The cryptocurrency market is still in the grips of bearish headwinds that have seen it struggle to retain the $1 trillion threshold, and its representative digital asset, Bitcoin (BTC), is no exception. However, its historical movements have suggested this could be an opportunity to buy BTC before the price increases.

Taking into consideration the previous significant ups and downs for Bitcoin, as well as the activities in between, the flagship digital asset has been demonstrating a steady pattern of ideal times for decision-making in crypto trading strategies – buy, hodl, and sell – as observed by the pseudonymous crypto analyst Stockmoney Lizards on March 7.

In line with these observations, the current bearish moment seems to be a good time to buy Bitcoin before its price begins another bullish movement upwards, at which point the better strategy would be to hodl and then sell when the price peaks, as indicated on the chart which ranges back to 2013.

Bitcoin price analysis

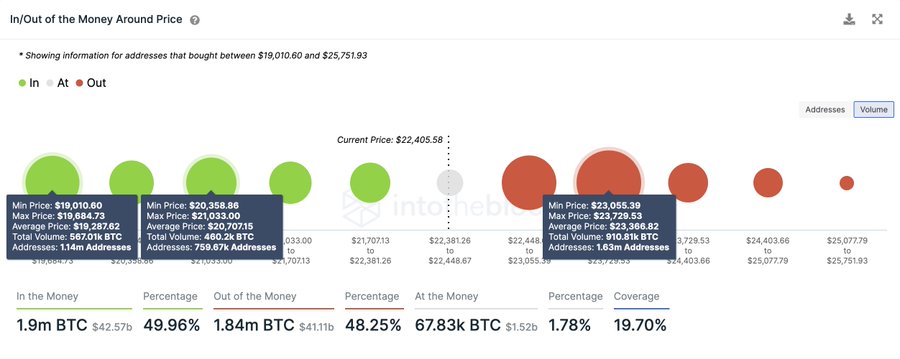

As noted by crypto expert Ali Martinez, Bitcoin’s current price was below a critical area of support between $23,050 and $23,730, where 1.63 million addresses purchased more than 910,000 BTC. According to him, if Bitcoin failed to regain this zone as support, it could trigger a sell-off that could push BTC down to $20,700 or even as low as $19,300.

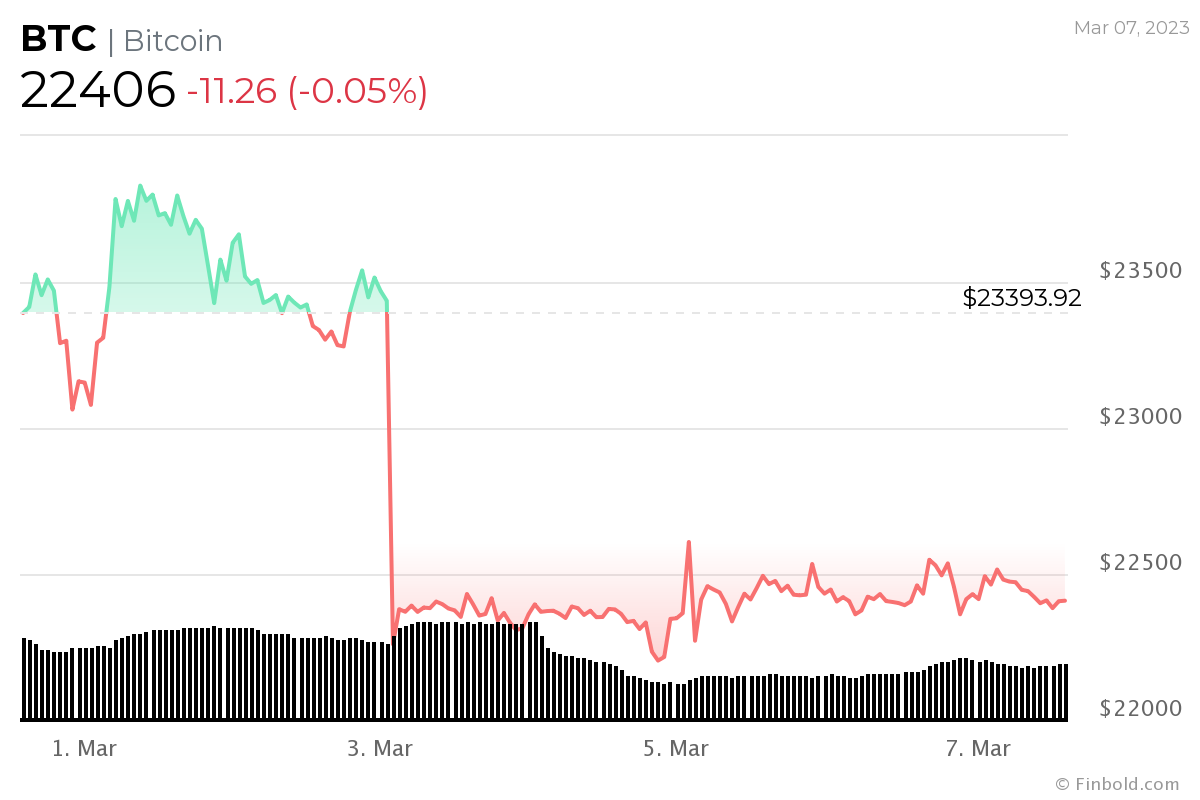

At press time, Bitcoin was changing hands at $22,406, representing a marginal decline of 0.05% over the last 24 hours, in addition to the flagship decentralized finance (DeFi) asset losing 4.73% across the week and 4% over the previous 30 days, as the charts indicate.

That said, Bitcoin’s further movements will depend on a range of factors, including directly related events such as the announced release of a Bitcoin debit card by Mastercard (NYSE: MA) and crypto exchange Bybit, as well as the sentiment in the wider crypto and macroeconomic landscape, which continues to await for the next major development that will influence the market’s direction.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com