As bitcoin dipped below the $29K threshold and the overall crypto economy experienced a 1.4% decrease to $1.17 trillion, cryptocurrency derivatives markets underwent $92 million in liquidations, primarily in long positions.

Cascading Effect: Bitcoin’s Fall Under $29K Sparks $92 Million in Liquidations

The crypto economy, along with a significant number of digital assets, faced a decline on the first day of August. The total value of the crypto market fell by 1.4% within the previous 24 hours, landing at $1.17 trillion as of Tuesday morning (11:00 a.m. Eastern Time).

The day’s largest losers included PLS and HEX, two tokens tied to Richard Heart’s projects. In addition, COMP, AAVE, SNX, GMX, and APE sustained losses ranging from 4.87% to 11.35% over the last day.

Bitcoin ($BTC) dropped 1.61% against the US dollar, while ethereum ($ETH) fell by 1.72%. With its network’s impending halving event in less than 24 hours, litecoin ($LTC) managed to ward off losses and maintained a 0.73% increase as of 11 a.m. on Tuesday.

Nevertheless, like bitcoin and various other cryptocurrencies, $LTC prices slipped throughout the late hours on July 31. According to coinglass.com data, $LTC derivatives traders encountered $2.63 million in liquidations, with $1.88 million in long positions.

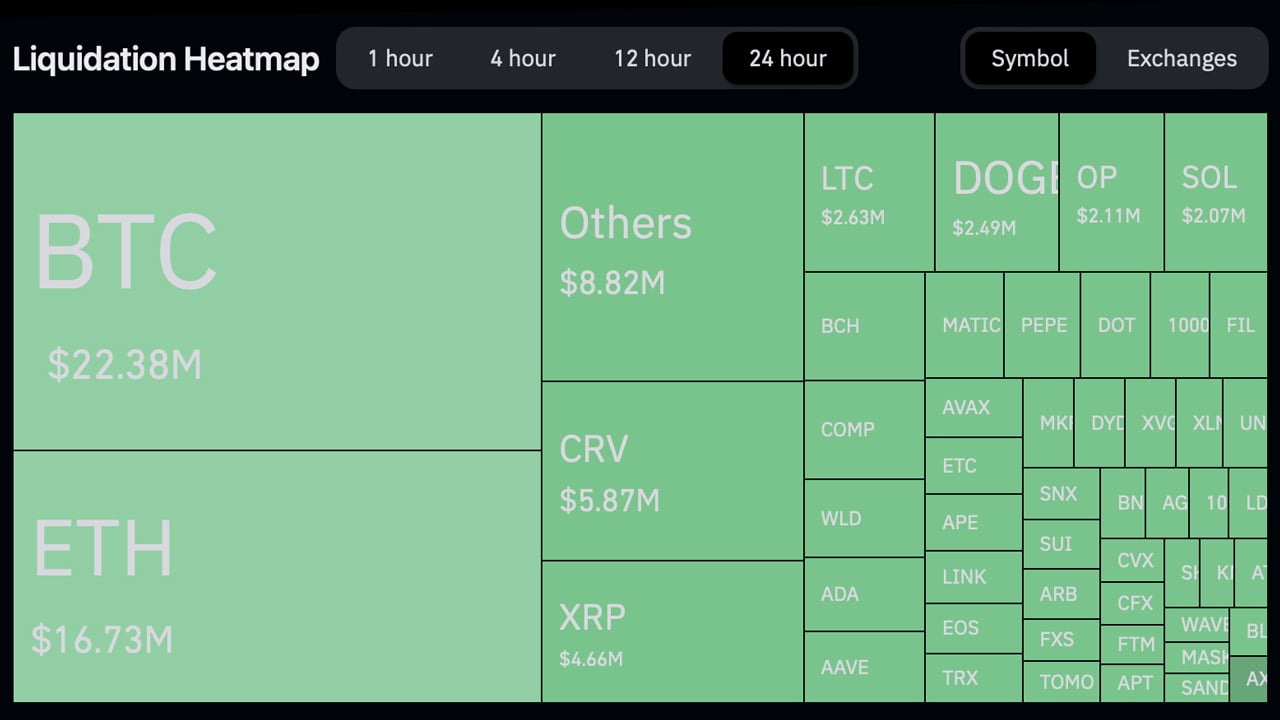

Of all cryptocurrency derivatives markets, $92.95 million was liquidated over the past day; bitcoin ($BTC) positions accounted for $22.38 million and $ETH for $16.73 million in liquidations. XRP saw $4.66 million in liquidations, while CRV registered $5.87 million over the previous 24 hours.

Approximately $80.20 million of these liquidations originated from long positions and $12.76 million from shorts. In the last 12 hours alone, there were $13.88 million in liquidations, which included $7.79 million in long positions.

news.bitcoin.com

news.bitcoin.com