Bitcoin’s (BTC) price surge near $40,000 left short sellers with losses exceeding $100 million over the past 24 hours.

Notably, these gains have not translated into wrapped Bitcoin (wBTC) on Ethereum despite the crypto market enjoying a green run.

Short Sellers Lose Over $100 Million

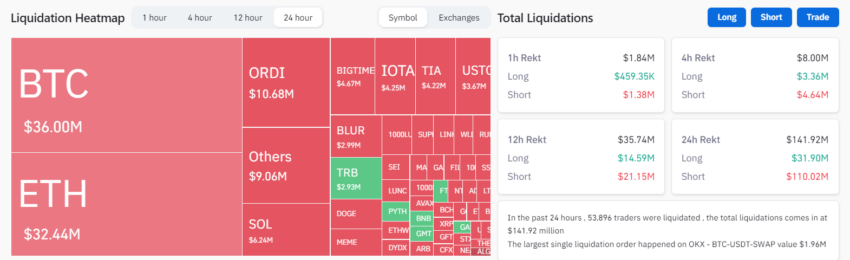

The recent cryptos market upswing caught several market participants off-guard as traders endured over $140 million of liquidations, with short sellers alone bearing the brunt of over $110 million in losses. This was the second-largest amount of short liquidations in any day since mid-November.

Bitcoin traders faced significant liquidations totaling $36 million, mainly affecting those who had taken short positions. Ethereum traders, on the other hand, experienced liquidations amounting to about $32 million. And, Solana traders encountered over $6 million in liquidations as the price of SOL briefly surged beyond $65, marking its highest price point since May 2022.

Crypto exchange Binance recorded the most losses among its counterparts at $53.44 million, followed by OKX at $51 million.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

The liquidations occurred as Bitcoin continued its year-long rally. Technical analyst Koroush AK said Bitcoin has found new resistance at $40,000 and built strong support around $38,000, hinting at a potential altseason on the horizon.

“[Bitcoin’s] new resistance $40,000, and new support $38,000. Time to rotate to altcoins again, especially ones that break local highs… We haven’t had a red weekly candle for 2 months,” Koroush AK said.

wBTC Supply Decrease in November

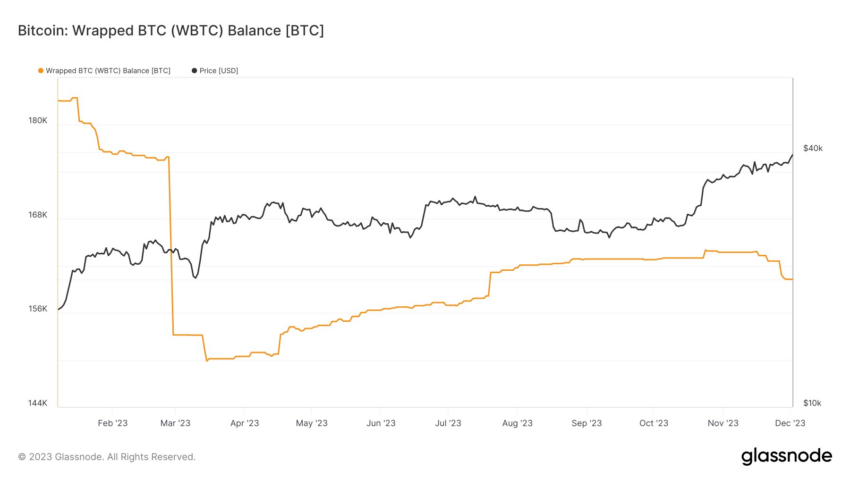

Wrapped Bitcoin (wBTC) supply on Ethereum decreased by around 2% or more than 3,000 BTC in November. This indicates that demand for BTC on the ETH blockchain has remained muted despite the flagship asset’s rising value.

wBTC order book shows that the digital asset saw more burning than minting during the past month. There are currently 160,286 wBTC against 160,293 BTC held in custody.

Read more: How To Trade Bitcoin Futures and Options Like a Pro

Tom Wan, a research analyst with 21co, explained that the balance decline could be linked to decreased DeFi appetite and the emergence of BRC-20 on the blockchain network. At the peak of its supply, demand for wBTC was relatively high as investors found a use for it in their DeFi activities.

However, with several DeFi protocols struggling to reach previous heights, demand for wBTC has waned.

“Supply of wBTC decreased by 3,456 (-2.16%) despite the increase in BTC price (+10.8%) in November. DeFi appetite hasn’t fully picked up yet. The TVL on Ethereum is still down 75% compared to ATH.” Wan added.

beincrypto.com

beincrypto.com