Breakdown

The latest Bitcoin (BTC) price analysis shows that the cryptocurrency has been trading in a bearish bias trend since the start of this week. The digital currency had dropped to lows of $26,883.67 on Wednesday but has recovered in value and is currently trading at $27,882.13.

According to Material Indicators, there was an increase in bid liquidity below $26,000 on the Binance BTC/USD order book overnight. However, the recent Binance “FUD” episode continued to impact short-term BTC price action, preventing Bitcoin bulls from reclaiming levels closer to $30,000.

Traders are now speculating on how BTC prices will react to the latest CPI print, with data suggesting that inflation will likely dissipate in the coming months. As a result, Bitcoin is eyeing a push toward $28,000, and traders are demanding more volatility on CPI day.

BTC/USD technical analysis on a daily chart: BTC consolidates above $27,700

Bitcoin price analysis on a daily chart shows BTC has been consolidating above the $27,700 level. The MACD shows a bullish crossover with increasing histogram values, and RSI is trading around 42. If the bulls can reclaim levels closer to $29,000, we could see BTC make its way up to $30k again in the near future.

Bitcoin price analysis on the daily chart shows BTC formed a bearish divergence pattern with the RSI indicator, suggesting a possible downside correction. The Stochastic RSI has started to roll over and is trading in the bearish zone, indicating that BTC could be on the verge of dropping back to $26,000. A daily candle close below $27,000 would confirm a bearish reversal and could see BTC prices drop back to the $25k level.

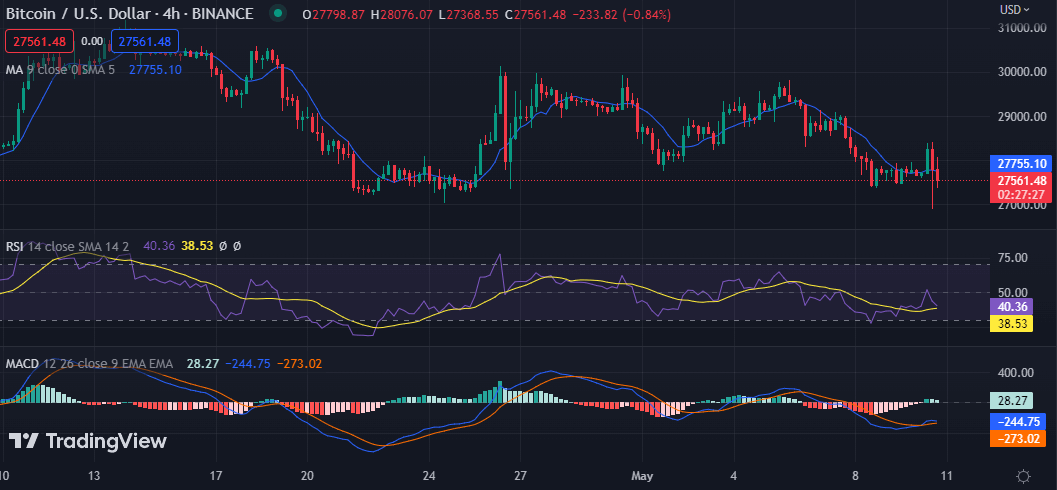

Bitcoin price analysis on a 4-hour chart: Bulls look to defend $27,500

Bitcoin price analysis on a 4-hour BTC is trading in a bullish bias trend on the higher time frames. The MACD shows increasing histogram values, and RSI is currently at 40.36. Bitcoin’s price is up by 0.86% after correcting from its intraday high of $27,992. The bulls must defend the $27,500 level if they want BTC to move higher toward the psychological resistance at $30k. A break below the critical support level of $25,800 could see BTC test lows of $24,000.

Looking at the technical indicators, a bullish crossover on the MACD and increasing histogram values suggest that Bitcoin could target a move above $28,000 in the coming sessions. The Relative Strength Index indicator is increasingly moving upward towards the overbought region, suggesting intense buying pressure in the market.

Bitcoin price analysis conclusion

Bitcoin price analysis for today reveals a correction from the intraday high of $27,992. BTC is currently trading in a bullish bias trend above the psychological support level at $27,500. If Bitcoin can break through the resistance near $29k, we could see another push to reclaim levels close to $30,000.

While waiting for Bitcoin to move further, see our Price Predictions on XDC, Polkadot, and Curve

cryptopolitan.com

cryptopolitan.com