- Bitcoin price climbed above the $18,000 level for the first time since November 2022, bulls remain cautiously optimistic with the impending US CPI release.

- Traders have not had a month-on-month core US CPI come in at market expectations since March 2022, highlighting the importance of the statistic.

- Bitcoin price experienced massive volatility in response to US CPI readings throughout 2022.

Bitcoin (BTC) price climbed hit a two-month high, crossing $18,000 on January 10, ahead of the US Consumer Price Index (CPI) data release. Industry experts anticipate the CPI for December to show annual inflation at 6.5 to 6.6%, a decrease from November’s reading of 7.1%.

The largest asset by market capitalization has reacted strongly to CPI readings for the last six months, making it a significant marker for traders attempting to decipher BTC’s next move.

Also read: Bitcoin price might crash violently ahead of US CPI release, dragging altcoins with it

What is Inflation, Core Inflation, CPI?

Inflation is a rise in prices and is often expressed as a percentage. Inflation results in a unit of currency effectively buying less (of a commodity or resource) than it did in prior time periods. When inflation occurs in the US, it indicates a decrease in the purchasing power of the dollar.

Inflation is measured using the Consumer Price Index (CPI), by tracking changes over time, in the prices paid by consumers for a basket of goods and services. The goods and servies are broken into eight major groups: food and beverages, housing, apparel, transportation, medical care, recreation, education, and communication. The CPI reflects purely price change and is an economic indicator most frequently used for identifying periods of inflation (or deflation) in the US.

The core inflation rate is the price change of goods and services minus two groups: food and energy. The prices of food and energy products are volatile and including them could skew an accurate reading of the severity of inflation.

Why inflation matters?

Inflation and interest rates tend to move in the same direction because the latter is the primary tool in the US Federal Reserve’s arsenal to manage the former. The Federal Reserve Act directs the Fed to promote maximum employment and stable prices. Nonfarm payrolls (NFPs) and inflation are the two metrics that guide the Federal Reserve’s decision on interest rates.

NFPs are the measure of the number of workers in the United States excluding farm workers and workers in a handful of other job classifications. Inflation is the sustained rise in overall prices for goods and services. Since inflation acts as key input for the Fed’s decision on interest rates, it has a significant impact on stock and risk asset prices.

US CPI expectations and Bitcoin price reaction

The Bitcoin price rally to the $18,000 level will be put to test with the release of US CPI data. Bulls are cautiously optimistic ahead of the reading as it plays a key role in determining the magnitude of the next interest rate increase by the US Federal Reserve. Experts anticipate the December CPI reading to show annual inflation at 6.5-6.6%, a decrease from November’s 7.1%.

Industry expert Jenny Harrington of Gilman Hill Asset Management, predicted a CPI of 6.6% which she argues “makes sense” considering the broader market overview.

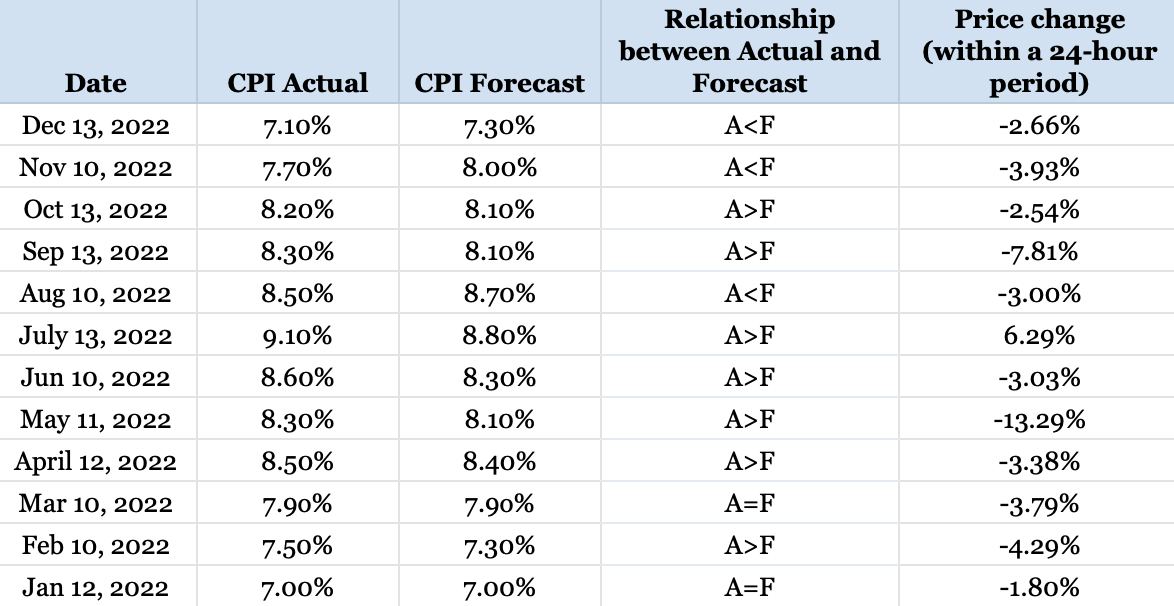

Bitcoin bulls pushed BTC to its two-month high of $18,247 and the newfound strength of the asset’s uptrend persisted. In the table below, it can be seen that BTC price reacted negatively to CPI readings throughout 2022. The data sheds light on the role of macroeconomic outlook in shaping the trend for risk assets like Bitcoin.

Bitcoin price reaction to US CPI readings

Bitcoin price reaction based on relationship between actual and forecasted CPI readings

As seen in the chart above, the immediate reaction of market participants is to push BTC lower in a knee-jerk. However, the relationship between the actual and forecasted CPI reading has a significant impact on BTC price, rather than the reading in itself.

The chart shows a steep decline in the weeks following events in which CPI was higher than forecasted.

If inflation exceeds expectations in the positive direction, it could spell trouble for Bitcoin’s uptrend. Since the beginning of the year, BTC price sustained a bullish momentum, riding on the back of a weaker US Dollar.

The December CPI reading is expected to influence the direction of Bitcoin price trend as BTC is at a key level, close to $18,000.

Will December CPI reading wipe out Bitcoin price gains from 2023?

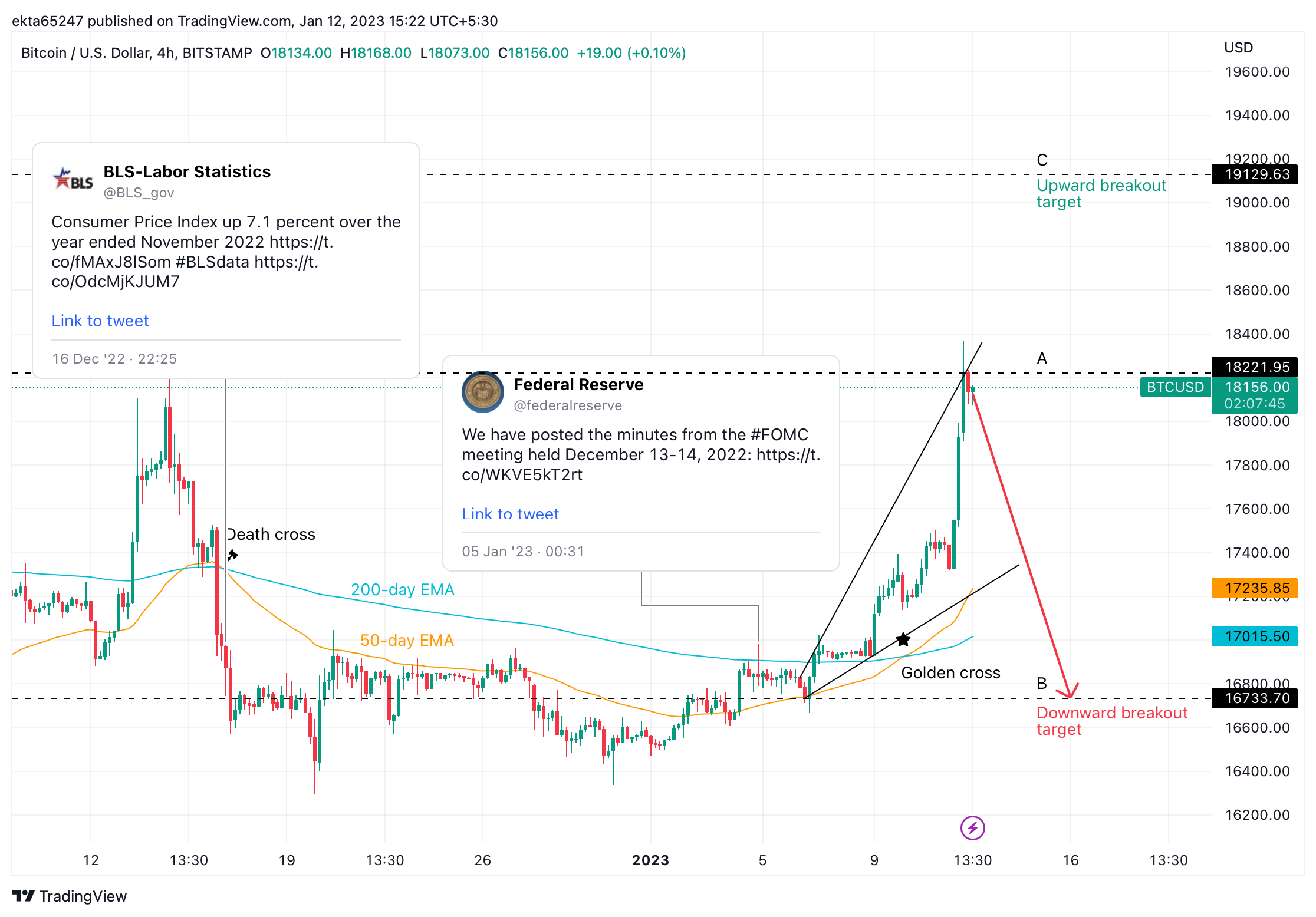

Bitcoin price has formed an ascending broadening wedge, as seen in the chart below. The pattern typically appears in a bull market, and results in a downward breakout, according to Bulkowski. 52% of the times, the wedge is followed by a decline in the asset’s price.

BTC/USD 4H price chart

The levels A and B represent the highest and lowest point within the ascending broadening wedge, at $18,221.95 and $16,733.70 respectively. The $16,733.70 level is the key downward breakout target for Bitcoin, following the measure rule.

The upward breakout target is $19,129.63, a level previously attained on November 8, 2022. It’s important to note the formation of a “Golden Cross” in the BTC price chart, where the 50-day Exponential Moving Average (EMA) crossed over the 200-day EMA, signaling the end of a downtrend.

Though there are bullish indicators like the “Golden Cross,” bulls remain cautiously optimistic that BTC could break out of the ascending broadening wedge with a drop below $16,700. The next area of support for the asset is between $16,700 and $16,500, where BTC spent considerable time throughout the last week of 2022 and the beginning of 2023.

Relative Strength Index (RSI), a momentum indicator reads 79.92, BTC is therefore oversold and there is a risk of a correction in the asset. This fuels the narrative of “cautious optimism” and “wait and watch” approach of Bitcoin bulls.

Why does the December CPI reading mark a turning point for risk assets?

In the past (2022), there were significant reactions to core CPI readings. Interestingly, it was counter to the trend and downside core CPI misses triggered higher volatility than upside surprises. Experts argue that the trend bias is relatively lower now.

Market participants are experiencing optimism on the inflation outlook. Since March 2022, no month-on-month core US CPI came in at market expectations, making reaction on CPI days less significant than expected. There is a pronounced impact on asset prices in the week or weeks following the announcement and leading up to the interest rate hike by the Federal Reserve.

Nevertheless, December’s CPI reading has the capacity to shock risk asset prices in both directions.

fxstreet.com

fxstreet.com