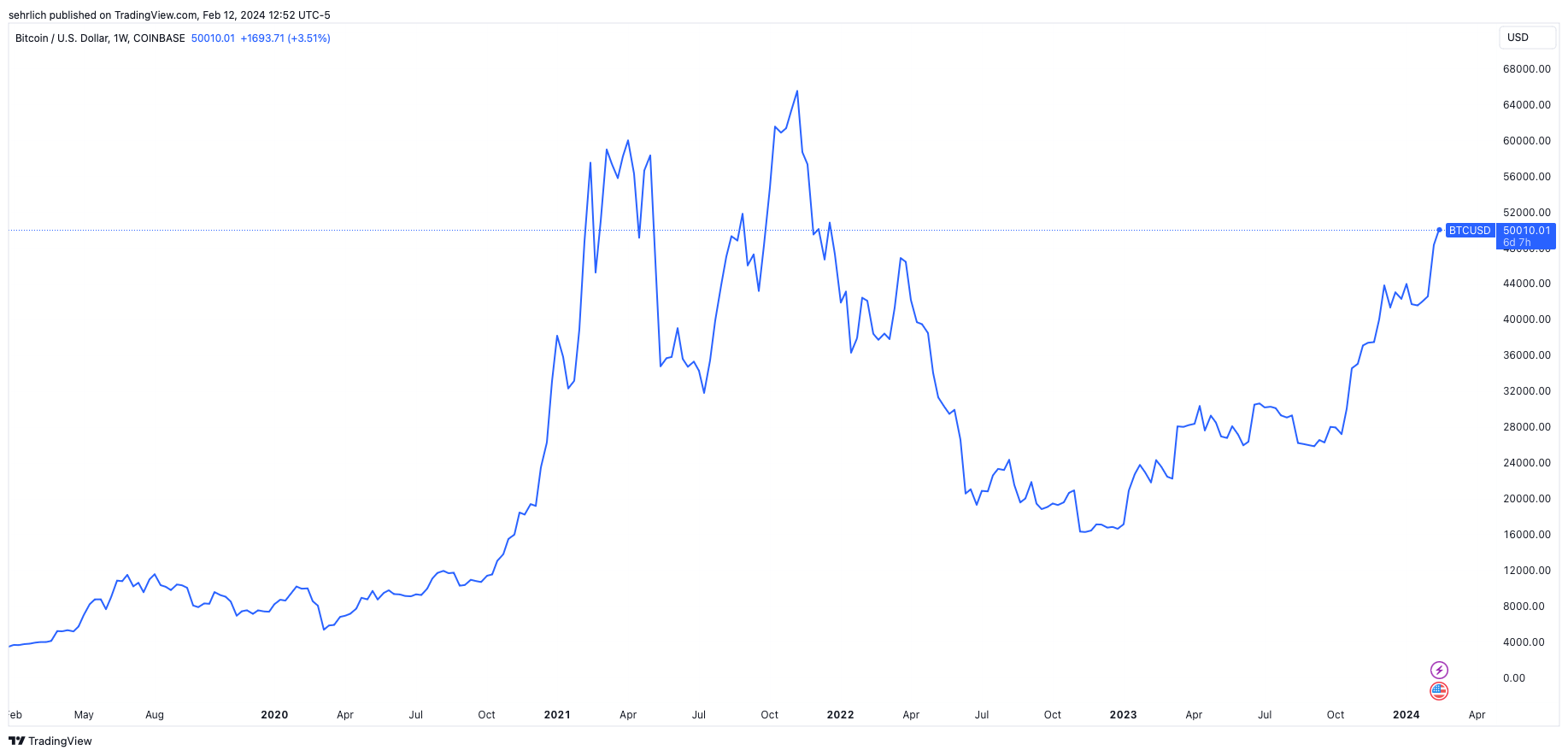

Bitcoin reached the $50,000 mark for the first time since the bullish days of 2021. Its surge comes from a five-day period where it gained 13% and represents a strong recovery from a large sell-off in mid-January when long-awaited spot bitcoin exchange-traded funds (ETF) began to trade.

During the January drop, bitcoin fell to $38,500, as it succumbed to a familiar pattern of ‘buying the rumor and selling the news’ that plagued previously anticipated events in crypto such as the April 2021 direct listing by Coinbase and the launch of cash-settled bitcoin futures ETFs in October 2021.

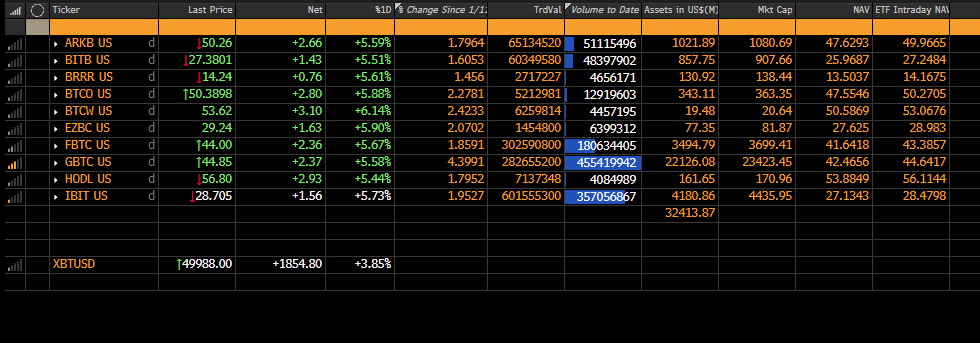

A major reason for the sell-off was the liquidation of $1.2 billion worth of shares held by the estate of bankrupt crypto exchange FTX in one such ETF, the Grayscale Bitcoin Trust (GBTC).

These sales, combined with those of other investors looking to flee the firm’s relatively high expense ratio of 150 bps dampened the impact of the billions of dollars flowing into competitors offered by the likes of Fidelity and BlackRock. However, flows out of GBTC are slowing while BlackRock and Fidelity’s offerings are closing in on a combined $8 billion in assets under management. In total, more than $3 billion in net new demand for bitcoin through these ETF products has entered the industry since these products began to trade.

There could be more bullish momentum in bitcoin’s immediate future as well. This April it will undergo its fourth ‘halving’, a quadrennial event that reduces the issuance rate of new bitcoin by 50%. This process will continue happening until the final bitcoin is mined in the year 2140.

forbes.com

forbes.com