- Bitcoin’s bull runs historically triggered by halving events.

- As absolute reduction of mined Bitcoin decreases, future bull runs might be less pronounced but longer.

- Predicted 2023 bull run expected to follow previous patterns, amidst changing investment dynamics.

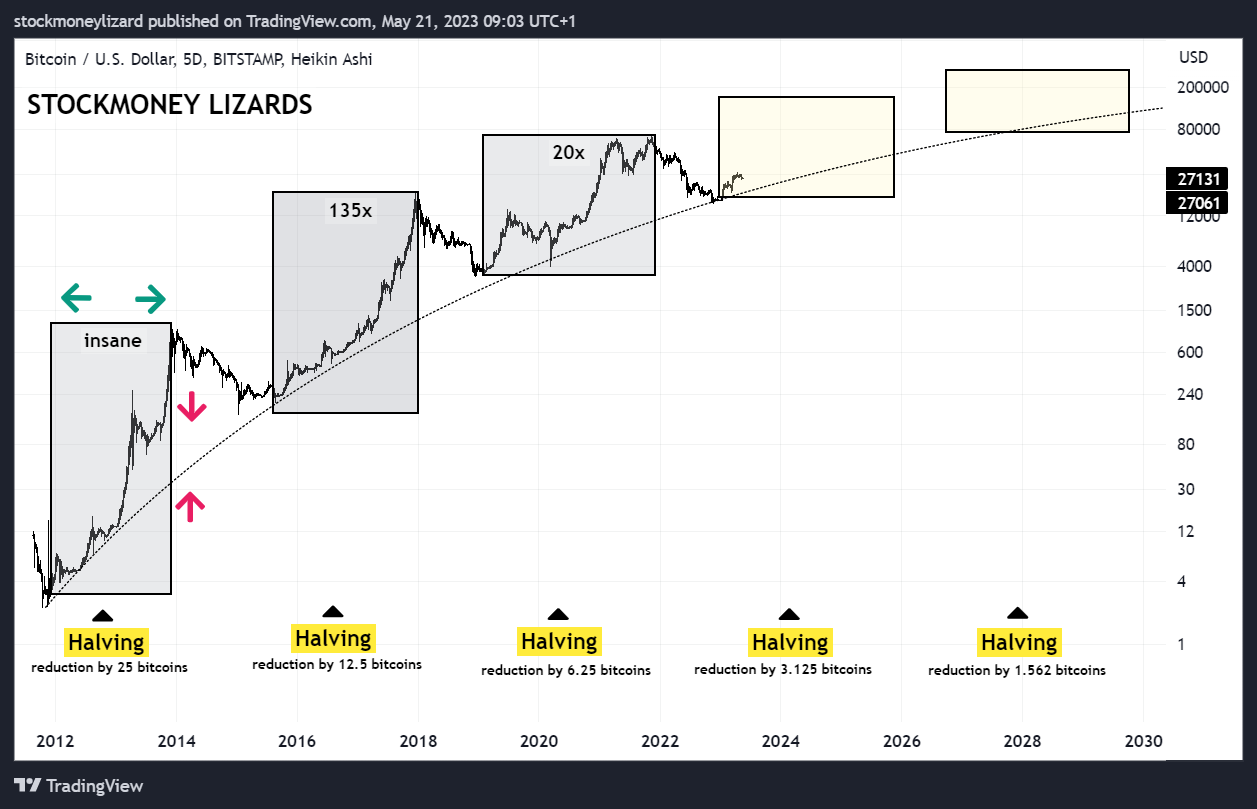

Bitcoin’s bull runs have historically been primarily triggered by halving events. These events, occurring roughly every four years, reduce the number of newly mined bitcoins by half, contributing to the volatile peaks and troughs that have become a characteristic pattern of Bitcoin’s investment cycles.

However, a recent thread posited an intriguing theory: Bitcoin’s investment cycles may be disappearing. As the absolute reduction of newly mined Bitcoin decreases over time due to halving events, the impact on the cryptocurrency’s value might not be as stark as before.

This transition doesn’t signify an end to Bitcoin’s bull runs, but rather a change in their nature. Future bull runs might be less pronounced but could span over more extended periods. This shift could potentially lead to a more stable growth pattern, making Bitcoin a less volatile, yet still profitable investment option.

The theory concludes that the upcoming bull run, predicted for the end of 2023, will likely follow the pattern of previous ones. This continuity will provide Bitcoin investors with familiar territory, even as the overall landscape shifts.

Thus, while the future of Bitcoin investment cycles remains speculative, this theory presents an exciting evolution in Bitcoin’s investment dynamics. As always, understanding these trends and staying informed is key for those who venture into the dynamic world of cryptocurrency.