Launched over ten years ago in 2009, Bitcoin is a virtual currency powered by blockchain technology. The coin was created by Satoshi Nakamoto to overcome the shortcomings of government-issued currencies without requiring a controlling authority. It acts as a store of value and a payment method for any transaction process in the markets.

It has since then grown in popularity and demand, often being compared to gold. Therefore, this article will cover the Bitcoin (BTC) price forecast from 2021 to 2030. Bitcoin trades on all the major crypto exchanges flashing the biggest market cap.

The popularity of BTC and blockchain technology has led to more people scrambling to get a place on the Bitcoin (BTC) train when time is still prime. Therefore, we will discuss the Bitcoin price prediction for 2021-2030.

BTC prices could rise and hit as much as millions according to expectations. This rise could happen eventually as only during February, the price change of one BTC increased by more than 70 percent leading to its all-time high.

This year, the cryptocurrency industry saw a huge surge in investment and the use of crypto for payments and trading, according to analysts.

Central banks from all over the world have been trying to push regulations for Bitcoin investment as well. Bitcoin network has become quite popular with teens, youth, and adults as well, including women as they indulge in Bitcoin trading.

This year has been quite crucial for Bitcoin as well cryptocurrencies in general wherein countries like El Salvador, China, and South Korea have played major roles. Recently, we saw that the news of the China ban led to a huge drop in the price of Bitcoin. Bitcoin dropped from 53K USD to $42K which scared everyone but it again got back it.

Bitcoin Overview

| Coin | Symbol | Price | Marketcap | Change | Last 24h | Supply | Volume (24h) |

|---|---|---|---|---|---|---|---|

Bitcoin

BTC

|

BTC | $ 49,358.00 | $ 932.82 B | 1.72% | 18.89 M | $ 34.70 B |

Bitcoin Network & Signals

GALAXY SCORE

The Galaxy Score indicates how healthy a coin is by looking at combined performance indicators across markets and social engagement. Display the real-time Galaxy Score of any coin.

Key Bitcoin moments to note

The popularity of Bitcoin brought with it a host of other problems and opportunities. For example, in 2019, scammers stole $722,000 million from unsuspecting investors who were fooled into investing in non-existent BTC mining equipment.

If you have a GPU and an internet connection, you can easily mine crypto and benefit from gathering more funds.

Mostly, scammers use websites whose registration dates and copyrights raise questions about their credibility. But as the value of every digital currency is reaching everywhere, we will see a decrease in scams rising in the coming years.

What followed was the period of stagnation for Bitcoin’s price over the week as it ended both 2018 and 2019 with sharp pullbacks. However, the BTC price did regain much of its value after Feb and Mar of 2020, when a strong rejection was seen for further downside.

Trillions of rising volumes were traded by the end of the month, resulting in one of the greatest reversals in the history of cryptocurrency. BTC`s price soared back above $10,000 in the middle of 2020, surprising investors across the board.

This was a notable increase and forced an update on many Bitcoin predictions. Exchange-traded volume had seen change across the board during this several-month upswing as the coin gets traded by short-term and long-term traders going for increased profits.

Over the past few weeks, after reaching the all-time high, the price of Bitcoin started to decline and what happened to be a bullish run turned into a bearish nature.

This led to a decrease in the price of all the altcoins as well. The price of BTC is now half of its all-time high, but it is expected that it will reach $100,000 by this year since institutional investors are coming into the cryptocurrency industry.

Current position of Bitcoin price

While Goldman Sach thinks favors Ethereum and says that it will overtake Bitcoin as a store of value in the future, Bloomberg thinks that Bitcoin will go to $100K. The rising price of BTC might optimize the market sentiment.

After the recent events, including the El Salvador adoption and new marketplaces coming up in the NFT industry, much positive news is filling in the market. China has also played its part in the downfall of Bitcoin, and now, it seems to be backing digital Yuan.

Ever since BTC’s price and market share have been debated among institutional investors and advisors with the latest price predictions and analysis updated frequently, one still holds – BTC will reach a trillion-dollar cap soon, proving many predictions correct.

Popular cryptocurrency market figures have made other notable price predictions, such as Anthony Pompliano, the founder of Morgan Creek Digital, Max Keiser, a filmmaker and broadcaster, and Joe Kernen, CNBC’s Squawk Box host, many being leading institutional investors.

Adoption by El Salvador

Another key point and good news for Bitcoin’s existence was when El Salvador became the first nation in Central America to accept cryptocurrencies in June following the passage by a majority of the Salvadoran Congress.

The President of El Salvador, known for his passion for digital currency and violating the Latin-American president’s rules, said the legislators had adopted the Bitcoin bill. He gave the green light to any store that wants to accept payment in the form of cryptocurrencies. The demand will boost economies, analysts say.

El Salvador became the first country to adopt Bitcoin as a legal tender, while China once again caused a stir in the market by shutting off mines, and miners are now migrating to other countries.

Bitcoin’s adoption led to people fearing if too much power resources will be consumed since the mining of Bitcoin will also be legal in the Central American country. El Salvador’s government has partners who will help in the achievement of Nayib’s goals.

The increase in payments using Bitcoin as a store of value and the involvement of partners have all helped El Salvador.

The establishment of Bitcoin miners in El Salvador was viewed internationally as a bold move owing to environmental concerns. But the President had a solution for that as well. The President will be harnessing the power of volcanoes to power the Bitcoin mines in El Salvador.

Around 95 MegaWatt power will be harnessed from the geothermal plants that would be enough to power the Bitcoin mines in El Salvador to validate payments and any transaction.

Bitfury founder George Kikvadze applauded this step the President of El Salvador took to use Bitcoin in payments. He stated that in the current atmosphere, 95 MW would be easily able to accommodate around 3 Exahashes.

3 Exahashes can be used to mine Bitcoin at a rate of around 1800 BTC per month. At the current rate, this would mean around $750 million in a year. George Kikvadze claimed this to be the biggest and most lucrative project for the entire country or even Central America.

Bitcoin and social media

Jack Dorsey, the current Chief Executive Officer of Twitter, has revealed much about integrating Bitcoin with the platform. This is indeed a new concept that is still in the works. The recent introduction to Twitter Tip Jar was just a peek into the future, it seems.

In the recent call for income from the second quarter, the CEO showed that shortly, plans are made to change how Twitter works by integrating Bitcoin transaction and payment system and expanding it into twitter products and subscriptions such as Super Follows. This shows that the demand for digital currencies is high.

Jack Dorsey mentioned that his primary eyes and the company were on Twitter integration with Bitcoin payment system and on delivering platform users what they desire. This is the first time in which the CEO has made his plans publicly known concerning cryptocurrency.

Twitter said it would offer 140 NFTs on Twitter at no cost, and that’s an indication that a great deal was already prepared by the CEO.

Twitter is not the only social media platform that is coming up with integrating Bitcoin and other cryptocurrencies with their platform. Facebook is also preparing for the launch of Diem.

The Diem is a Facebook Pay-included stablecoin. The contrast between Twitter and FB would be that Bitcoin is a standard open to the internet.

Bitcoin’s integration with Twitter and Facebook will be the new future for artists and vendors. It is also being expected that the sale of NFTs will be held on Instagram with the help of a new feature that the platform has been planning to launch. With the usage of this new platform, the artists on Instagram will be able to easily sell their NFTs.

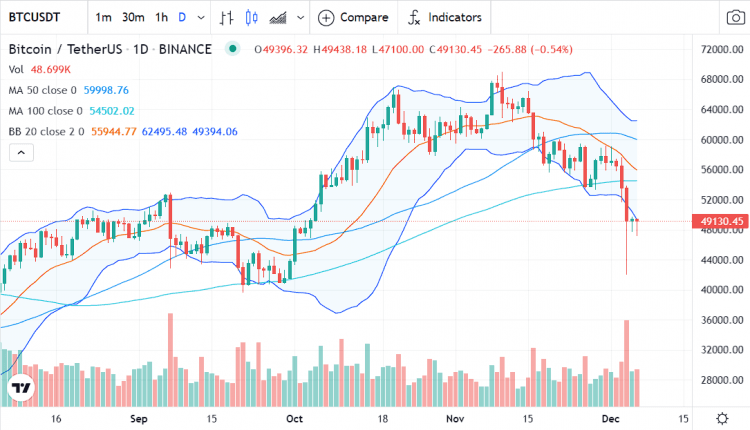

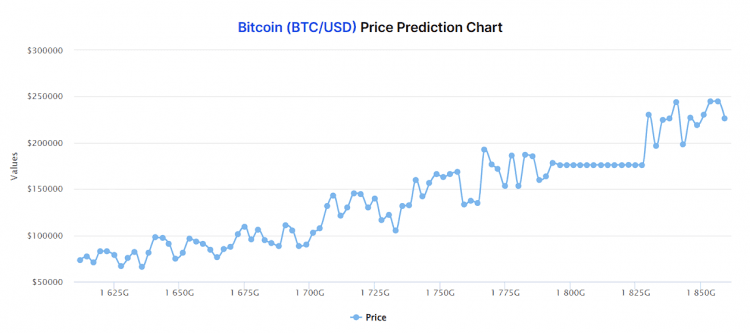

Bitcoin Prediction using Technical Analysis on current Bitcoin price

It can be seen above that in the 1-day chart, the price has been seen a huge drop, and the bears seem to take charge of the market. The price-performance of Bitcoin has been quite poor as it is traveling below the 100-day but below the 50-day Moving Average.

The price is situated in the lower end of the Bollinger Band, indicating a bearish trend in the short term, and is currently trying to reclaim the support at $53. The RSI levels indicate that we can see a reversal if the bulls take charge soon and hold. For now, the 1-day chart looks quite bearish.

An increasing number of institutional investors are pouring money into the crypto industry with a multi-billion dollar market cap. Investors have more interest in crypto prices than gold.

If you carefully look at the chart above, we saw Bitcoin take a huge dump when the price of the cryptocurrency was unable to break the resistance at $53K. But, the bigger question is, how high Bitcoin will go.

Bitcoin price predictions 2021 -2030

As mentioned before, Bitcoin price predictions for 2021 vary. Several predictions estimate the currency to be worth at least $1 million soon due to the adoption of Bitcoin transactions and increased investment compared to gold investors.

However, some price predictions predict the opposite – the currency will move below $20,000 and never recover.

The bitcoin price predictions are usually made by people seeking to manipulate the price of the currency in their favor using a certain process. This is why people like Jackson Palmer, the co-creator of Dogecoin, claim that the crypto industry is corrupt and manipulated.

Let`s take a look at the Bitcoin price prediction 2021 and what price Bitcoin could reach based on the current price.

What to expect from Bitcoin by the end of 2021?

Bitcoin forecast: The first half of 2021

This year, Bitcoin saw strong bullish momentum at the end of January when support was found at $30,000.

What followed was a very strong rally towards $58,000 for the first time during most of February, which set a clear high and indicated that the overall long-term momentum is very bullish.

Thereafter, the onset of the bullish trend changed everything, and now, Bitcoin fell from its all-time high to half of its ATH. The price prediction Bitcoin will use the current price for analysis.

Bitcoin forecast: The second half of 2021

The biggest question is the value of the coin by the end of 2021. It has been considered that BTC/USD is not following the Wyckoff Distribution pattern anymore and now has reclaimed the support at $45,676 but lost at $48k. It might fall further, but what follows is a huge bullish momentum by the end of 2021.

According to our predictions, Bitcoin might reach $100,000 by the end of 2021 because of plenty of big whales accumulating Bitcoin in recent times, and a huge upswing is possible in the future.

Also, with the global adoption of Bitcoin, we can say that the pros outweigh the cons. Also, as of now, the biggest GBTC Unlock is over, and there are chances that the price of Bitcoin will see a strong reversal soon.

Also, it was noticed that the GBTC shares were trading at their highest discounts ever since May, in the month of August.

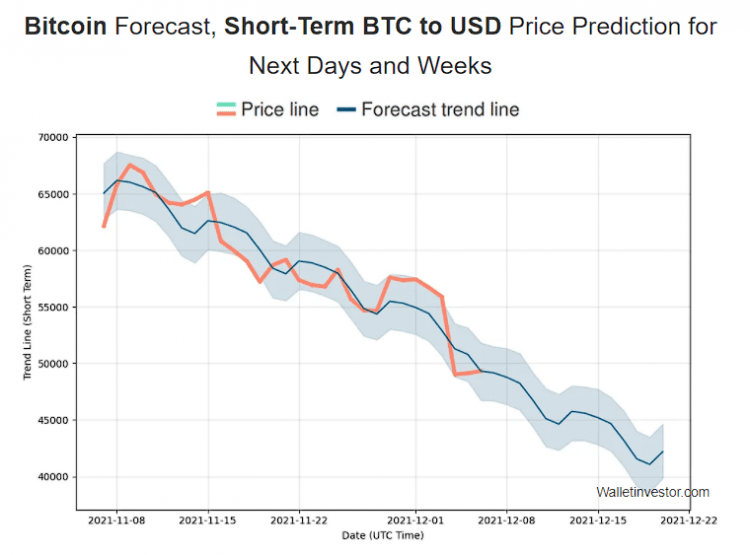

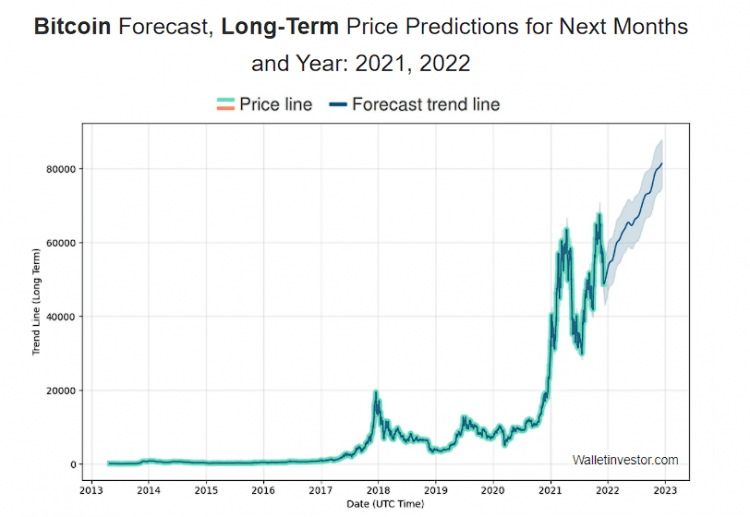

According to Wallet Investor, the price of Bitcoin will increase to a maximum of $74010 by the end of 2021. Although, the maximum price is set at 61524.80 USD for December 2021, according to the Bitcoin forecast by Wallet Investor.

On the other hand, Digital Coin has predicted a value of $76,209.11 by the end of 2021. They are as optimistic as Wallet Investor for the 2021 Bitcoin price.

Bitcoin forecast 2022

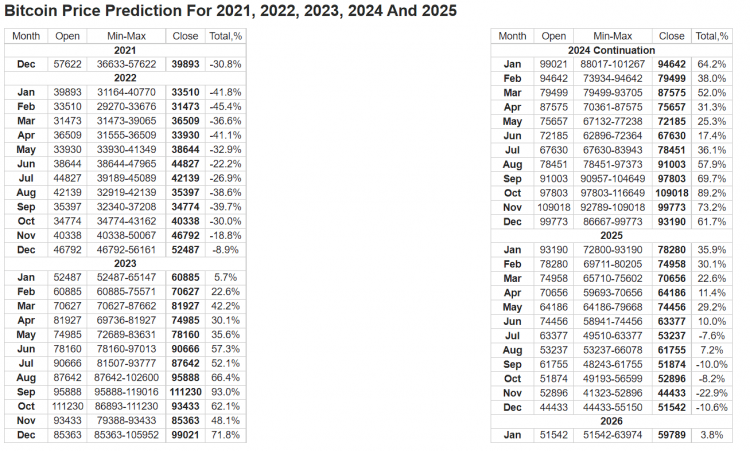

It is hard to predict what the Bitcoin price will be in 2022. Therefore, this Bitcoin price for 2022 is quite an estimate and not absolute. Considering the previous cycle from 2015 to the end of 2017, when Bitcoin peaked just under $20,000, resulted in a gain of over 10,000 percent, we can make a basic estimate.

From the current lowest point at the end of month December 2019, when the Bitcoin price traded at $3,100, an equal gain of 10,000 percent would mean that the price target for the end of this cycle is $310,000.

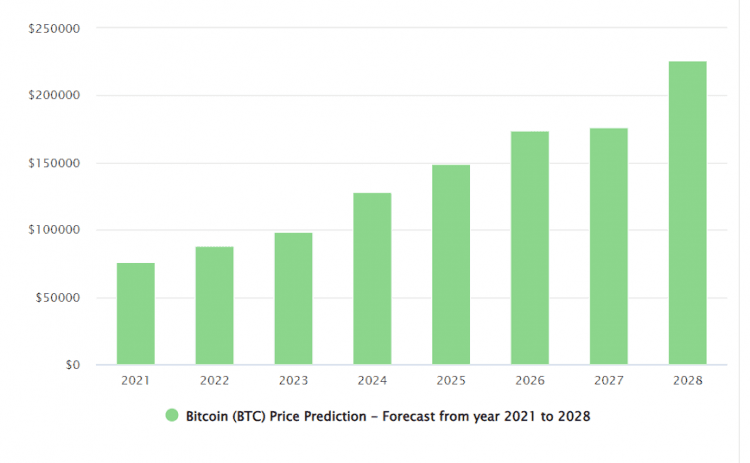

According to Longforecast, the currency will be trading in the range of $46792-$56161 by the end of 2022. At the same time, Digital Coin predicts that by the end of 2022, the world’s largest cryptocurrency will reach the highest price of $88,035.55 by the end of 2022.

Bitcoin price prediction 2025

According to Ballet wallet CEO Bobby Lee, Bitcoin`s price should exceed a minimum of $500k by the end of 2028 and have a capitalization that exceeds gold, which is currently estimated between $10 and $11 trillion.

Recently, Bitcoin passed the $1 trillion mark, indicating that much of the work has already been done as Bitcoin is valued at more than 10 percent of what gold does.

But after the fall in the coin price, the market cap has now reduced to billions. It is estimated that by the end of 2021, the currency will resume its status of trillion-dollar dominance.

Bitcoin price prediction 2025 should easily exceed the $10 trillion capitalization mark.

Digital Coin predicts that Bitcoin will reach $226,035.42 in 2028. It can be expected that by the end of 2026, the maximum price that Bitcoin will reach is a maximum of $212121, as said by Wallet Investor.

Market cap of over $10 trillion?

Considering how fast the capitalization of Bitcoin has grown over the last years, we can assume that another 1000 percent gain in price prediction for Bitcoin is more than possible over the next five years.

Therefore, the Bitcoin price prediction for the year 2025 should easily exceed the $10 trillion capitalization mark, which would mean that the price target at $550,000 will be reached.

What drove this institution into Bitcoin

We have seen how global acceptance of the asset has driven institutions into investing in Bitcoin, but many do not know what exactly pushed them to the asset. Some of these reasons are mentioned below:

Fear of inflation

Microstrategy began investing in Bitcoin due to the belief that the government of the United States of America would be pumping more money into the economy, which invariably was going to lead to a surge in the inflation rate.

To circumvent this, the company decided to invest in the currency, and since then, it has grown to become one of the highest holders of the crypto asset. Jack Dorsey’s Square is another company to have towed this path.

Secured, faster, and cheaper transactions

PayPal and other financial institutions investing in the space believe that Bitcoin and other crypto-assets provide them an opportunity to offer their users a financial product that would help them carry out secured, faster, and cheaper transactions.

Fear of missing out (FOMO)

Everybody is scare of missing out on an important financial decision. And because nobody wants to be left out, they adopt the trends in their sector and try to adapt to any changes in the world. This is one of the reasons that has driven some investors into the Bitcoin industry, as they do not want to appear to be left behind by their peers.

Increased digitization of the world

The world has gradually moved away from a paper-intensive world to a world that is now dominated by technology. One of such developments is Bitcoin and the crypto industry that has made the world more digitally compliant.

FAQs on Bitcoin price prediction

Is Bitcoin a good investment?

One thing is for sure, Bitcoin has been the best performing asset class of the decade, and we are likely to see it change many conventional supporters to the side of crypto by the end of 2021.

Major hedge fund manager Osprey Funds and many more are currently in line to get their ETFs approved by SEC. The hedge fund manager, Osprey Funds CEO, claims that SEC is causing a delay in approval.

According to our investment advice, it is definitely good to buy Bitcoin before it’s too late and the entire world starts to accept Bitcoin and it turns into a global currency. Fiat currencies won’t hold much value in the future as the crypto market surges to new heights despite the bearish market we see now. Our technical indicators show that blockchain technology adoption will surge.

What will Bitcoin be worth in 2030?

Bitcoin should exceed the $10 trillion cap by 2030, given the previous momentum. With El Salvador’s adoption, the Bitcoin price predictions for 2030 depends on the adoption rate.

The Bitcoin journey has been quite adventurous, and every day brings something new in the crypto land.

How much does it take to invest in Bitcoin?

As everyone has frequently said- buy or sell as little or as much as you want. Exchanges since the beginning have offered to trade for positions as small as $10 but keep following our Bitcoin price prediction. You conduct your thorough research before making any investment decisions or accepting recommendations to buy Bitcoin and take your own risk. However, compared to stock market, BTC gives higher returns.

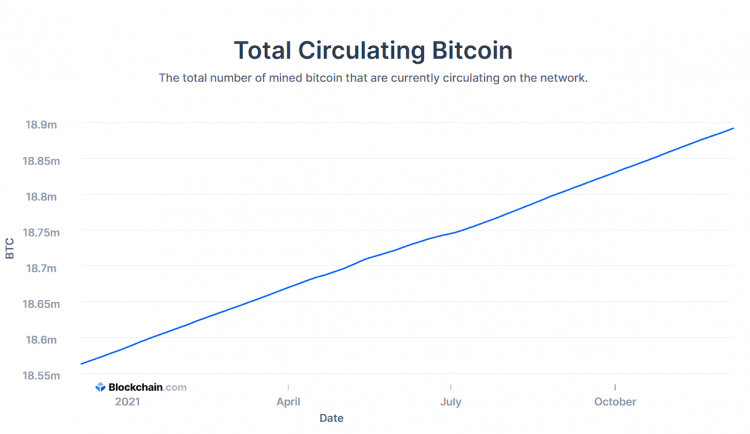

How many Bitcoin tokens are left?

There are a total of 21 million Bitcoin to be ever created. 18.7 have already come out of the massive mining farms that perform hashing algorithms that help Bitcoins blockchain network and related companies to do their work.

Therefore, most Bitcoin has already come into existence (around 89 percent), and one would think what would need to change to get more Bitcoin after the total maximum is exceeded. The answer is – you will have to do an exchange.

cryptopolitan.com

cryptopolitan.com