In recent times, the price of Bitcoin (BTC), the flagship of the markets, has experienced a significant increase due to the effect of increasing network activity. As general prices rise, miner fees also show an upward trend. According to a recent IntoTheBlock post, Bitcoin fees have surpassed $60 million, reaching a six-month high.

Analytical Reports on Bitcoin

According to the data, this fee increase attributed to the increased interest in Ordinals represents a 60% increase. A more detailed examination of crypto fees revealed a significant increase in fees throughout November, reaching their highest points in the past ten days. Daily fees exceeded $11 million on November 17 and 18 but have since dropped to $3.6 million with the latest update.

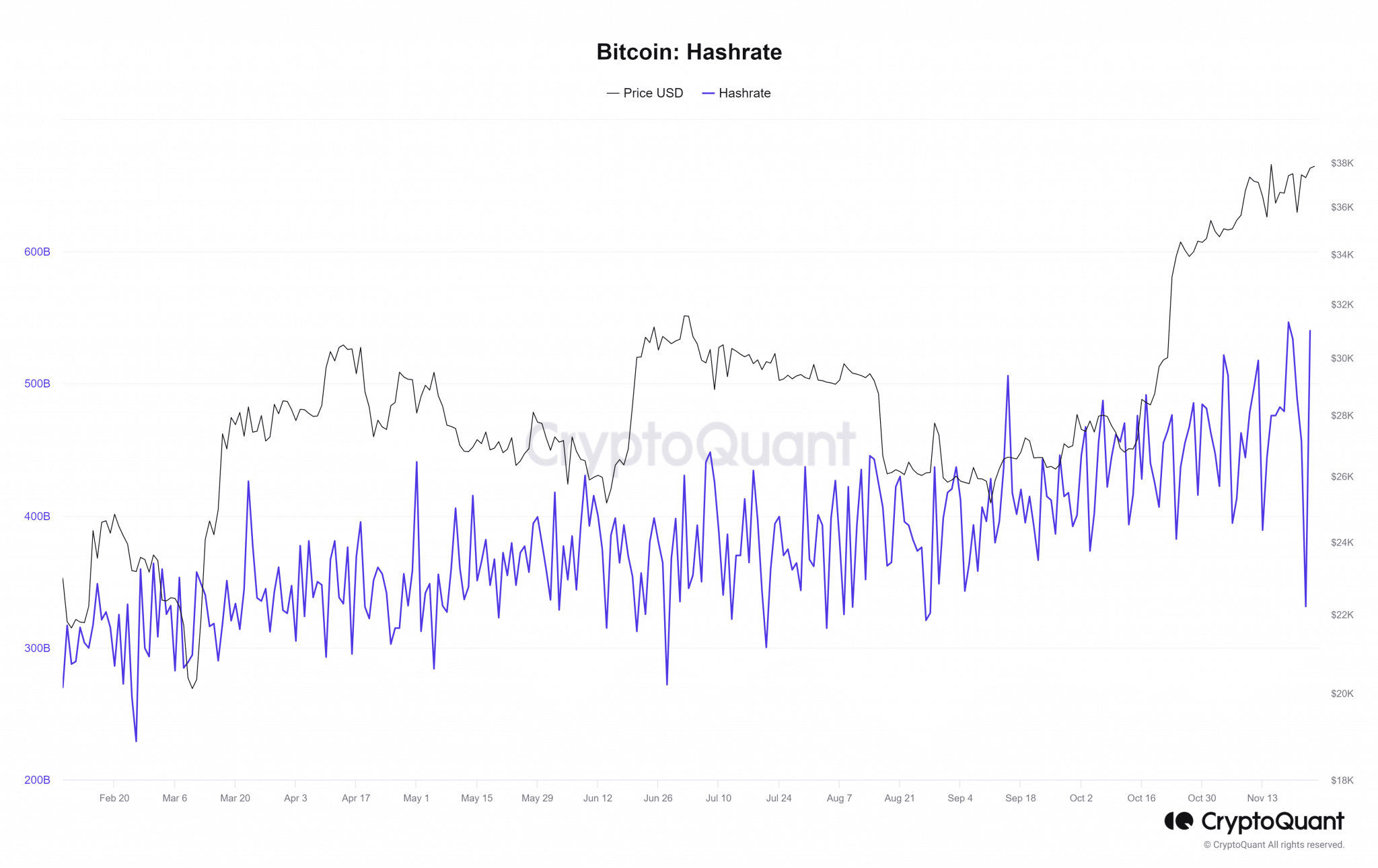

Despite the fee decrease, hashrate remained at one of its highest levels this year. An analysis of Bitcoin’s hash rate on CryptoQuant recently indicated a consistent upward trend in the past few weeks. This increase can be attributed to the increased transaction volume on the network, requiring more computational power to process these transactions. The graph showed that the hash rate peaked at over 546 million on November 19, the highest of the year. However, it dropped to around 331 billion on November 23. At the time of writing, the hash rate has risen above 540 billion, reaching the second-highest level in over six months.

BTC Mining Revenues

Another notable observation is the increase in revenue from Bitcoin miners’ fees in the past few weeks. Although it did not reach the peak observed around May 8, its consistency sets this trend apart. The graph analysis reveals that miners’ revenue from fees has exceeded 20% three times this month. At the time of writing, revenue from fees has dropped to approximately 8.5%. Despite this decrease, it continues to remain above what was observed in the previous three months, indicating a significant contribution of fees to miners’ income in recent months.

Based on the current evaluation, the daily timeframe of Bitcoin may indicate that it has remained stable within the $37,000 price range. The graph showed a marginal increase of less than 1% after the previous session, which saw an increase of over 1%. It continued to exhibit a strong trend as the weekend approached.