Almost 17,000 BTC were sent to addresses related to those four ETFs in the past 24 hours, with the total AUM surpassing $3 billion.

A new dashboard keeps track of the Bitcoin (BTC) flows of BlackRock, Fidelity, Bitwise, and Franklin Templeton’s spot BTC exchange-traded funds (ETFs). On-chain data platform Arkham published the addresses for those ETFs on Jan. 22.

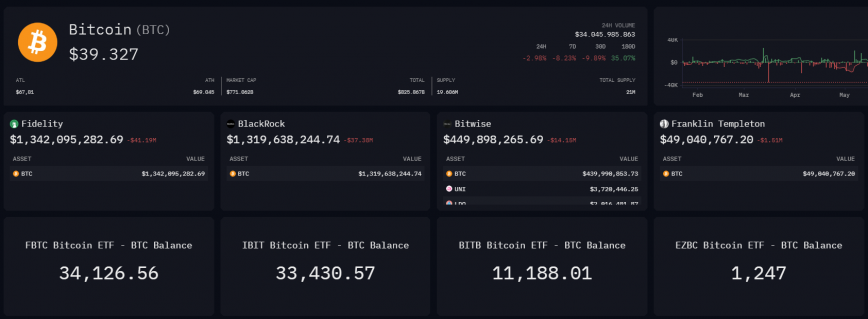

At the time of writing, the cumulative holdings of those four ETFs are close to 80,000 BTC, worth more than $3 billion. Fidelity’s Bitcoin ETF (FBTC) is the fund with the largest amount of Bitcoin holdings, totaling 34,126 BTC, valued at roughly $1.3 billion. In the past 24 hours, FBTC registered an inflow of almost 9,300 BTC sent from three different and unlabeled wallets.

Following close, BlackRock’s Bitcoin ETF (IBIT) shows 33,430 BTC under management. On Jan. 22, IBIT showed an inflow of almost 5,000 Bitcoins, most of them sent from Coinbase Prime’s hot wallet.

Bitwise’s BITB wallet shows a significantly lower quantity of Bitcoins. The BITB’s custody address holds 11,188 BTC, with 2,500 BTC received between Jan. 22 and 23. One batch of 1,352 BTC was sent from a wallet labeled as ‘Flow Traders’, while the rest was sent from an unlabeled address.

Franklin Templeton’s EZBC comes at the parade’s end with 1,247 BTC attributed to its custody address, most acquired two weeks ago through Coinbase Prime.

The dashboard also includes Grayscale’s GBTC holdings, with the ETF showing 558,280 BTC under management, which is $28.4 billion at the time of writing.

cryptobriefing.com

cryptobriefing.com