Bitcoin (BTC) has again taken center stage in the cryptocurrency market as institutional interest surges. This interest has been spurred by major financial giants such as BlackRock, Fidelity, and Ark Invest, who have applied with the U.S. Securities and Exchange Commission (SEC) to launch a spot Bitcoin Exchange Traded Fund (ETF).

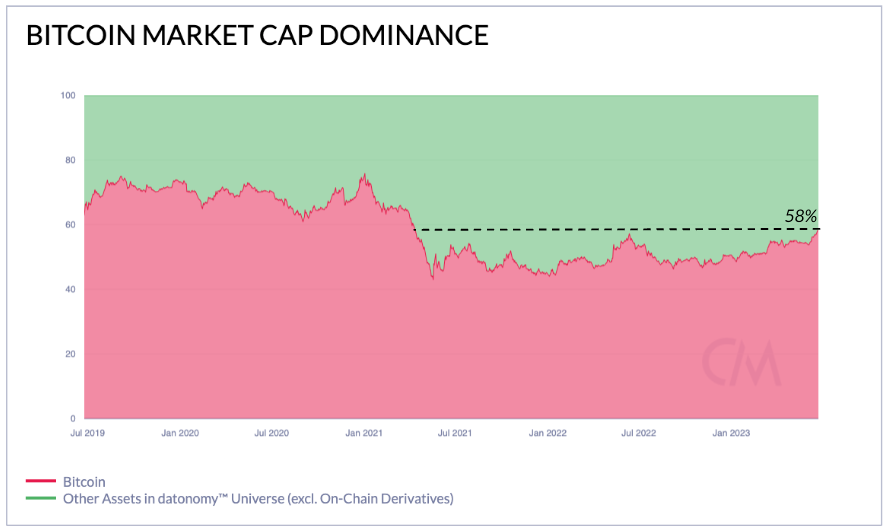

According to Coin Metrics, BTC’s market capitalization dominance has reached a new high for 2023, currently at 58%, the highest since April 2021.

Bitcoin Rules The Crypto Kingdom

BTC has been the leading digital asset and has maintained its position as the top cryptocurrency for a long time. Its market cap of $586 billion is significantly higher than the industry’s combined market cap, which stands at $425 billion (excluding stablecoins).

According to Coin Metrics ‘ report, BTC’s dominance fell in the spring of 2021 as traders bid up smaller-cap altcoins, but it never dropped below 40% of the total market.

However, with some newer tokens facing intensified regulatory scrutiny in the US, BTC has pulled ahead in 2023. BTC’s weighting in the CMBI 10, index of the 10 largest cryptocurrencies by market capitalization, is also at a 2-year high of 65%.

Looking at a broader basket of assets, BTC’s 85% return year-to-date outpaces most of the other major digital assets. Per the report, the only two assets with a greater return year-to-date compared to BTC are Bitcoin Cash (BCH) at 102% and Lido (LDO) at 104%.

BTC Dominance Rallying Trend Ahead?

On the other hand, crypto analyst Michael Van de Poppe recently shared some insights regarding the Bitcoin dominance chart. According to Van de Poppe, “the chart looks like it wants to continue rallying,” but there are some key points to remember.

One of the most important takeaways is that in September 2019, BTC tested the 200-week moving average (MA) and exponential moving average (EMA) and encountered resistance. This was 10 months before the Bitcoin halving event in May 2020.

Van de Poppe notes that the current situation is similar to September 2019. BTC is once again testing the 200-week MA and EMA, and whether it can break through this resistance level remains to be seen.

This could be a positive sign for Bitcoin investors, as the halving event was followed by a period of strong price growth for BTC.

Overall, while there are some potential challenges for BTC to overcome in the short term, Van de Poppe’s analysis suggests that the long-term outlook for Bitcoin remains positive.

As of now, Bitcoin trades at $30,100, and it continues to experience a decline in value, representing a 2% drop over the past 24 hours. Additionally, its market dominance, which considers all other cryptocurrencies in the ecosystem, currently stands at 52%. There is a significant contrast between its current dominance and the 72% it achieved in 2021.

newsbtc.com

newsbtc.com