Bitcoin (BTC) surged 10% in two days from trading below the $40,000 mark to above $44,000 on December 6. With the bullish volatility, Bitcoin’s average transaction fee now costs what the average global population receives as their daily income.

Notably, a study by Zippia from April 2023 discovered, “The average global personal income is $9,733 per year.” In a 365-day year, the average global personal income is $26.66 per day. Moreover, Burundi is the country with the lowest average annual income of $220, while Monaco has the highest at $186,080.

In the meantime, Bitcoin transaction fees reached a daily average of $25.02 or 56,740 sats per transaction. Sats, or ‘satoshis,’ is the smallest unit of a Bitcoin, with 1 BTC having 100 million sats.

Therefore, a single Bitcoin transaction already costs what the average person earns daily for their work. In what advocates call “the Bitcoin standard,” making one financial transaction daily would consume the global average annual income. This data evidences the challenges BTC faces to fulfill its narrative of becoming a global currency.

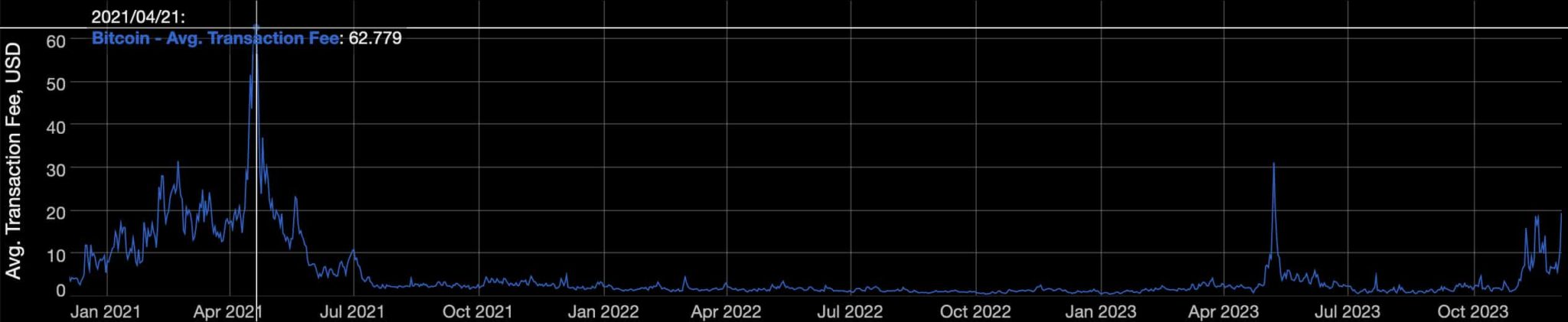

Historically, Bitcoin reached an all-time high average transaction fee of $62.78 on April 21, 2021. On May 8, 2023, fees peaked at $31.14 and are currently trending above the cost of a Big Mac, according to BitInfoCharts.

How do average Bitcoin transaction fees work?

Essentially, Bitcoin has one of the most limited transaction capacities among all cryptocurrencies. Fees work as a prioritization mechanism, allowing users to outbid each other, jumping in line for faster confirmations.

Interestingly, a Bitcoin transaction needs approximately two hours — after the first confirmation — to be considered final in the current state of its network. Hence, high-volatility events incentivize Bitcoin transaction fee hikes due to an increased urgency to settle a sending.

Mempool.space calculates the $25 average by looking at all transaction fees paid in the last 144 blocks (24 hours).

Despite being dynamic data, average transaction fees are a valuable indicator of Bitcoin’s ability as money. The higher this average is, the less organic demand BTC can attract from the global population. Meanwhile, the more demand for block space and usage, the higher fees are expected to grow.

Additionally, Experts consider higher fees as needed to keep the network’s security. With the block subsidy halving happening every four years, miners’ rewards are reduced, and compensation is required to keep the same hashrate levels.

All things considered, it is already a consensus that Bitcoin transaction fees are expected to keep rising in the following years, which creates a paradox for lower accessibility.

In this context, cryptocurrency users often seek alternatives among lower (or zero) fee networks like Nano (XNO), Monero (XMR), Bitcoin Cash (BCH), Litecoin (LTC), Dash (DASH), ZCash (ZEC), XRP Ledger (XRP), and others. For that reason, fee hikes can usually be considered a predecessor for altseason events.

finbold.com

finbold.com