There has been a flurry of activity from industry analysts following the spot Bitcoin exchange-traded fund (ETF) race. New time frames have been predicted alongside Bitcoin prices and Grayscale has met with the SEC again.

Crypto asset manager Grayscale has met with the US Securities and Exchange Commission again this week.

Spot Bitcoin ETF Plans Progressing

On Nov. 22, Grayscale filed a new preliminary prospectus for its plans to convert the GBTC fund into a spot ETF following a meeting with the regulator.

On Nov. 29, the company updated its GBTC agreement for the first time since 2018 in preparation for the conversion.

Details are still being ironed out as reported by ETF Store president Nate Geraci on Dec. 1.

“I think we’re approaching finish line,” he said before pondering how these meetings play out.

“I picture Sonnenshein walking in w/ a fruit basket and being like ‘Sorry about the lawsuit and all. Water under the bridge! Now about that conversion.’”

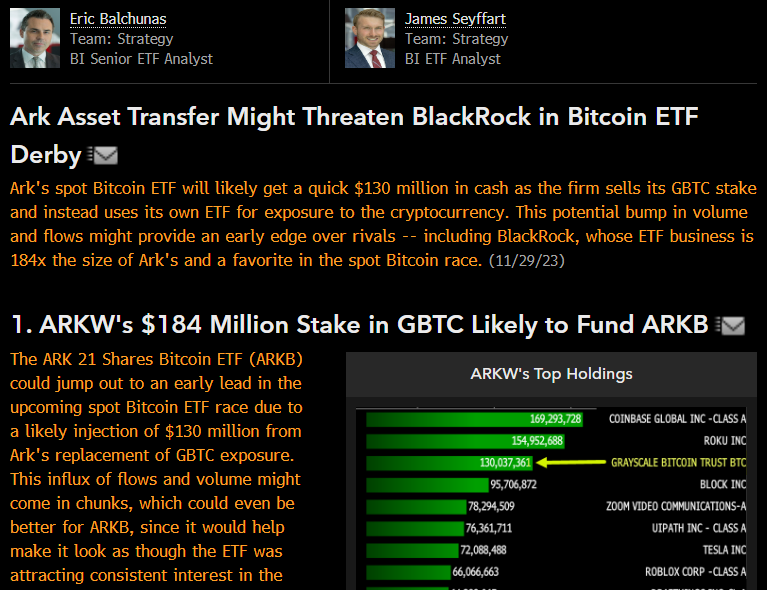

On November 30 Bloomberg senior ETF analyst Eric Balchunas commented on the ARK and 21Shares spot Bitcoin ETF application.

“ARK/21Shares has ace up sleeve in the Bitcoin ETF Derby as it likely to move $130m out of GBTC and into ARKB.”

Ark Invest holds a large stake in the Grayscale fund which it is likely to use to kickstart its own ETF.

Fellow Bloomberg ETF analyst James Seyffart predicted that approval would come in early January.

“Okay the window for potential spot Bitcoin ETF approval is looking like its gonna be between Jan 5 & Jan 10 2024.”

January 6 and 7 are a weekend so it could come in the week beginning January 8.

Hashdex Delayed

He also reported that the SEC met with Hashdex this week, delaying their application after the meeting. However, it was not considered as a bad thing:

“This is another in a continuing flow of indications that the SEC is working hard with potential Bitcoin ETF issuers on backend details and plumbing.”

The Hashdex application is novel he explained because it focuses on exchange for physical transactions via CME futures to get spot Bitcoin into the ETF structure.

Finance lawyer Scott Johnsson agreed that it was a good sign. The “quicker turnaround than usual indicates again this is about lining up potential approvals,” he said.

“Quicker than usual” is more evidence that things could be approved on January 10, offered Balchunas in response.

BlackRock had another meeting with the SEC’s Trading and Markets division this week to present a revised in-kind model relating to redemption flow.

beincrypto.com

beincrypto.com