Bitcoin’s novelty and uncertainty have engendered much carelessness among pioneering $BTC holders. This caused millions of bitcoins to be lost and addresses to become dormant. But recently, a trend of cold addresses warming up has been observed on the Bitcoin blockchain.

Bitcoin Dormant Addresses Waking Up

Nothing can topple Bitcoin’s price more than intense selling pressure. And that pressure is typically caused by Bitcoin holders who acquired $BTC under $1,000 per coin, who now are considered whales. This is why it is essential to understand the scope of this potential danger, as all technical analysis falls flat if just one ancient whale decides to move.

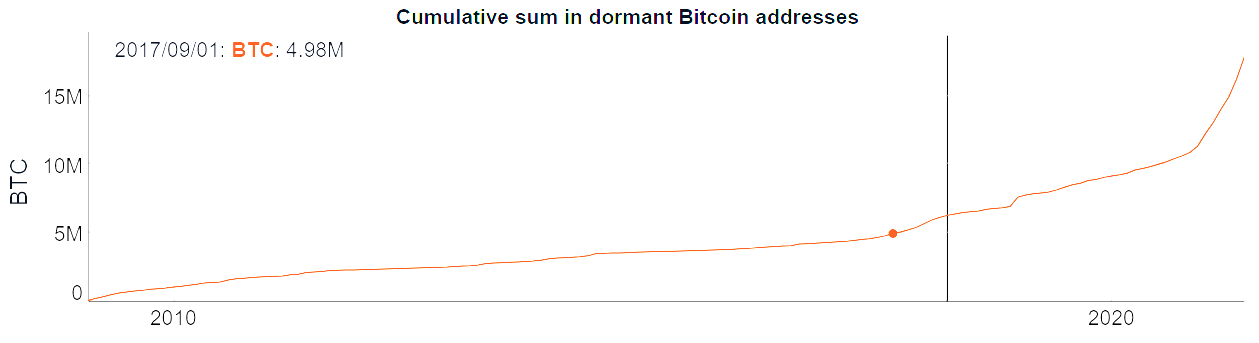

Fortunately, having a public blockchain makes that easier. Up until September 2017, when the price of $BTC was $4.9k, data shows nearly 5 million dormant $BTC, as a cumulative sum. Such a drastic price difference would then provide plenty of incentive to awaken.

The largest dormant address holds 79.9k $BTC ($2.2 billion), having gone dormant in March 2011. Its last activity was recorded this Monday, sitting at an unrealized profit of $2.2 billion at press time, just a $76k value difference from the wallet’s balance.

Even older but minor $BTC wallets have taken advantage of Bitcoin’s rally this year. In February, an 11-year-old wallet profited $9.5 million for exchanging 412 $BTC. Also, this Monday, a 12-year-old wallet became active, holding 1,000 $BTC ($27.4 million). The owner sent out 400 $BTC.

Awakening of decade-old addresses is expected, given the Mt.Gox $BTC repayment release. Even if old Bitcoin whales are not directly tied to the bankrupt exchange, they may be spurred on by the expected sell pressure.

Mt. Gox-Associated Sell Pressure

What Binance is today was Mt. Gox in 2014. When it was hacked in February, Bitcoin price was at $606, with the exchange holding around 850,000 $BTC. After April 6, 2023, when the repayment deadline was set, some of those whales became active.

On April 19, the Mt.Gox-linked wallet moved 2,071 $BTC, still holding $109 million worth of bitcoins. Employing blockchain forensics, ErgoBTC analyst linked the wallet to another address, speculatively assumed to belong to Jed McCaleb, founder of Mt.Gox, Ripple Labs, and Vast as his latest aerospace project.

“These coins are sourced from the Gox saga, and possibly controlled by Jeb McCaleb. Two txs for 5K $BTC were sent to Kraken and Coinbase.”

Forbes estimates McCaleb’s net worth at $2.4 billion. Overall, Mt.Gox trustee, Nobuaki Kobayashi, has held 142,000 $BTC for auction to repay the exchange’s creditors.

Will $BTC Buying Wave Compensate the Selling Wave?

Following a strong rally this year, even topping $30k on April 13th, Bitcoin is back to the March 29th level of ~$27.4k. This $3k correction is somewhat expected despite the 70% gains in Q1 due to the hostile regulatory environment in the US.

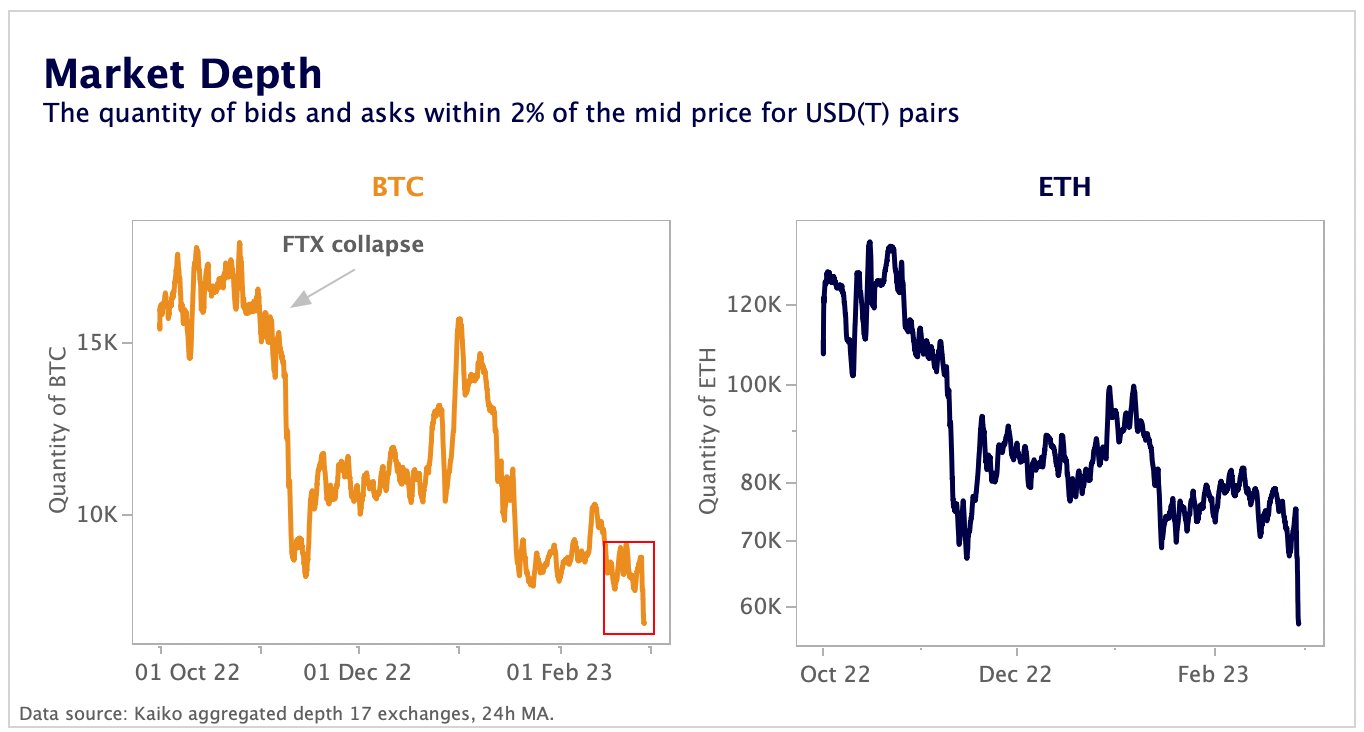

Specifically due to the downfall of two crypto-facing banks, Silvergate and Signature. This caused external liquidity on exchanges, as evidenced by the lowest market depth in March since the collapse of Terra (LUNA).

In short, there wasn’t enough liquidity juice to sustain the Bitcoin rally. Combined with uncertain macro conditions such as the looming recession and Mt. Gox fallout, this rally was somewhat expected to have short legs.

Despite being perceived as an on-risk asset, Bitcoin is primarily a long-term investment against currency debasement. Even TradFi admits as much. Most recently, London-based Standard Chartered called the next Bitcoin price at $100k by the end of 2024.

“While sources of uncertainty remain, we think the pathway to the USD 100,000 level is becoming clearer,”

Geoff Kendrick, head of Standard Chartered’s digital assets division

This coincides with the expected Fed pivot by the end of 2023, ending the rate-hiking cycle. If inflation persists at higher levels as the global de-dollarization threat looms, Bitcoin will step in as a security blanket.

Do you think sufficient demand will be supplied if old whales give to temptation? Let us know in the comments below.

tokenist.com

tokenist.com