On Tuesday, the first-ever Bitcoin Exchange-Traded Fund (ETF) finally started trading on the New York Stock Exchange (NYSE). Offered by Proshares, the ETF trading under the $BITO ticker sold over $1 billion in 24 hours.

It has become the first Asset Under Management (AUM) to achieve this feat. On its first full trading day, the fund gained 2.59%, finishing at $41.94 per share. Gold’s ETF, on the other hand, took at least three days to hit this mark.

There it is! It's only 1:30 and $BITO has already traded $1 billion on its second day. Wild. Assuming this thing converted just 43% of this volume into assets (it converted 57% yesterday), this is the first ETF to crack $1 billion in AUM in under 2 days. GLD did it in 3 days. https://t.co/rRcmZuwhcv pic.twitter.com/ONJ21GH9JH

— James Seyffart (@JSeyff) October 20, 2021

The clamor for Bitcoin ETFs has long been in the works, with the first-ever application made by the Winklevoss twins eight years ago. However, the availability of these ETFs has faced challenges and delays from the Securities and Exchange Commission (SEC).

What is an ETF?

An ETF is a type of security that tracks the price of an index, commodity, or asset and can be traded on the stock exchange. These securities are designed to monitor the prices of either a single entity or a group of assets while following specific investment strategies. Examples of ETFs include SPDR S&P 500 ETF (SPY), iShares Russell 2000 (IWM), SPDR Gold Shares (GLD), etc.

As the name implies, the Bitcoin ETF tracks the crypto asset’s price and allows investors to trade BITO as they would stocks. The path to its recent approval has not been plain sailing. Some see the ETF as the final hurdle for institutional investors to participate in the crypto market thereby leading to faster adoption. The SEC has previously taken a hard stance against bitcoin ETFs, rejecting numerous applications while citing the volatility of Bitcoin prices and the potential for price manipulation.

The SEC chairman, Gary Gensler, has previously labeled the Crypto ecosystem as “the wild west” and has repeatedly called on Congress to allow the SEC to regulate crypto exchanges. In his view, these platforms will control the spot prices for Bitcoin, pointing out that their activities are seen as a hindrance to the SEC’s ability to monitor trade flows since some are unregulated:

“Currently, we just don’t have enough investor protection in crypto finance, issuance, trading, or lending. Frankly, at this time, it’s more like the Wild West or the old world of “buyer beware” that existed before the securities laws were enacted. This asset class is rife with fraud, scams, and abuse in certain applications. We can do better.”

The recent approval of the Proshares Bitcoin ETF comes after it adopted futures pricing at the Chicago Mercantile Exchange (CME). The CME is overseen by the Commodity Futures Trading Corporation (CFTC) and does not pose any regulatory challenge to the SEC.

Since its inception in 2017, the CME’s Bitcoin Futures has become increasingly popular with institutional investors who use it as a channel to make profits from the volatile asset. This development has caused a swift transition from the use of gold to cryptocurrencies as an inflation hedge.

Crypto Stocks Outperform Traditional Sectors

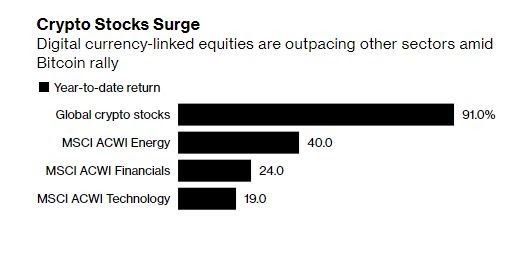

With Bitcoin hitting a new all-time high (ATH) for the first time since April, globally linked crypto shares have outperformed traditional equity sectors on the stock market leaderboard in 2021.

Data released by Bloomberg shows that global crypto-assets have soared by 91%. The Bloomberg-curated basket of stocks has outperformed the MSCI AC World Index by 14%, as well as exceeding growth in global equities sectors such as energy, financials, and technology.

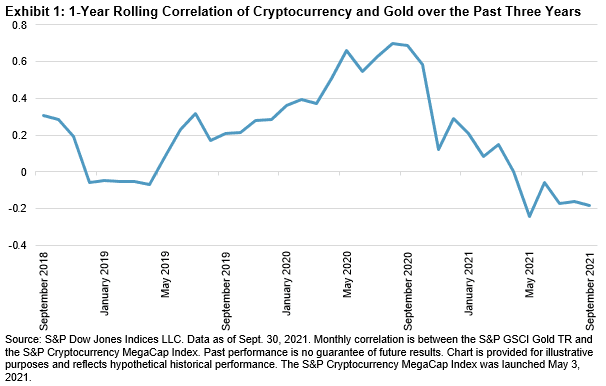

When compared with gold, Bitcoin seems to be catching up with the precious metal, thereby reinforcing the belief in certain quarters that it is a better store of value. The correlation between Bitcoin and gold turned negative this year as the volatility of Bitcoin exploded while that of gold slowed down.

These new developments with Bitcoin ETF will see more institutional investors become active in the space. Over 52 companies with a combined market capitalization of $7.1 trillion are currently exposed to cryptocurrencies. Going by this trend, these numbers could be set to rise further.

Do you see Bitcoin as a potential contender to traditional stocks? Let us know in the comments below.

tokenist.com

tokenist.com