This article looks at Bitcoin’s price action ($BTC) and highlights Bitcoin-related news that is worth paying attention to.

As of 9:20 a.m. UTC on March 7, $BTC is trading at around $22,435 (up 0.1% in the past 24-hour period), making it the most valuable cryptocurrency, with a reported market cap (i.e., current price * circulating supply) of around $433.25 billion and a fully diluted valuation (i.e., current price * max supply) of roughly $471.15 billion.

$BTC’s all-time high was 69,044.77, and it was reached on November 10, 2021.

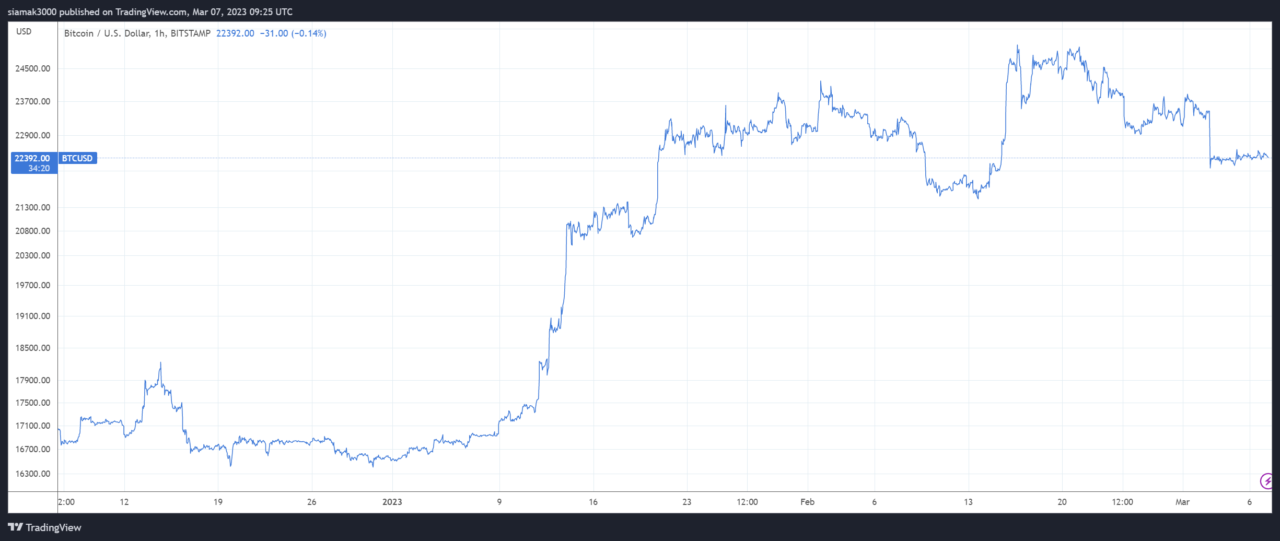

At the time of writing (9:25 a.m. UTC on March 7), according to data from TradingView, on crypto exchange Bitstamp, $BTC is trading at around $22,393, up 35.48% in the year-to-date period.

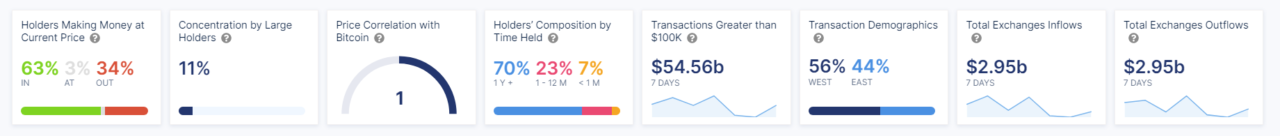

Data from blockchain analytics firm IntoTheBlock (ITB) shows that 63% of $BTC addresses are in the money (making profits), 3% are at the money (breaking even), and 34% are out of the money (losing money) given the current market price of $ADA.

Yesterday, Dylan LeClair, Head of Market Research at Bitcoin Magazine, Senior Research Analyst at UTXO Management, and Co-Founder of 21st Paradigm, reminded Bitcoin HODLers that although $BTC is down around 67% from its all-time high, the average cost price for anyone DCAing since November 10, 2021, is around $25,800:

#Bitcoin is currently -67% from all time highs.

— Dylan LeClair 🟠 (@DylanLeClair_) March 6, 2023

However, if you began buying $BTC daily starting on the day it reached its $69k ATH, your average purchase price would be $25.8k, for a current ROI of -13.3%.

Not great, but not as terrible as you may be led to believe. pic.twitter.com/YQKmCWk9LS

Image Credit

Featured Image via Pixabay

cryptoglobe.com

cryptoglobe.com