- An alert on miner outflows led to the discovery of a significant BTC transfer to Binance.

- The movement of 1750 BTC points to a possible increase in selling pressure from miners.

- With miner reserves decreasing, market dynamics could experience shifts, calling for strategic adjustments.

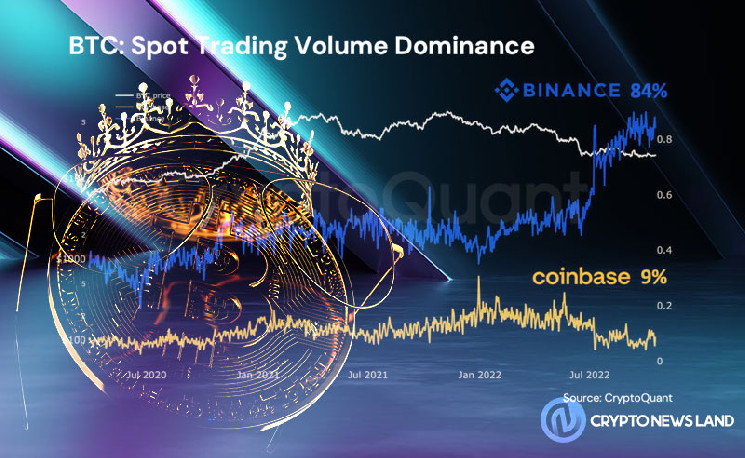

In the ever-changing landscape of cryptocurrency, notable movements can have substantial implications. A recent instance of this is miner outflows of Bitcoin (BTC), which have come under the spotlight today. Alerted by CryptoQuant via Telegram about these outflows, I took it upon myself to delve into the transaction addresses to unearth more.

The findings were indeed intriguing. Miner Poolin, using the address 3BPAodH6WkNQC8TUrnwFKhETiFacNUi68X, transferred a considerable volume of 1750 BTC to another address: 14nr1dktB2fCn2XkUV2AdwhcmqcHk3acji. The story doesn’t end there. The receiving address then proceeded to move the same amount of BTC to Binance, with the recipient address being bc1qm34lsc65zpw79lxes69zkqmk6ee3ewf0j77s3h.

Drawing the lines between these transactions, it seems highly probable that this 1750 BTC ultimately found its way to Binance. This significant movement is not without implications. It points to the possibility of increasing selling pressure from miners.

Notably, the reserves of miners are on a decline, further solidifying this hypothesis. It’s essential to keep a close watch on these movements, as the supply and demand dynamics of Bitcoin could experience shifts. Crypto investors and enthusiasts must stay abreast of these developments, as they might necessitate adjustments to their strategies.