Bitcoin maintained steady above $25,000 after the Swiss National Bank seemed to head off a European banking crisis by agreeing to lend troubled investment bank Credit Suisse about $50 billion, and investors’ hopes rose that the U.S. central bank would turn more dovish at its next meeting.

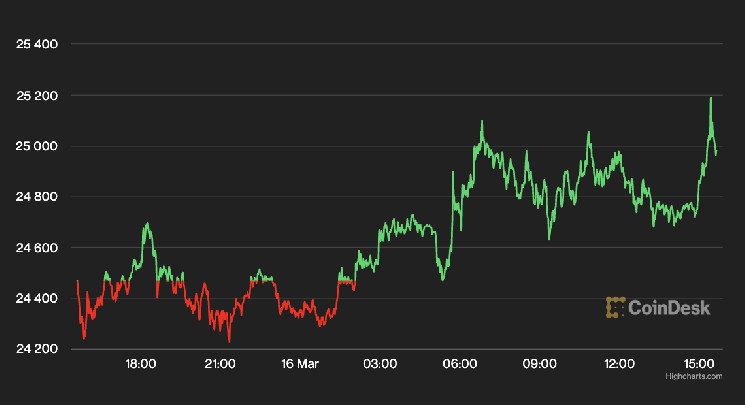

The largest cryptocurrency by market capitalization was trading at $25,050, up 3% over the past 24 hours, according to CoinDesk data. BTC has remained largely range-bound between $24,000 and $25,000 since Tuesday afternoon when U.S. inflation data took a slight turn for the better, and is up 19% over the week amid renewed market optimism about the U.S. banking sector and the Fed potentially suspending its current regime of interest rate hikes.

On Wednesday, the CME FedWatch Tool, a predictor of interest rate decisions, forecast a 45% chance of a zero basis point rate hike. It’s now predicting an 80.5% chance of a 25 basis-point (bps) increase. Both numbers contrast sharply from last week when the CME showed a 68% chance of a 50 bps rate boost.

"The resilience of BTC since shows that while it's clear now that BTC is not an inflation hedge, it certainly is a hedge against monetary irresponsibility," Singapore-based crypto options trading firm QCP Capital wrote in a Telegram broadcast note.

Ether (ETH), the second largest cryptocurrency in market value, was recently hovering around $1,690, up 2% from Wednesday at the same time. BNB, the native token of the Binance-initiated blockchain network BNB Chain and fourth-largest cryptocurrency by market cap, jumped 7% to trade at $328 from roughly $300 a day ago. Indexing protocol The Graph's GRT token surged 13%.

The CoinDesk Market Index, which measures overall crypto market performance, was recently up 2%.

U.S. equity markets also turned green as markets continued to digest Federal regulators’ backstop for depositors at Silicon Valley Bank and Signature Bank. The S&P 500, Wall Street's benchmark equity index, recently rose by 1.2%. The tech-heavy Nasdaq Composite and the Dow Jones Industrial Average (DJIA) were up 1.8% and 0.7%, respectively.

Meanwhile, the European central bank continued its own monetary tightening amid rising inflation on the continent, increasing its interest rate by 50 bps on Thursday.

In a note, QCP Capital saw the move as a precursor of the Fed raising its rate by 25 bps.

“Anything overly dovish would strike fear in markets that the Fed knows something more, while pausing would confuse the message on inflation,” QCP Capital wrote. “Central banks will be keeping up their fight against inflation while working separately on ringfencing troubled financial institutions.”

coindesk.com

coindesk.com