After several weeks of consolidating around $27k, the price of Bitcoin has experienced heightened bearish sentiment, resulting in over $111 million being liquidated within the last 24 hours. The entire cryptocurrency market has been impacted by this downturn, triggered by the United States Securities and Exchange Commission (SEC) filing a lawsuit against Binance, the leading cryptocurrency exchange by daily traded volume. The SEC claims that Binance violated US securities law by listing unregistered security assets, including Cardano (ADA), Polygon (MATIC), and SAND.

Coinpedia has unveiled all the details you need to know: Binance Faces SEC Lawsuit: $700M Withdrawals and Metaverse Tokens Plummet! – Coinpedia Fintech News

Technical Analysis Points to Bitcoin Dip

From a technical standpoint, the recent Bitcoin dip was not surprising when considering higher time frames. The price of Bitcoin had issued several red warnings of an imminent drop. However, there were no major fundamental aspects to support the bears in their quest. Market trader Jason Pizzino suggests that the altcoin industry will continue to suffer, despite Bitcoin’s dominance declining from recent highs of around 48 percent.

Is There A Possibility Of A Rebound?

In terms of the short-term perspective, Pizzino notes that the Bitcoin price could continue dropping toward the next significant support level of around $24k. However, for scalp traders, the analyst believes that a short-term rebound may occur after the Bitcoin price hits $24k.

Increasing FUD In American Crypto Markets

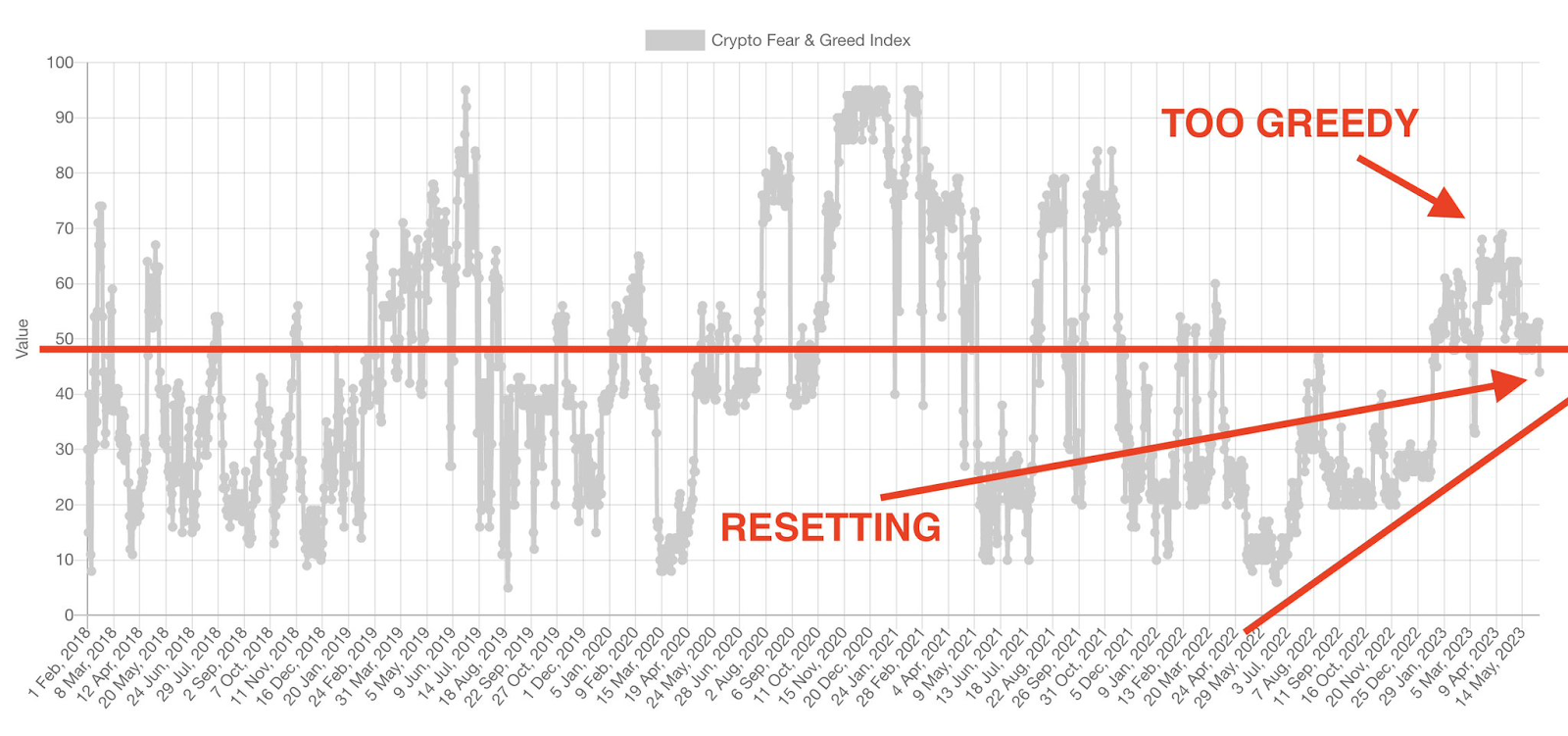

The recent bearish sentiment in the crypto market has amplified fear and uncertainty among industry participants. The SEC’s lawsuit against Binance has added to the overall unease. However, despite this temporary downturn, the long-term outlook for cryptocurrencies remains bullish. Other markets, including Europe, have implemented friendly policies contributing to this positive sentiment.

coinpedia.org

coinpedia.org