After the bullish rally of Bitcoin (BTC), the largest cryptocurrency by market capitalization has slowed down over the past day; however, its bulls are working hard trying to renew the effort toward further strengthening the asset, as data from the charts has demonstrated.

As it happens, Bitcoin bulls have achieved somewhat of an upside technical momentum and are creating a renewed price uptrend on the daily bar chart, along with pushing just above key resistance at the 50-day moving average (MA), as observed by Kitco News analyst Jim Wyckoff on January 11.

According to Wyckoff’s chart analysis, the current support level for the flagship decentralized finance (DeFi) asset stands at around $16,000, whereas it needs to overtake the resistance at the key level of $18,285 to maintain the upward trend.

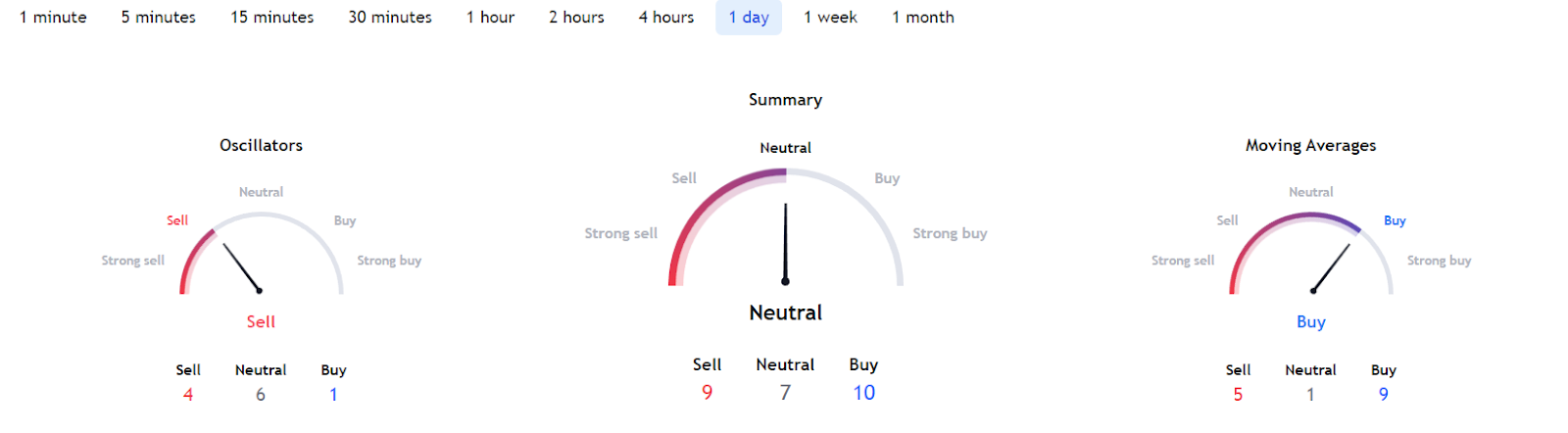

At the same time, the sentiment around Bitcoin on its 1-day gauges is presently in the ‘neutral’ zone, which is the result of oscillators pointing to ‘sell’ at 4, but moving averages indicating ‘buy’ at 9, according to the TradingView data retrieved on January 11.

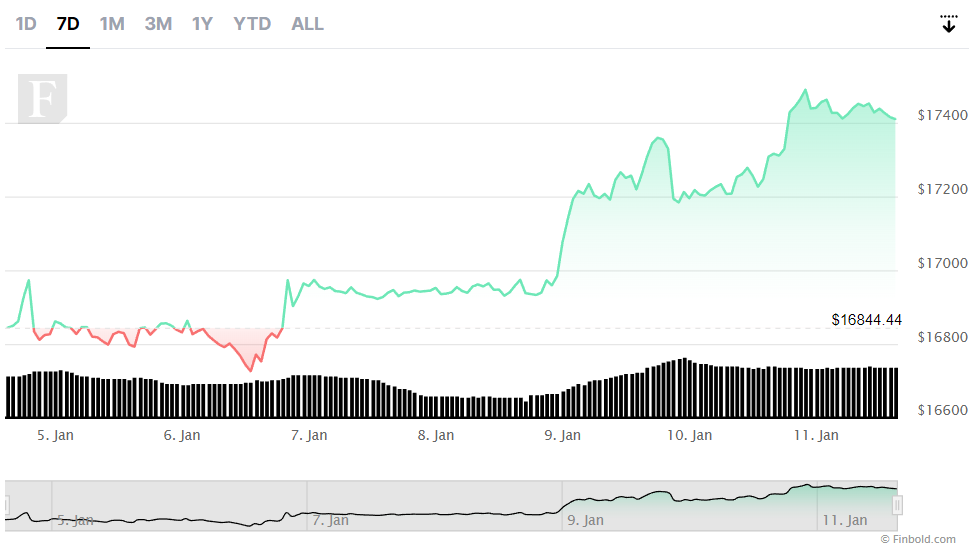

As a reminder, Bitcoin recently confirmed a break above its 50-day MA for the first time since the collapse of once one of the largest crypto trading platforms, FTX, suggesting a bullish continuation if it manages to break the resistance at around $17,600, as noted by investment insights platform Game of Trades, Finbold reported.

Bitcoin price analysis

For now, Bitcoin seems to be heading in that direction, as at press time it was changing hands at the price of $17,408, which represents an increase of 0.72% on the day, and a more significant gain of 3.47% across the week, as its advances on the monthly chart stand at 2.33%.

Meanwhile, the founding asset of the cryptocurrency market has a market cap of $335.26 billion, while its daily trading volume stands at $15.68 billion (899,999 BTC), according to the latest data retrieved from the crypto tracking platform CoinMarketCapon January 11.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com