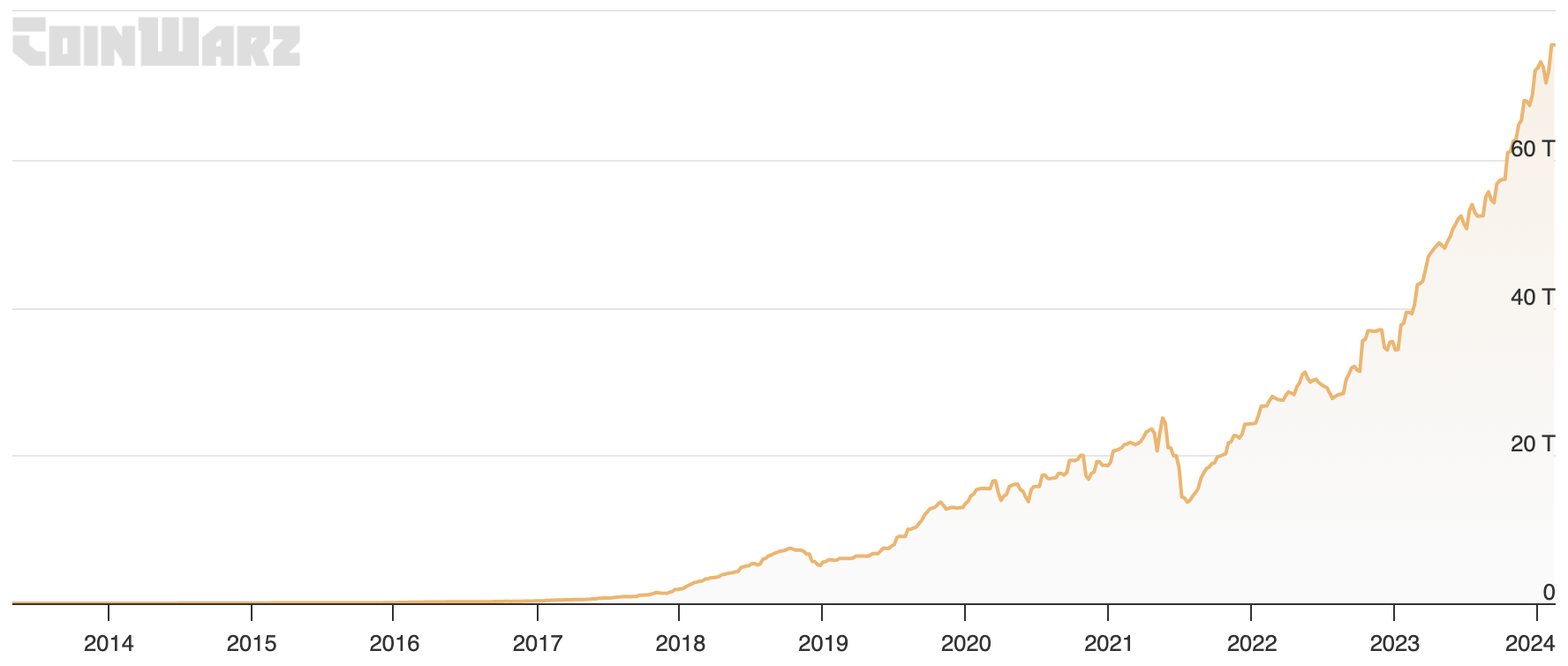

Further amplifying optimism, Bitcoin's mining difficulty has recently surged to a record-high of 75.5 T, reflecting the network's robustness and signaling a historically bullish trend for the cryptocurrency.

As Bitcoin's halving event approaches, investors like Novogratz remain optimistic about its long-term prospects, citing institutional investment, supply dynamics and historical patterns as key indicators of continued growth in the digital asset space.my

u.today

u.today