Top crypto analytics firm Glassnode says a number of on-chain metrics are now suggesting that Bitcoin (BTC) is getting ready to move into a new price range.

In its latest update, Glassnode says that BTC prices are tight and a “volatility spring” has coiled, signaling that Bitcoin is prepared to break out of its current equilibrium.

With BTC consolidating within a narrow range for nearly two and a half months now, Glassnode says that the king crypto is likely entering a new phase of high volatility. The firm says that a potential short-term upside target could reside around the $33,500 level where many investors who bought in 2021 and 2022 will break even.

“The Active Investor Cost Basis is currently trading at $33.5k, which accounts only for investors actively participating in the market, and provides a near-term upper bound price model. With the Active Investor MVRV (market-value-to-realized-value) at 0.83, it suggests that many 2021-22 cycle buyers are still underwater, and may be waiting for break-even prices to liquidate their holdings.

…Price breaking above $33.5k would indicate that the average investor from the 2021-22 cycle is now back in profit, and reflects a psychological area of interest.”

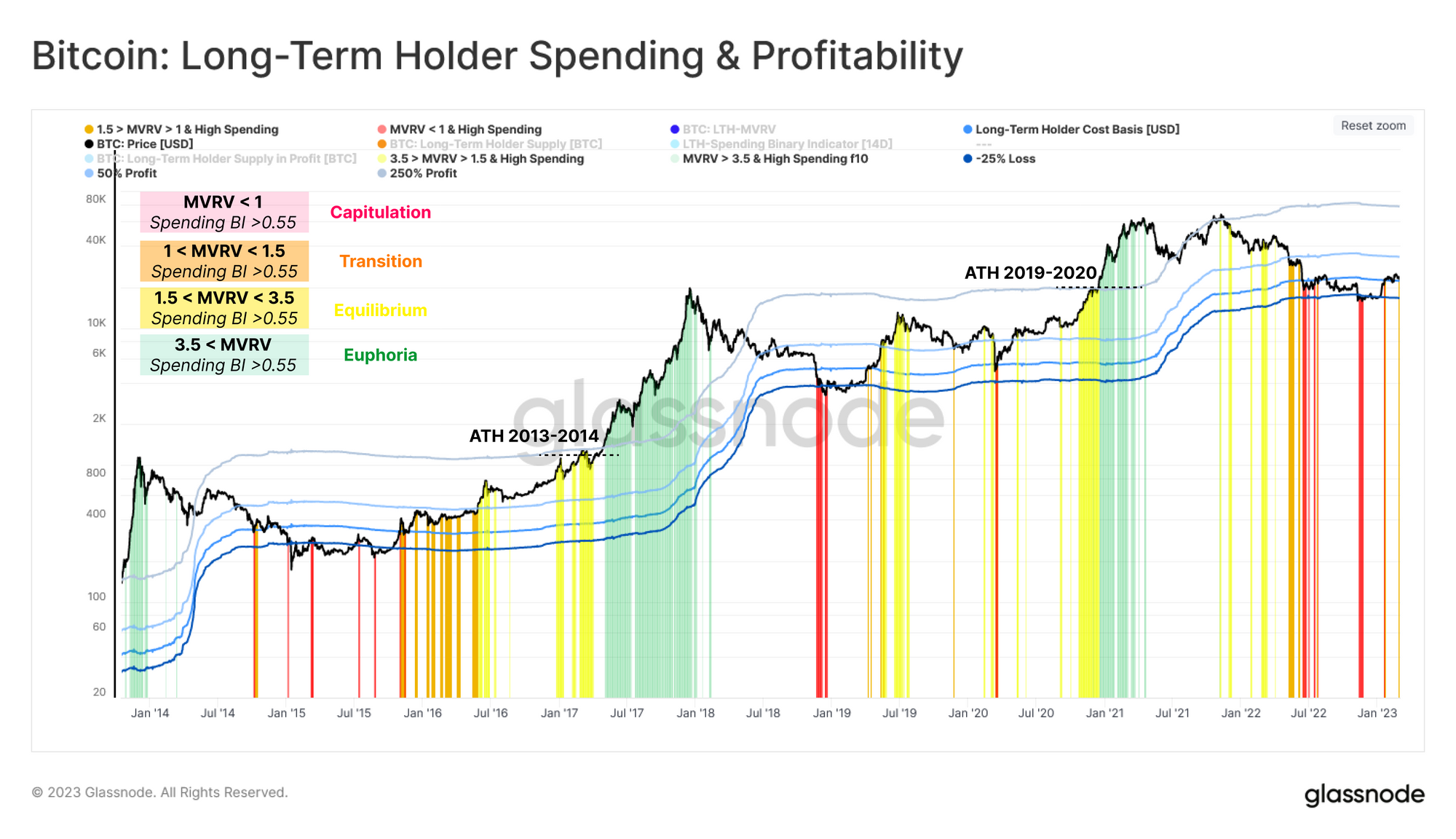

By analyzing the cost basis of long-term holders (LTHs), or entities that have held their coins for at least 155 days, Glassnode breaks the bull market cycle into four stages – capitulation, transition, equilibrium, and euphoria.

According to the firm, Bitcoin’s market cycle is now in the “Transition” phase, where BTC trades slightly above LTHs’ cost basis.

“Our current market has recently reached the Transition phase, flagging a local uptick in LTH spending this week. Depending on what direction volatility erupts next, we can employ this tool to locate local periods of overheated conditions, as observed from the lens of Long-Term Holders.”

dailyhodl.com

dailyhodl.com