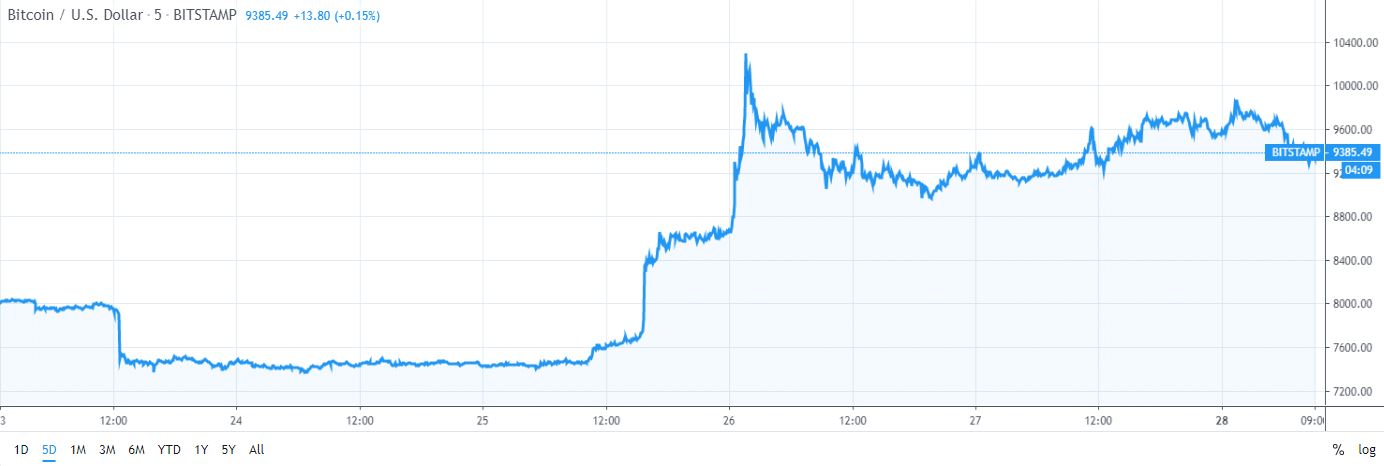

It’s safe to say that the last few days have been nothing but turbulent for Bitcoin. After having traded in a close range for a few weeks with rather low volatility, the cryptocurrency recorded its largest daily price increase since 2011. In a span of about 24 hours back on Friday and Saturday, it surged by more than 40%, bringing its price to as much as $10,350.

However, what followed was perhaps a somewhat expected correction. Bitcoin lost about $1,000, bringing its current price to around $9,400. Bitcoin’s dominance also increased notably. Prior to the latest increase, BTC dominance was around 65.5% and it went up to as much as 68.6% before pulling back to its current rate of 67.9%.

It’s also worth noting that altcoins also charted substantial gains following Bitcoin’s price surge. This is especially true for Chinese projects, which saw massive increases. That’s perhaps to be expected, given that one of the potential reasons for the overall market increase could have been that China’s President Xi Jinping urged to streamline the usage of blockchain technology.

The total market capitalization is $248 billion. | Bitcoin’s market capitalization is $168 billion. | BTC Dominance is 67.9%

Major Cryptocurrency Headlines

Mark Zuckerberg Is Right About China: President Xi Jinping Urges Investment In Blockchain. The president of China, Xi Jinping, urged the country to increase the development and implementation of blockchain-based technology, praising its qualities and usage in various industries. Interestingly enough, this came just a couple of days after Facebook’s CEO, Mark Zuckerberg, said that “China is moving quickly” in this regard and that the US could fall behind if it fails to speed up.

Bitcoin’s Price Touches $10,350, Records Largest Daily Percentage Increase Since 2011. Immediately after President Xi Jinping’s speech, Bitcoin recorded its largest daily increase since 2011. The cryptocurrency went parabolic, spiking up by more than 40%. The move was sudden and the price cooled off a bit, as it retraced back to the levels of $9,400.

WeChat Search Volume Blockchain Spiked 1,200% Following The New Chinese Cryptocurrency Laws. It goes without saying that regulations have a lot to do with adoption and awareness in the field of cryptocurrencies. WeChat, a Chinese multi-purpose application, saw a substantial surge in blockchain-associated terms on its platform. The move followed not only the president’s statement but also some purported changes in cryptography laws in the country.

The Biggest Winners and Losers

Bytom (+84.91%)

Bytom, being one of the Chinese-based cryptocurrency projects, is undoubtedly among the biggest winners in the top 100. BTM surged upwards of 86% in the past 24 hours, bringing its price to around $0.144 at the time of this writing. Against Bitcoin, BTM is up around 85%. It’s currently sitting at a market cap of around $144 million and has also seen a notable surge in trading volume. Over the past day, the trading volume is more than $152 million.

Ontology (+33.19%)

Ontology is another project which managed to capitalize very well on the latest market movement and increase in Bitcoin’s price. The project increased by about 33% and ONT is currently trading at around $0.973. Its market cap is around $541 million. Interestingly enough, the cryptocurrency also made substantial gains against Bitcoin, as it’s trading around 31% higher. The trading volume is also massive – it’s more than $709 million in the past 24 hours alone.

Nexo (-9.66%)

Unfortunately, not all projects managed to catch Bitcoin’s latest tidal wave. NEXO is one of these projects. In the past 24 hours, the cryptocurrency is down by about 10% against the USD and 11% against BTC, making it the biggest loser among the top 100 coins. Its current market capitalization is around $53 million and the trading volume is a little more than $10 million.

cryptopotato.com

cryptopotato.com