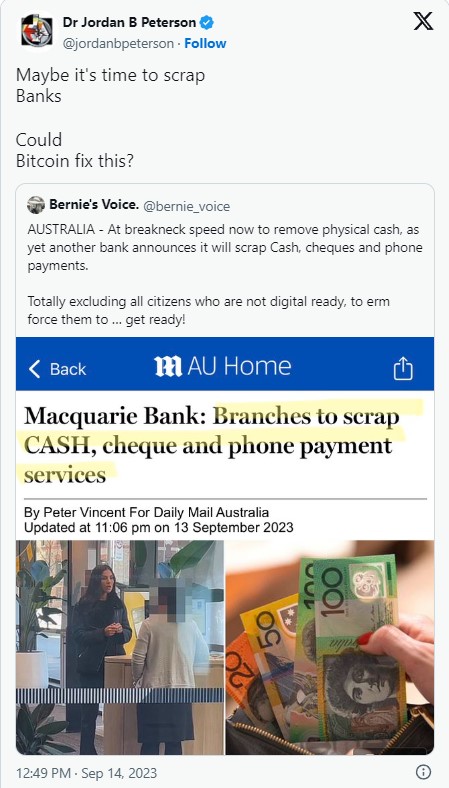

Dr. Jordan Peterson, a renowned Canadian psychologist with over 4.6 million followers and a best-selling author, sparked a debate on September 14th about the “debanking” movement and how Bitcoin could potentially render banks obsolete.

Bitcoin and Banking

Peterson’s post gained attention as a response to reports in Australia about Macquarie Bank’s move to phase out cash, cheques, and telephone payment services.

Australia is not the only country looking to eliminate the use of physical cash or other non-centralized means of payment. In most European countries, cash usage is already limited to small transactions, and Nigerian banks continue to operate with low cash withdrawal limits at their ATMs.

In this context, Jordan Peterson suggested that people stop using banks and questioned whether Bitcoin could be an alternative tool for those still seeking a cash-like experience with their money.

Bitcoin and Cryptocurrencies

Interestingly, the Canadian psychologist has previously emphasized his willingness to use Bitcoin as a facilitator for global monetary transactions. He even partnered with Joe Nakamoto (@JoeNakamoto) to receive unlimited donations through Lightning Network wallets instead of using fiat-based crowdfunding services like GoFundMe.

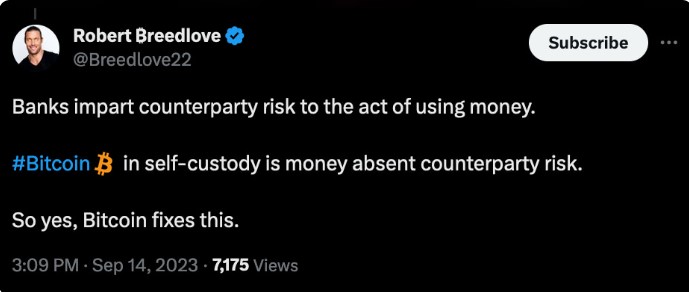

Many prominent Bitcoin advocates responded to Peterson’s question, expressing support for his case. Robert Breedlove, host of the “What is Money?” podcast, made the following statement:

Traditional banks impose counterparty risk on the act of using money. Bitcoin, being self-sovereign, is a money without counterparty risk. So yes, Bitcoin fixes this.

Additionally, enthusiasts of other cryptocurrency networks, such as Bitcoin Cash (BCH), Nano (XNO), Monero (XMR), XRP Ledger (XRP), Dash (DASH), ZCash (ZCH), Litecoin (LTC), and Dogecoin (DOGE), which focus on providing users with a decentralized and surveillance-resistant cash-like experience, also found a place in the discussion.

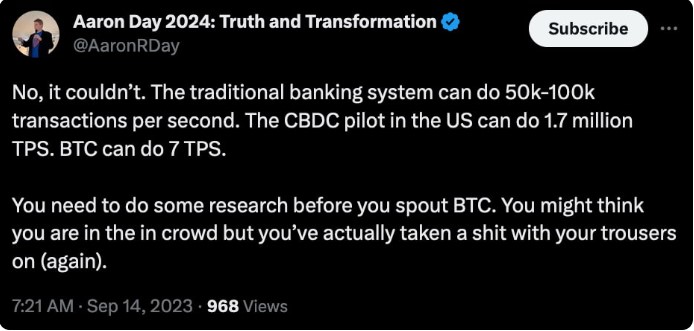

However, the debate also brought critics like Aaron Day, a presidential candidate for the 2024 elections in the United States, who stated:

No, it cannot. The traditional banking system can process 50,000-100,000 transactions per second. The CBDC pilot program in the US can handle 1.7 million TPS. Bitcoin can handle 7 TPS. You should do some research before talking about BTC.