Bitcoin price is still stuck in the low $20K region, but has opened with a bullish crossover of a high timeframe momentum tool.

In the past, the signal brought a minimum of a 1,000% return on investment. Here is a closer look at previous signals throughout the history of BTCUSD.

High Timeframe Momentum Change Begins

The selling has stopped, but the buying has yet to kick in, as is evident by the Bitcoin price chart and several weeks now of consolidation. In the past a trend change truly kicked in once momentum measures the began to turn up on a higher timeframe.

Reversals first begin on the lowest timeframes, with the daily flipping bullish first.As higher, more significant timeframes also cross positive, the trend change strengthens until it can no longer be ignored.

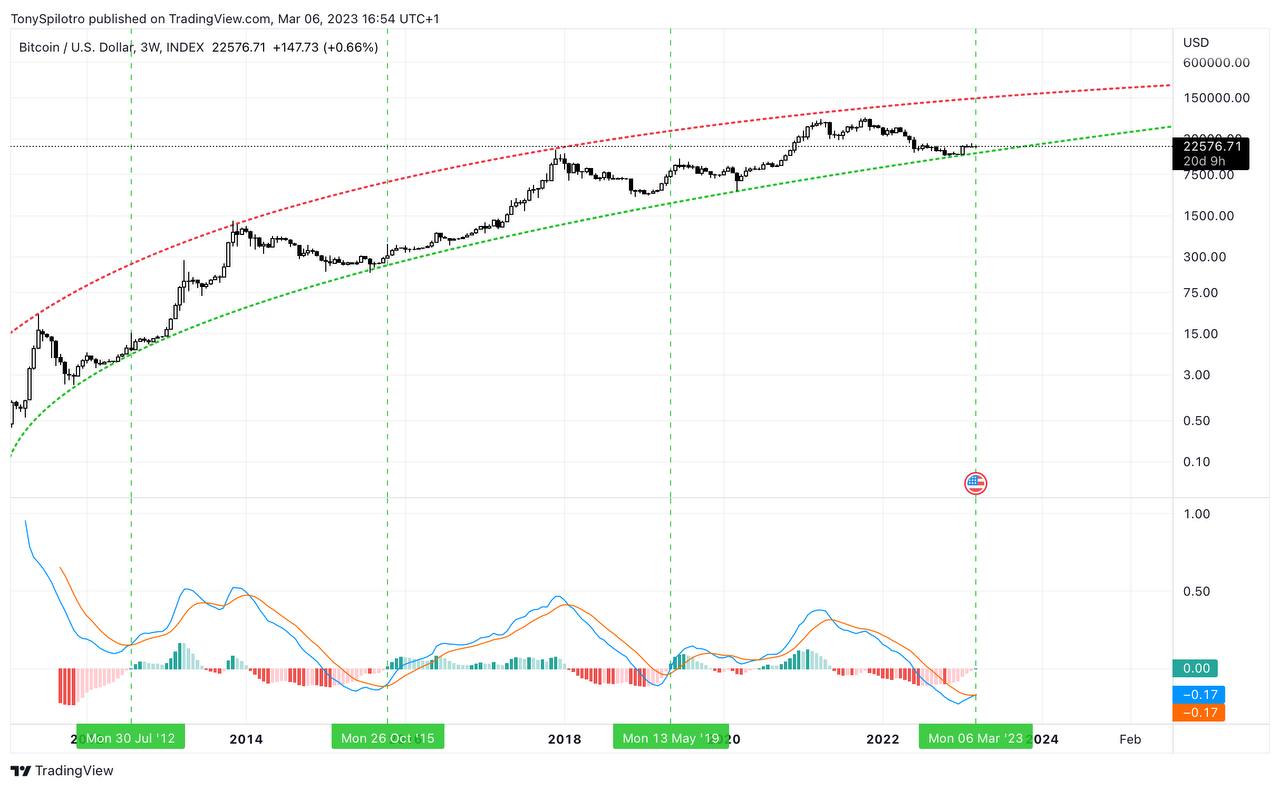

That time could finally be coming soon, according to a bullish crossover on the 3-week LMACD. The LMACD is the logarithmic version of the MACD. The original was created by J. Welles Wilder, Jr.

Momentum is about to change in a big way | BTCUSD on TradingView.com

Momentum is about to change in a big way | BTCUSD on TradingView.com

LMACD Buy Signal Brings 1,000% Or More ROI

The LMACD line crossing above the signal line from below is considered a buy signal. It is only the fourth time from below the zero line that the bullish crossover has occurred.

Each time the bullish crossover occurred below the zero line on 3-week BTCUSD charts, Bitcoin went on to provide a minimum of a 1,000% return on investment. Two times previously resulted in 16,000% and 7,000% each. On average, this is 8,000% across the three crossovers total.

Considering the law of diminishing returns, another 8,000% is improbable. Even another 1,000% rally is unlikely. But the track record of producing upside after the signal confirms is enough to anticipate a positive return.

A confirmation is necessary, which doesn’t take place until 20 days from now. This gives 20 days to either bulls to push higher and confirm the signal, or bears to step in and uncross the signal before the current 3-week candle closes.

newsbtc.com

newsbtc.com