- The marketcap begins to decrease as Bitcoin loses domain by -0.13%.

- 9,666 BTC has been moved by the whales during the day.

- Bitcoin has lost 100 points in the last hour.

The crypto market remains sensitive to the movements registered in the main asset Bitcoin and the generalized FOMO that caused unusual transfers of funds by great whales on different exchanges. In the last hour, the market cap has lost $ 3 billion to go back to USD 221 billion, a decline of -0.13% so far at the time of writing.

Despite the substantial decline in recent hours and the decrease in volumes last week, the positive slope has not yet been broken and the RSI still shows signs of growth towards the sales area.

Paradoxically the downtrend returns to dominate the market, with more than 70 percent of the coins in red territory, a product of traction loss on the upside trend, causing fall in the price of the main reference of the crypto market in recent hours .

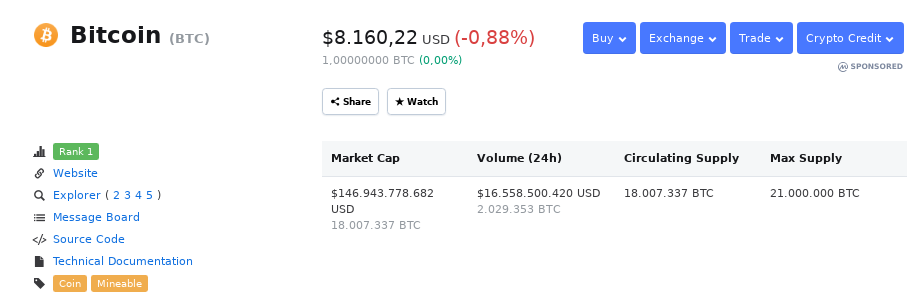

At the time of writing Bitcoin is trading at a spot price of $ 8,160.22 with a loss of 1% in the last 24 hours and a loss of domain by -0.13% to fall to 65.99%.

Bitcoin currently got rejected again at the monthly open. We suspect there is probability market makers push the price a little more down, to get out of the rest short positions, before pushing the market up at least to the next demand zone as outlined in the chart. Safest bets now are wait for a confirmed short setup above, or meet the price at demand zones.

A short strategy up to the target zone TP1 now seems to be the most convenient with some stop loss activated in the current position and a take profit in the demand zone. However, we could see a boost and rebound in the price of BTC to the R1 and R1 resistance around $ 8,400 line as long as it manages to win first, the immediate ceiling in EMA @ 100 days, and finally break the resistance previously tested and failed to break @ $ 8,306.53.

Bitcoin Price Technical indicators @ 1H

In the graph of the BTC / USD pair established in the 1H time frame, we reaffirm the previous position thanks to the signals shown by the technical indicators Aroon, Bollinger Bands and RSI.

Bollinger Bands clearly show how the last candle has broken the Bollinger moving average set at $ 8,138.08, which if we follow this trend we could see BTC enter the demand zone and dangerously fall below the lower band as the Cloud dispersion between the bands is smaller.

Aroon is now projected bearish, sending positive signal directly to the bottom of the chart.

RSI has experienced a drastic fall from values of 70 to an average of 50, due to the strong sales pressure that exists on Bitcoin at this time.

Bitcoin Whale Extracts 5,000 BTC from Bitstamp

According to the Whale-alert site, a transfer for 5,000 BTC was moved in the last few hours from Bitstamp exchange to an unknown wallet addrress. Estimated to be around $ 40,973,560 USD, the fund was moved before the latest slump BTC witnessed.

🚨 🚨 🚨 🚨 5,000 #BTC (41,055,387 USD) transferred from #Bitstamp to unknown wallet

Tx: https://t.co/K3606skmR8

— Whale Alert (@whale_alert) October 22, 2019

The transaction is part of the 9,666 BTC registered today by the website specialized in monitoring transfers of crypto whales, in which the Bitstamp, Binance and Coinbase crypto exchanges have been mainly involved.

Although there is no clear evidence regarding the consequences of the whale movement, it seems that the transfer caused enough fear in the market for the asset to begin to fall in its price momentarily before the possibility that similar new transactions originate from massive form.