As Bitcoin’s hashrate and mining difficulty near all-time highs, analysts claim miners will struggle to maintain profitability.

When the Bitcoin (BTC) hashrate increases, the network becomes more secure. But on the flip side, mining the blocks requires more power, impacting miners’ profitability.

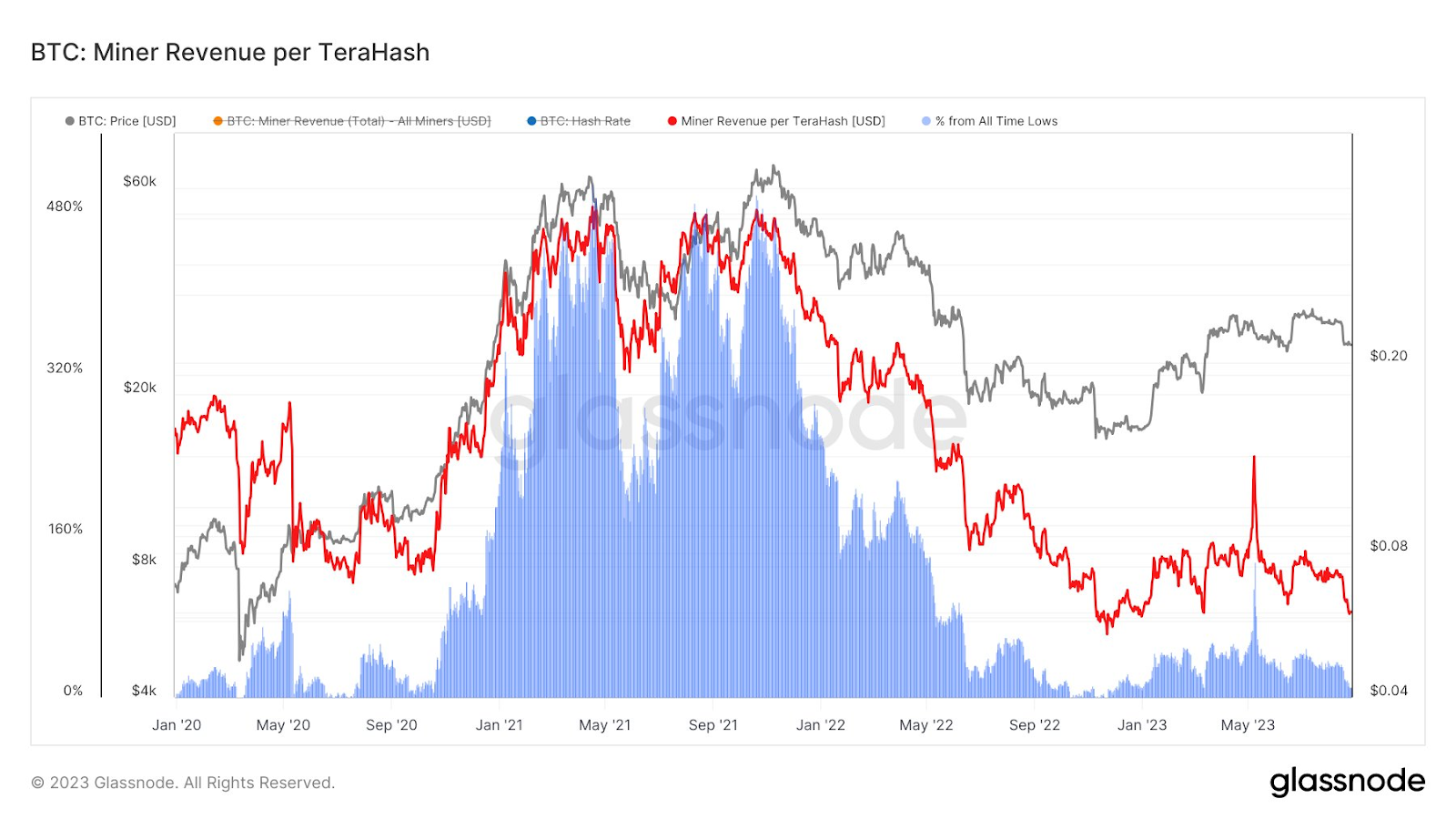

Declining Profitability: Bitcoin Miner Revenue Per Terahash Nears All-Time Lows

Bitcoin (BTC) analyst Dylan LeClair shared on X (Twitter) that the miner revenue per terahash is near its fresh lows. The screenshot below shows that the metric is nearing the lows of November 2022.

On Aug. 23, BeInCrypto reported that both Bitcoin hashrate and mining difficulty are at all-time highs. Other analysts also raised concerns that the soaring hashrate will impact the Bitcoin miners’ profitability.

Click here to read an in-depth article on cloud mining.

Meanwhile, the Bitcoin halving event is less than a year away. The block rewards will be halved with the halving, potentially decreasing the miners’ profitability if the Bitcoin price remains in the current range.

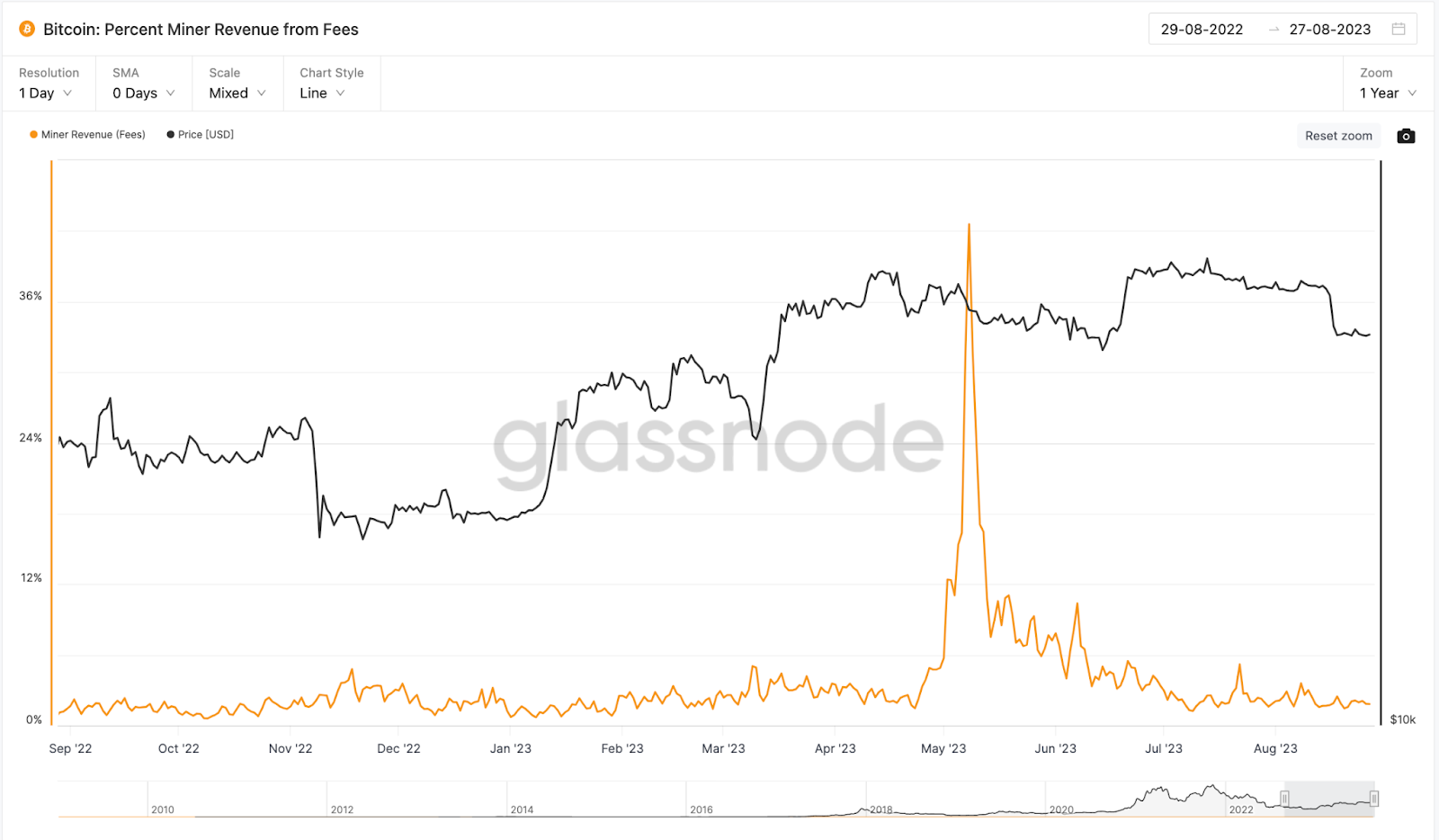

However, some community members have countered LeClair’s argument, stating that network terahash increases due to hardware efficiency. An X (Twitter) user, Udi Wertheimer, has argued that while miner revenue per terahash is down, mining fees have increased since Bitcoin Ordinals. He wrote:

“Counting terahashes is meaningless, as I would’ve expected you to know by now, because total network hashrate always go up, due to increase in hardware efficiency.

That does NOT imply an increase in miner operating costs (aka security budget), and therefore tracking fees per terahash is meaningless

Instead, you should be tracking fees vs block reward. that figure, today, is 10x higher than it was before ordinals.”

The screenshot below shows that miner revenue from fees is nearly two times higher compared to November 2022. In May 2023, the fees spiked due to the Bitcoin Ordinals craze.

beincrypto.com

beincrypto.com