- Bitcoin price is showing signs of strength despite the recent surge.

- The listing of ARK Invest, BlackRock, and Invesco’s spot BTC ETF hints at the target audience for these investment products being the institutional and richer cohort.

- Thanks to Bitcoin’s 109% year-to-date rally, the optimism has reached a two-year high.

Bitcoin price rise has impressed both retail and institutional investors, with the latter seemingly developing a more bullish attitude towards the cryptocurrency. This rise was largely influenced by the spot Bitcoin ETF filing, hyped by the investors. Looking at the listing, however, it seems that while the impact of the exchange-traded funds (ETFs) will be on younger retail investors, the influence might come from some other cohort.

Daily Digest Market Movers: Spot Bitcoin ETFs target audience revealed

Bitcoin has millions of investors around the globe who have been patiently awaiting a spot ETF for a long time now. Applicants, including the likes of BlackRock, the world’s largest asset manager, have been relentlessly pushing the approval. But by the looks of it, these applicants have a different target audience in mind.

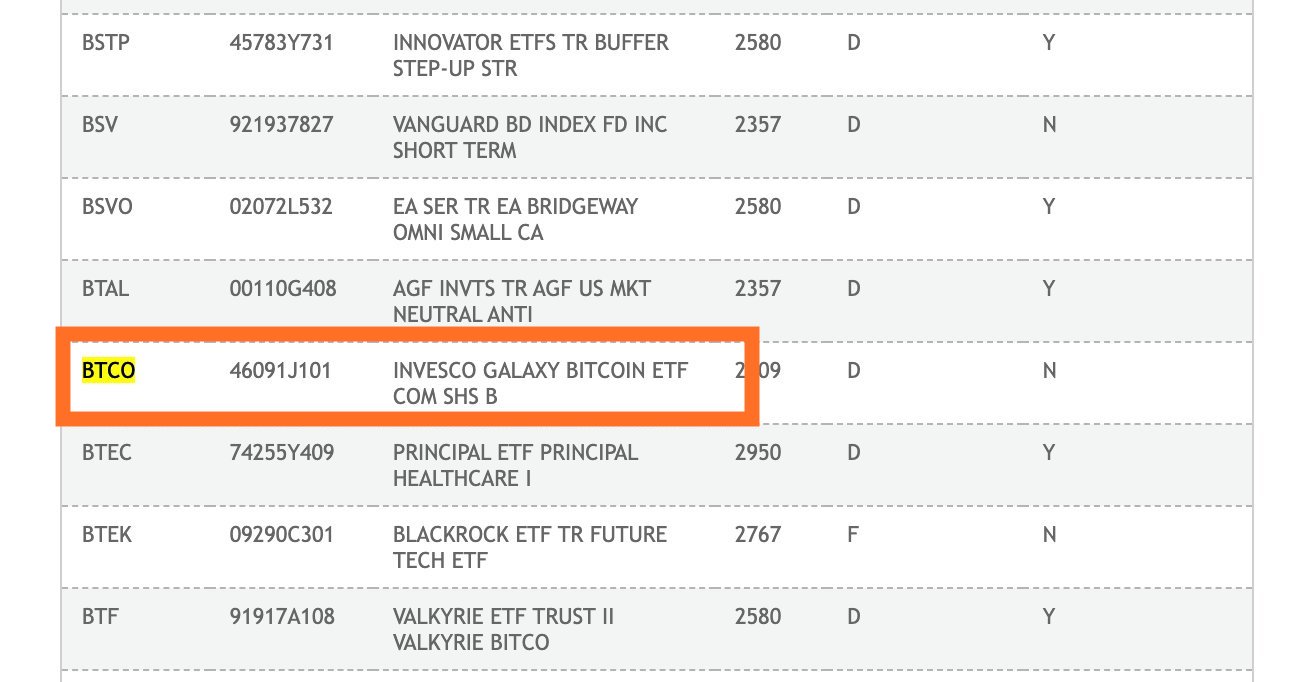

According to Eric Balchunas, a Bloomberg ETF analyst, the recent listing of ARK Invest, BlackRock and Invesco ETFs on the DTCC site suggests that these companies are aiming at money-loaded investors and/or institutional investors primarily. He stated,

“Each of the tickers chosen so far, $ARKB, $IBTC and $BTCO, shows these ETFs are being aimed squarely at advisors (and the rich Boomers they serve) vs aimed at retail (otherwise we’d see $HODL type tickers). Boring but smart IMO.

Spot Bitcoin ETFs listing on DTCC

While the comment may be harsh in tone, it is rather accurate when it comes to the crypto market. Retail investors have historically been known to pump tokens with no fundamental value that have either been trending owing to a pop cultural significance or due to an appealing name. This list includes the likes of Dogecoin, PEPE, Squid Games token, DogeElon Mars, etc.

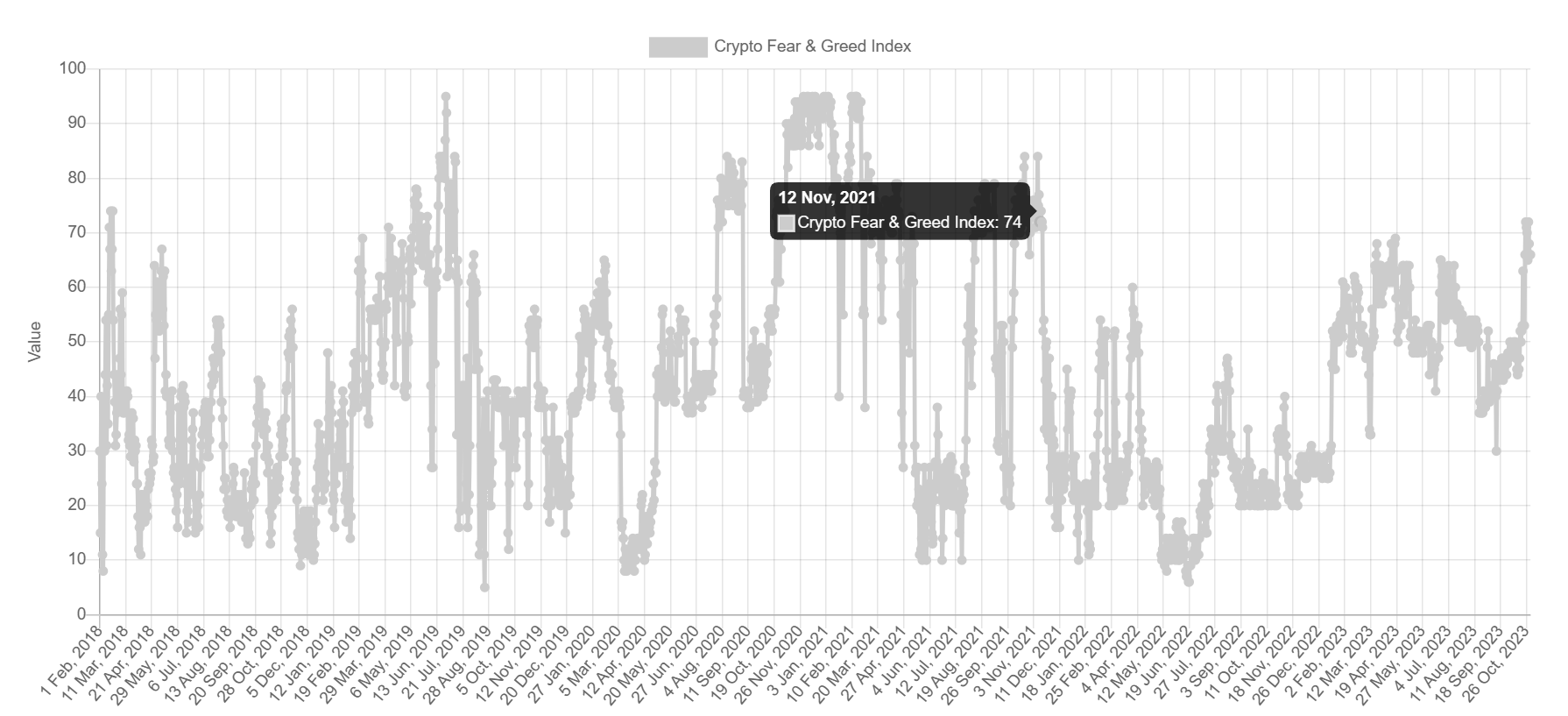

Besides, since the next bull run will come at the hands of institutions, it makes sense as to why these ETFs are primarily catering to them. This would, regardless, prove to be beneficial to retail investors as BTC should climb further. The recent rally injected significant optimism into the market as observed on the Crypto Fear and Greed index.

The index is presently at a two-year high, sitting at 66, but reached 72 in the past week. This level of figures was last seen in November 2021. This sentiment is expected to act as a catalyst for Bitcoin price, which has performed exceptionally these past ten months despite facing investor bearishness.

Crypto Fear and Greed Index

Since the year began, BTC has grown by 109% to date, eclipsing other major investment options by a mile. The closest competition to the cryptocurrency after Ethereum was Apple and NASDAQ, both of which grew by 30% since January 1, 2023.

Can you spot the outlier? pic.twitter.com/y5IIY1fVyx

— ecoinometrics (@ecoinometrics) November 1, 2023

This development will keep the bullish momentum going for the asset, which is crucial for the forecasted price rise.

Technical Analysis: Bitcoin price has high targets

Bitcoin price is presently trading at $34,603, bouncing off the short-term support level of $33,901 on the 3-day chart. Testing this level as a support floor is necessary for BTC to sustain the uptick it has achieved in the past few weeks and push the cryptocurrency toward the next major barriers.

Bitcoin has its eyes set on $36,833, the reclaiming of which is crucial for a rise toward $40,000. Breaching this level would likely mark the beginning of the bull run that the market has been waiting for since 2023 began.

The Moving Average Convergence Divergence (MACD) indicator suggests the bullish momentum is far from waning as the green bars continue to increase on the histogram, which is a positive sign.

BTC/USD 3-day chart

However, if Bitcoin price loses the support of $33,901, a drawdown to $31,507 is likely and potentially inevitable. This would also push short traders to bring the cryptocurrency down to $30,000, and breaking through that level would invalidate the bullish thesis for good.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

fxstreet.com

fxstreet.com