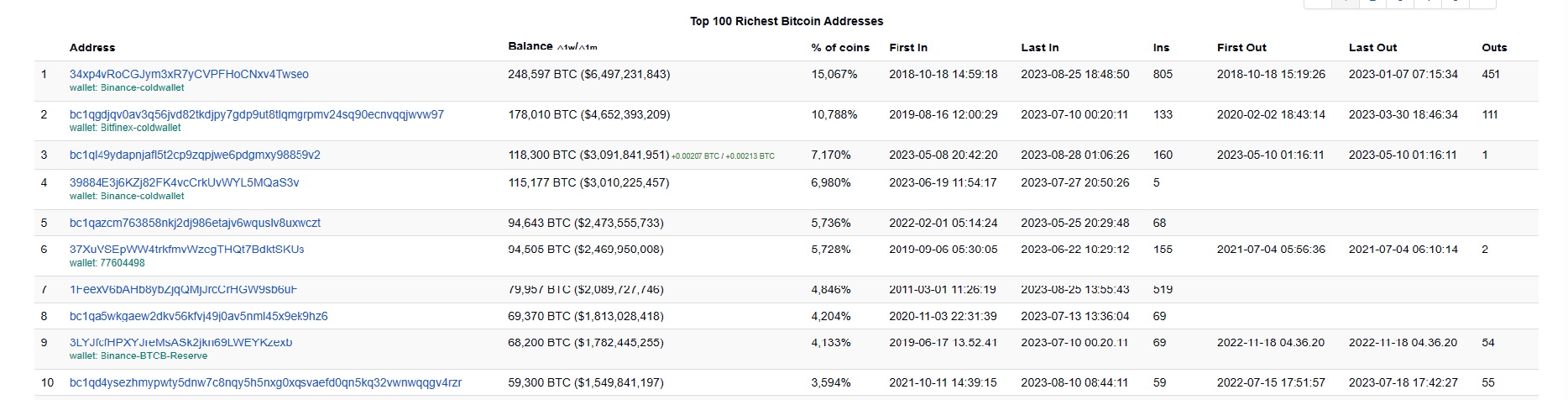

Robinhood, the commission-free brokerage, holds over 118,000 Bitcoin (BTC) worth more than $3 billion, according to data from Arkham Intelligence, a blockchain analytics company. This makes the brokerage owner of the third-largest BTC address after cryptocurrency exchanges, Binance and Bitfinext, data from another firm, BitInfoCharts, shows.

Robinhood Unmasked as Third Largest Bitcoin Holder

According to BitInfoCharts, a Binance cold wallet address with over 249,000 BTC worth approximately $6.5 billion (at the current market price) is the largest single BTC wallet. This is followed by Bitfinex’s cold wallet holding over 178,000 BTC worth about $4.7 billion as the second richest BTC address. Another Binance cold wallet with over 115,000 BTC worth $3 billion comes in fourth after Robinhood.

The attribution of Robinhood to the BTC address comes after months of online speculation about the owner of the BTC holding. Previously, spectators attributed the address to Gemini, a crypto exchange, and BlackRock, the world’s largest asset manager. In May, BlackRock’s submission for a crypto exchange-traded fund with the US Securities and Exchange Commission inspired a flurry of similar submissions by other firms.

This unknown address has accumulated over $3 Billion worth of #Bitcoin in the last 3 months.

— DivXMaN (@crypto_div) August 21, 2023

The prime suspect?

The first major transaction of 3400 BTC occurred on May 16th 2023. Almost exactly 1 month later on June 15th 2023, BlackRock filed for it's spot #Bitcoin ETF. pic.twitter.com/TdFuUkELuH

Gemini has transferred bitcoins to the new address bc1q....59v2 in the past 3 months. It currently holds 118,000 bitcoins, or about 3.08 billion U.S. dollars. It is currently the third largest bitcoin holder. The first and second largest Bitcoin addresses are Binance Cold Wallet…

— Wu Blockchain (@WuBlockchain) August 22, 2023

Shrinking Crypto Trading Volume

Meanwhile, data on BitInfoCharts’ website shows that BTC was first sent to the address now attributed to Robinhood on May 8th, 2020. The address reportedly received the last BTC transfer yesterday (Sunday).

However, the American online trading provider’s massive build-up of its crypto holding comes at a time when the broker is seeing a decline in digital asset trading on its platform. In July, the total volume of cryptocurrency traded on Robinhood declined by 38% to $3.4 billion compared to the $5.5 billion generated during the same month in 2022, Finance Magnates reported.

Furthermore, the firm saw its revenue from cryptocurrency transactions go down by 18% to $31 million during the second quarter of 2023 as monthly active users tanked by 1 million to 10.8 million. Nonetheless, Robinhood during the recent quarter, reported its fifth consecutive quarter of revenue growth. Specifically, the stock trading platform saw its revenue jump by 10% to $486 million during the last quarter.

Additionally, the firm generated its first GAAP profitability during the second quarter. This means that the earnings were calculated in line with the generally accepted accounting principles (GAAP).

Meanwhile, while Robinhood recently lost its case against the Massachusetts Secretary of State, Bill Galvin, at the Supreme Judicial Court of Massachusetts, the broker prevailed over a legal action initiated by a group of investors over trading restrictions it imposed during the meme stock frenzy in 2021.

ASIC suspends AFS license; FCA warns against 5 fraudulent firms; read today's news nuggets.

financemagnates.com

financemagnates.com