Although Bitcoin (BTC) is back above the $44,500 price mark for the first time since the start of the exchange-traded fund (ETF) hangover retrace, machine learning and artificial intelligence (AI) algorithms are not certain that it would retain the current bullish momentum by this Valentine’s Day.

Indeed, the advanced AI algorithms deployed by cryptocurrency and stock analytics platform CoinCodex see the price of the maiden crypto asset in decline for the next month, setting it at $43,182 on February 14, 2024, which would suggest a 3.41% loss compared to its current price on February 8.

Previous Valentine’s Days

Historically, the previous Valentine’s Days were a mix of bearish, bullish, or middle-road movements for Bitcoin, with February 14, 2017, seeing it changing hands at the price of $1,004 – in pretty much the same sentiment as in the days leading up to it but igniting an increase toward the month’s end.

That said, the following year’s Valentine’s Day was exceptionally bullish for the flagship decentralized finance (DeFi) asset, which witnessed an increase to $9,495, moving further up in the days after February 14, 2018, according to historical data.

On the other hand, the Feast of Saint Valentine in 2019 saw a massive drop in the value of Bitcoin, which traded in roughly the same price range during the entire month of February – recording a price of $3,603.37 on February 14, 2019, as per the information retrieved by Finbold.

The next year’s celebration of love saw the maiden crypto asset climbing to a price nearly 190% higher than the last year’s, reaching a price of $10,356, which indicated a slight increase compared to the weeks leading up to it, but suffering a decline by the end of February.

Breaking the record

As for 2021 – a record-breaking year for Bitcoin – the largest asset in the crypto industry by market capitalization traded at $48,633 on February 14, 2021, recording an increase from $36,000 from the month’s start to $57,000 in the days that followed, racing to its all-time high (ATH) of $69,045 in November.

However, Bitcoin slowed down its gains again in 2022, recording only mediocre performance on February 14, 2022, compared to the days before – $42,739 – as well as declining in the weeks that followed, but ending the month on a bullish note in the area above $43,000.

Finally, the famous crypto asset was changing hands at the price of $22,221 on Valentine’s Day 2023, recording a modest increase before and after, as it moved to recover from an especially poor performance in late 2022, exacerbated by the collapse of the crypto exchange FTX in November.

Bitcoin price analysis

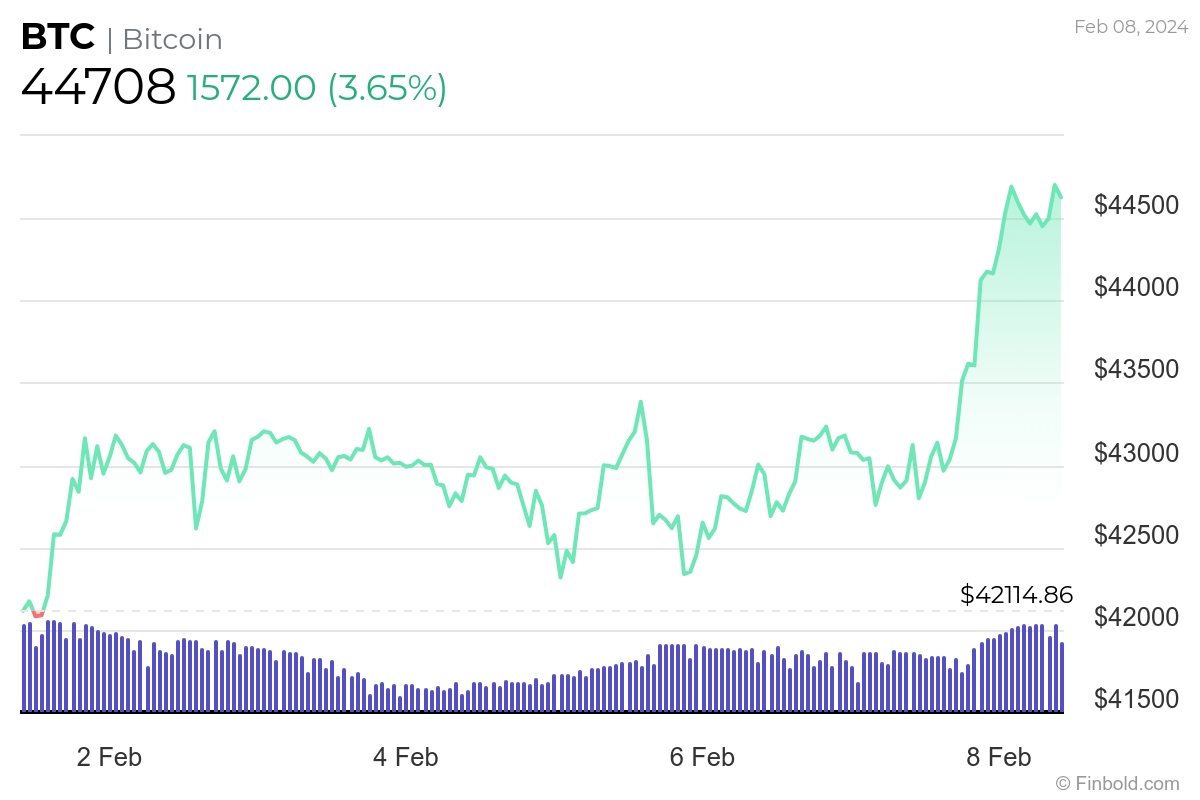

As things stand, the price of Bitcoin currently amounts to $44,708, which indicates an increase of 3.65% in the last 24 hours, as well as a 6% gain across the previous seven days, whereas, on its monthly chart, it is recording a decline of 4.06%, as per data on February 8.

All things considered, Bitcoin could, indeed, drop to the price range set by the AI algorithms, but such a decline would likely represent a temporary setback as the original cryptocurrency moves toward its next halving in April, which many experts believe would trigger a massive rally.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com