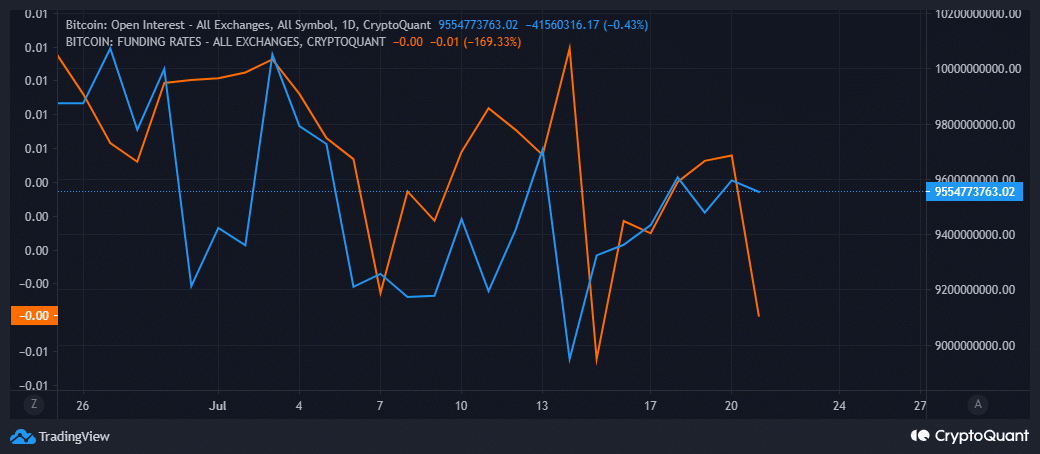

Over the past four weeks, Bitcoin’s Open Interest has experienced a significant decline. Concurrently, the funding rates for the king coin have also dropped notably within the same timeframe.

For those closely monitoring Bitcoin (BTC), it’s evident that the cryptocurrency has been consolidating over the last four weeks. Recent observations indicate that Bitcoin is poised to break out of its consolidation zone soon.

According to the Twitter account woonomic, Bitcoin appears to be approaching the conclusion of its consolidation phase. This assertion is supported by the increasing demand for futures, which has been on an upward trend despite Bitcoin’s price action remaining sideways.

This indicates a prevailing bullish bias, particularly in the derivatives segment.

Early signs that BTC consolidation is nearing completion (FSI chart below).

Futures demand is currently moving the market, this demand has been climbing against sideways price action (this is bullish).

Volatility dynamics also signalling a larger move is probable. pic.twitter.com/WkmiQO0B17

— Willy Woo (@woonomic) July 20, 2023

The same findings imply that the market could be on the verge of a resurgence in volatility. However, it remains to be seen if Bitcoin is indeed experiencing robust demand in the derivatives segment.

Indeed, Bitcoin’s Open Interest has experienced a notable decline over the past four weeks. Additionally, the funding rates for Bitcoin have also dropped significantly within the same period.

These findings can be attributed to the low volatility observed during the recent consolidation phase, which indicates that the demand has not been particularly strong. However, if the bullish expectations materialize, we will likely witness a surge in demand for BTC, possibly during this weekend and potentially extending into the coming week.

Will The Bitcoin Bears Arise?

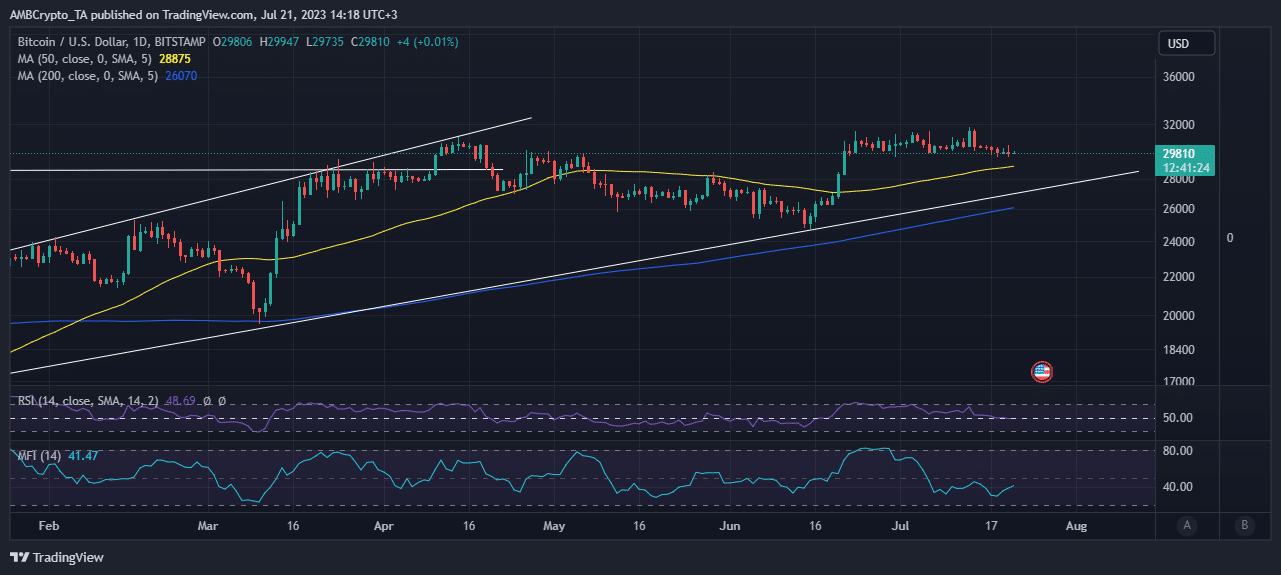

BTC’s price action has shown signs of sell pressure since mid-July, indicating a possibility of further sell pressure contrary to expectations. In such a scenario, the price could retreat towards the ascending support level.

This implies that there is a chance of witnessing another unexpected dip, potentially pushing the price below $28,000.

Bitcoin’s price action has shown weakness below the $30,000 range, leading to concerns about eroding investor confidence and the possibility of further downside.

However, on a positive note, the Money Flow Index (MFI) signals that liquidity is gradually returning to Bitcoin. Additionally, the Relative Strength Index (RSI) is optimally positioned at the 50% level, indicating the potential for a bounce-back soon.

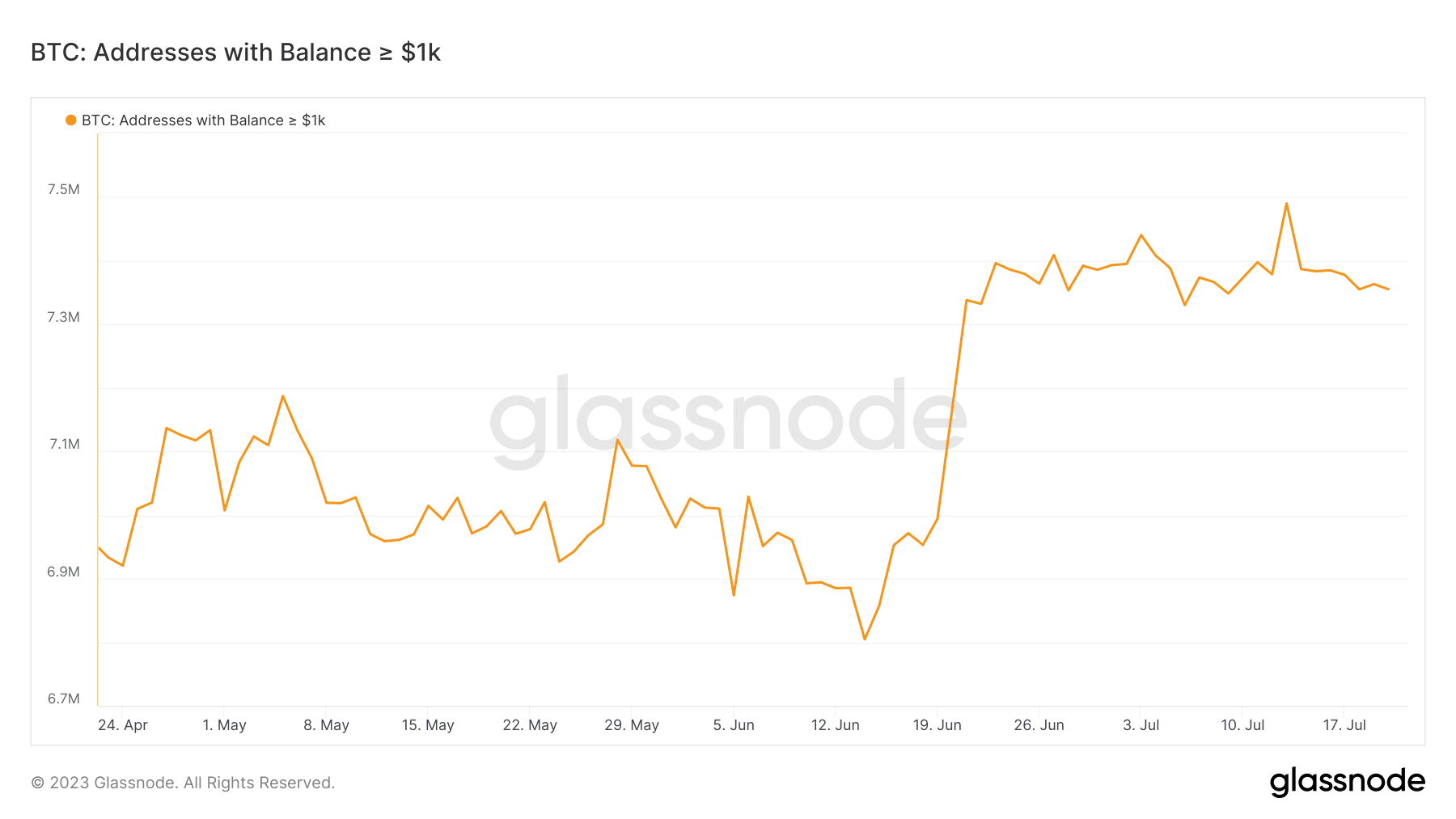

Examining Bitcoin metrics provides valuable insight into BTC’s current state. Ultimately, the fate of Bitcoin is significantly influenced by addresses with substantial balances, known as whales. Notably, addresses holding over 1000 BTC have been reducing their balances since 13 July.

Despite the slight outflows, the same metric reveals that the levels held by whales remain significantly high, particularly when compared to the lowest levels observed in June.

This observation reinforces the notion of low sell pressure at present. Consequently, the outcome remains uncertain, but there is a potential inclination towards a bullish stance, largely influenced by institutional demand.