JPMorgan has released a report forecasting a potential 20% decline in the Bitcoin Network Hash Rate following the Bitcoin halving in April 2024.

“We estimate as much as 80 EH/s (or 20% of the network hashrate) could be removed at the next halving (April ‘24) as less-efficient hardware is decommissioned,” the report stated.

Anticipated Significant Drop in Bitcoin’s Hash Rate

The research report outlines that the Bitcoin mining industry is at a “crucible moment” in the lead-up to the Bitcoin halving in April 2024.

The Bitcoin halving occurs every four years, and it involves a reduction in Bitcoin miners’ rewards by half. It aims to mitigate inflation, and the fourth halving will be in April 2024.

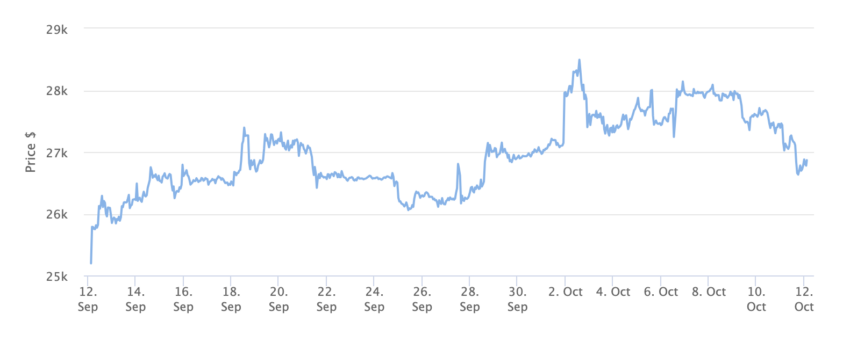

It goes on to state that the four-year block reward opportunity totals approximately $20 billion. This prediction is based on Bitcoin’s current price. However, it underscores a substantial decrease of around 72% from a little over two years ago:

“For context, this figure peaked at roughly $73 billion in April ‘21 and has fluctuated between $14 billion and $25 billion over the past year.”

At the time of publication, Bitcoin’s price is $26,778.

JPMorgan lists several Bitcoin mining firms but designates Bitcoin mining firm, CleanSpark, as its preferred option:

“We believe CLSK, our top pick, offers the best balance of scale, growth potential, power costs, and relative value.”

However, the investment firm notes while Marathon Digital is the largest operator, it has the highest energy costs and lowest margins.

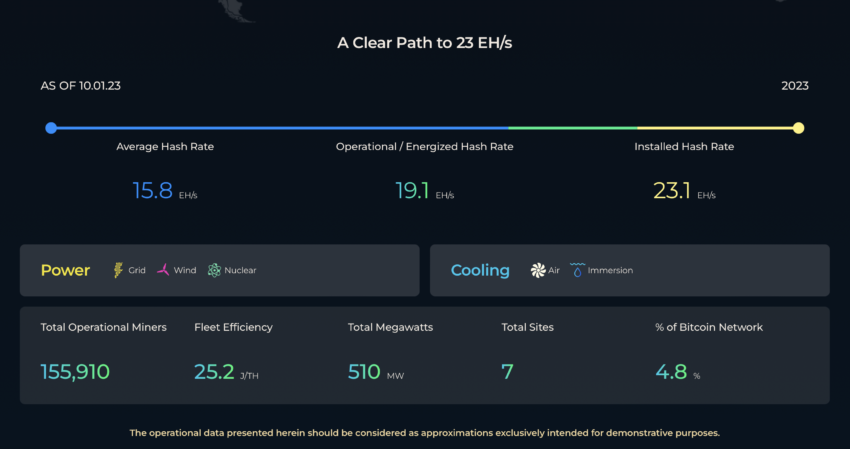

Marathon Digital provides an operational summary on its website, noting that the figures are rough estimates. However, the company asserts that it currently has approximately 155,910 operational miners worldwide.

Meanwhile, it believes Riot Platforms has fairly low power costs and liquidity.

Conversely, BeInCrypto recently reported that the four-year cycles may not be related to Bitcoin halving, as commonly assumed.

Referencing recent online commentary, ‘Pledditor,’ a Bitcoin enthusiast, questions the widespread assumptions.

“Bitcoin’s four-year cycles are just coincidences and have little to do with the halvenings.”

beincrypto.com

beincrypto.com