Grayscale officially won in court against SEC and is one step closer to bringing the first spot Bitcoin ETF to the US.

The news sparked a price surge across the whole cryptocurrency market, reigniting investor optimism, which was low during the past few weeks.

Bitcoin climbed to $27,500 after a 5% jump and currently has a $16.6 billion trading volume in the past 24 hours.

The 1-day technical analysis from TradingView shows mixed santiment with the summary pointing to “neutral” at 9, oscillators showing “buy” at 3, and the moving averages showing “sell” at 8.

READ MORE: G20 Summit: Narendra Modi Calls for Unified Crypto and AI Rules

Ethereum also went on an upward trend surging to $1,720, which is up 4.4% in the past hour. ETH currently has a 24-hour trading volume of around $6.65 billion.

The 1-day TA for Ethereum shows a similar to Bitcoin santiment with the summary pointing to “neutral” at 10, oscillators showing “buy” at 2 and the moving averages point to “sell” at 9.

Other cryptocurrencies have also witnessed significant gains – BNB is currently trading at $230 (+5.3%), XRP at $0.54 (+4%), ADA at $0.27 (+5.6%), SOL at $21.68 (+6.2%), MATIC at $0.60 (+7.8%), BCH at $209 (+8.3%).

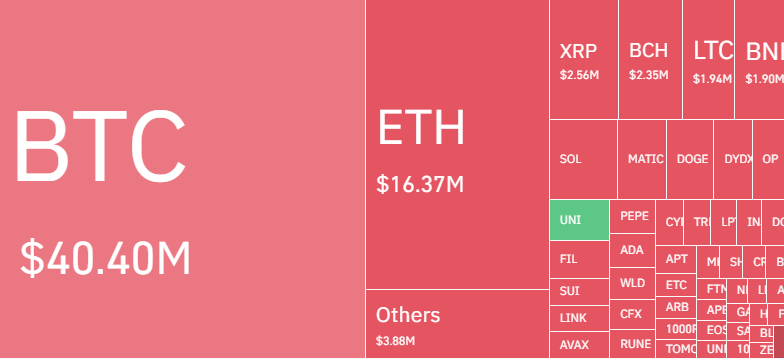

Following the recent surge, approximately $88 million was liquidated within the past hour in the cryptocurrency market. Out of this sum, about $75 million originated from short positions. Notably, the primary cryptocurrencies affected by these liquidations were Bitcoin, accounting for around $40.4 million, Ethereum with $16.3 million, and XRP with approximately $2.56 million in liquidations.

The news about the recent court ruling is quite significant, especially during times where many behemoths in the investment world are fighting over who will be the first to launch a spot Bitcoin ETF, which may change the whole cryptocurrency market and mark the beginning of a new massive bull run.