Although the majority of assets in the cryptocurrency sector got off to a slow start this week, Bitcoin (BTC) could be looking at a massive advance toward and beyond the threshold of $47,000 soon, provided it manages to break the key resistance that currently stands in its way.

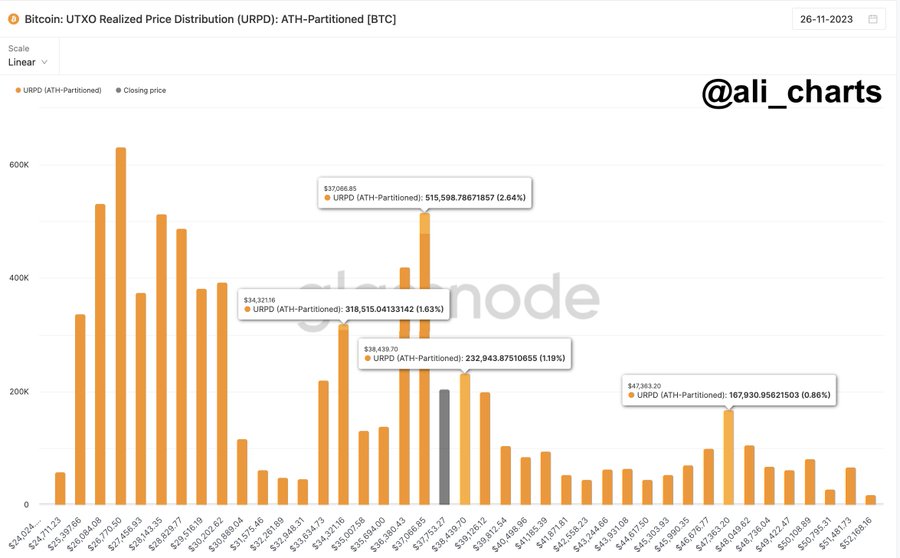

As it happens, Bitcoin’s realized price distribution (URPD) or unspent transactions output (UTXO), or the amount remaining after every transaction, suggests that the maiden cryptocurrency is facing “stiff resistance at $38,500,” as noted by crypto market analyst Ali Martinez in an X post on November 26.

Having said that, the crypto trading expert also observed that the flagship decentralized finance (DeFi) asset “slicing through this barrier could help BTC advance toward $47,360,” which is the next significant point in the chart analysis that Martinez shared.

Specifically, UTXO UPRD shows at which prices the current Bitcoin UTXOs appeared, each bar representing the existing BTC amount that last moved within that price bucket. ATH-Partitioned refers to buckets defined by dividing the range between 0 and the current ATH into 100 equally-spaced partitions.

Bitcoin price analysis

As things stand, Bitcoin is currently trading at the price of $37,282, which indicates a decline of 1.23% in the last 24 hours while still retaining the increase of 0.18% across the previous seven days and a more significant gain of 9.33% over the past month, as per the latest information on November 27.

In fact, the largest crypto by market capitalization recently got close to the above resistance as it hit $38,190 on November 24, and as anticipation builds for the upcoming halving event and possible approval of a spot Bitcoin exchange-traded fund (ETF), it could indeed break it and proceed toward $47,000.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com