Bitcoin whales, or individuals holding large amounts of the cryptocurrency, appear to be gradually retreating from crypto exchanges, according to a critical indicator known as the exchange-whale ratio.

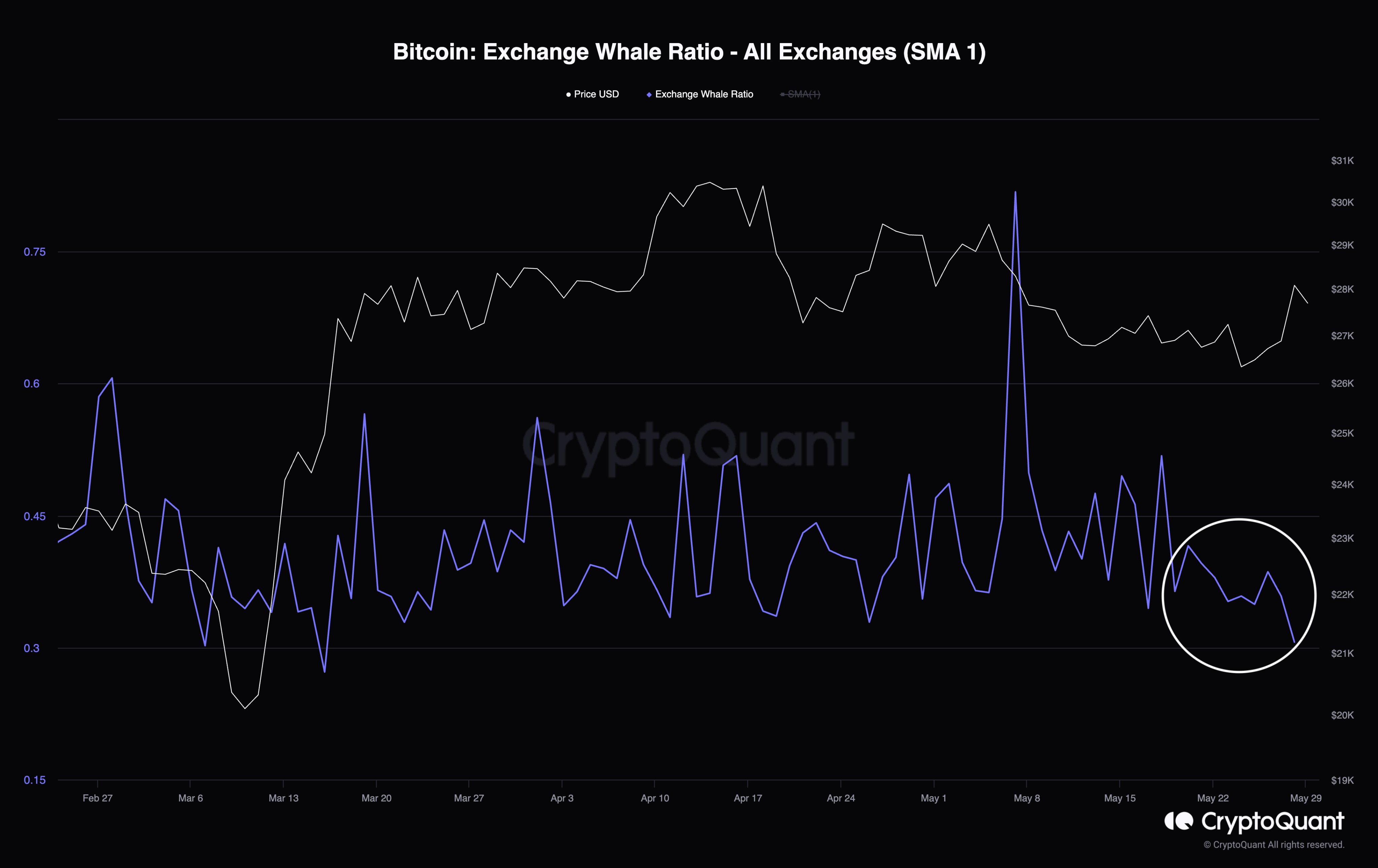

This metric, which is the total BTC amount of the top 10 transactions divided by the total BTC amount flowing into exchanges, has slid to around 0.3, a level not seen since March.

As per this figure, large bitcoin holders seem to be either hodling or possibly moving their assets into other forms of investments or private wallets.

The exchange-whale ratio is primarily used to identify the exchanges favored by these so-called whales. Analyzing the relative size of the top 10 inflows to total inflows sheds light on where the big players are most active.

For instance, Gemini, which is known to cater predominantly to whale users, often witnesses dramatic price fluctuations. This behavior can lead to potential risks for some traders while simultaneously opening opportunities for arbitrage.

Meanwhile, the Bitcoin price seems relatively stable, sitting at $27,642, according to data from CoinGecko. This calm pricing in the face of whales' movements might suggest a growing resilience in the market to large sell-offs.

What remains unclear is the reason behind this massive whale migration. This might be due to whales feeling more comfortable with their coins in personal wallets. Others might speculate that these large holders could be diversifying into other investment avenues or cryptocurrencies.

u.today

u.today