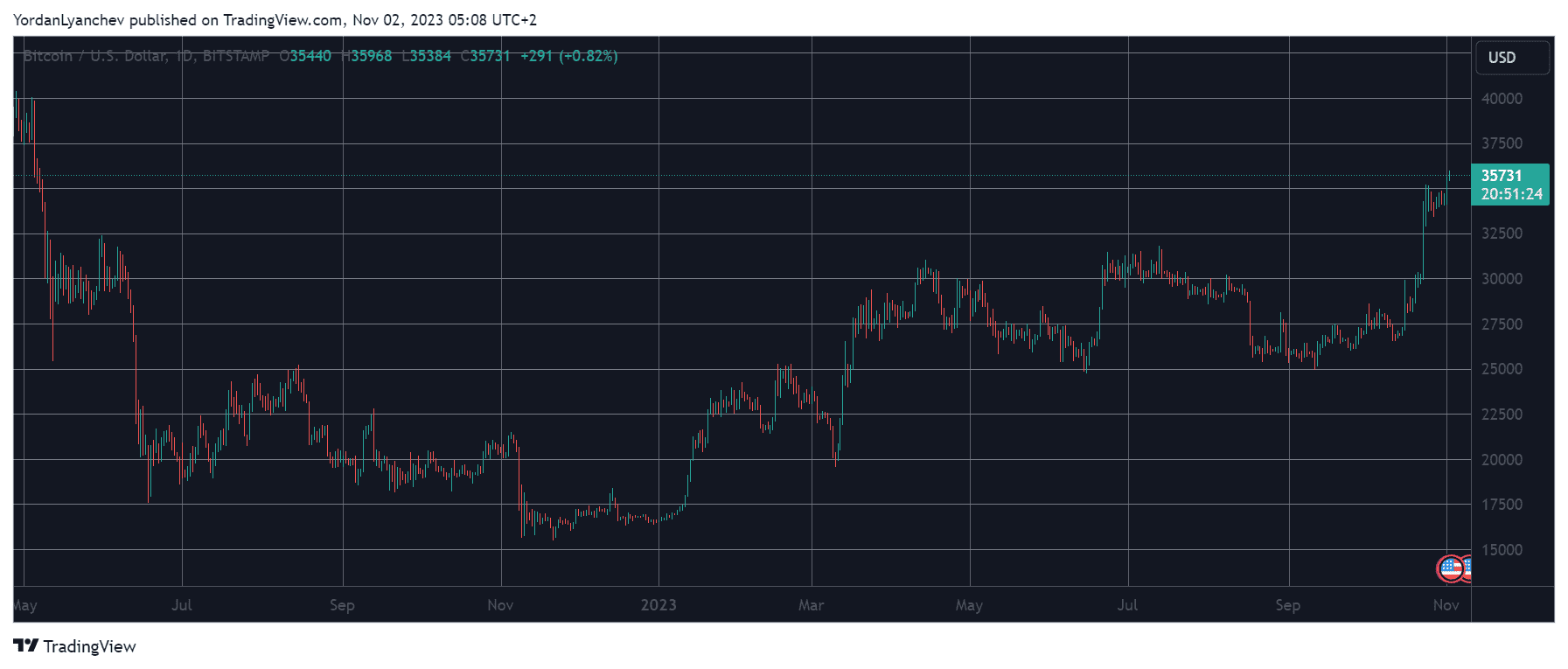

Yesterday’s rollercoaster was just the beginning for bitcoin as the asset went back on the offensive during the early Asian trading hours and soared to just over $36,000 for the first time since May 2022.

With many altcoins performing even better, the total value of liquidated trading positions has jumped to $150 million on a daily scale.

- CryptoPotato reported yesterday’s pump and dump, which saw BTC moving by about a grand within minutes. Nevertheless, the cryptocurrency ultimately returned to around $34,000.

- After several hours of trading quietly around that level, the bulls took charge early on Thursday and initiated a massive leg up that only capitalized on the gains registered during October.

- In a matter of hours, bitcoin skyrocketed to just over $36,000, which became its highest price tag in a year and a half.

- Despite losing some ground since then, BTC is still 4% up on the day, with a market cap of around $700 billion. Its dominance over the altcoins is also steady at 53% and even in an expansion state, according to Glassnode, even though many have performed better on a daily scale.

- Solana and Uniswap have both shot up by double digits, by 11% and 15%, respectively. Impressive price jumps also come from the likes of ADA, MATIC, DOT, and AVAX.

- This enhanced volatility has harmed over-leveraged traders. The total liquidations on a daily scale have increased to $150 million, with more than 60,000 traders getting wrecked.

- The single-largest liquidation order took place on Binance and was worth over $1.5 million.

cryptopotato.com

cryptopotato.com